The market feels confident… and that’s exactly why it’s dangerous. 🐂⚠️

While traders chant “bullish,” a massive risk event is sitting right under their feet.

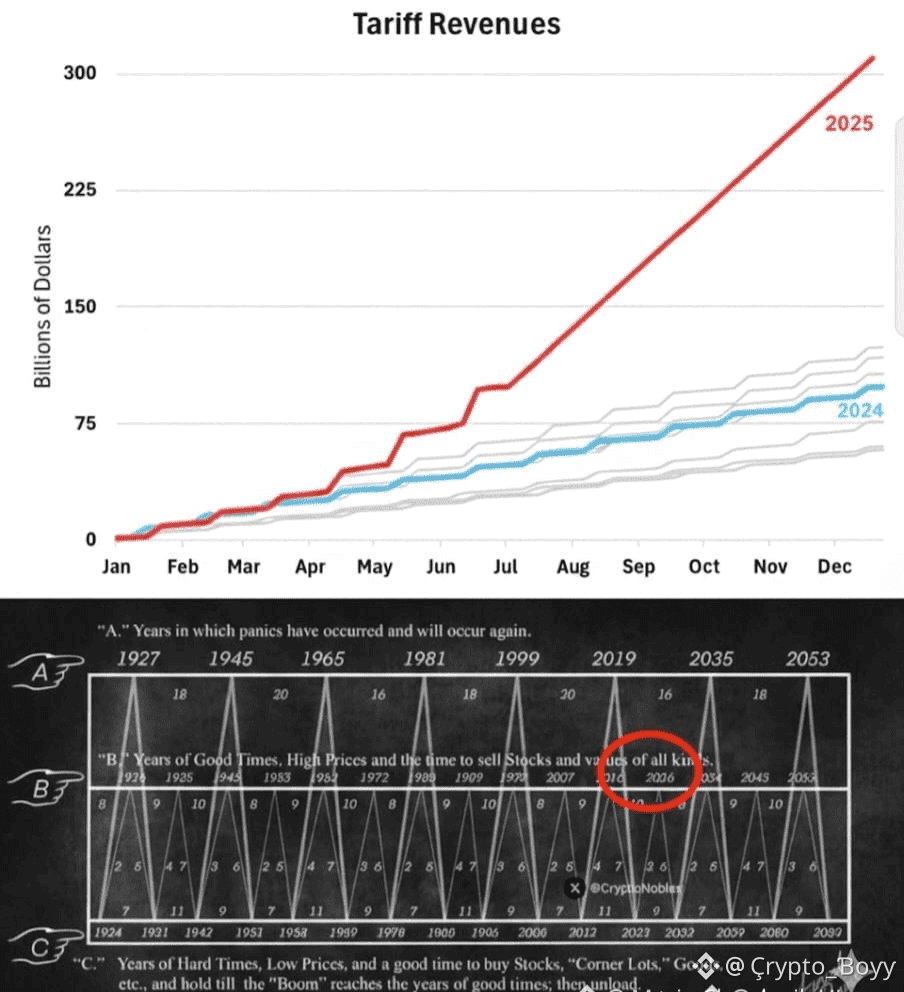

The U.S. Supreme Court is about to rule on Trump-era tariffs — and this is not just a trade headline. It’s a liquidity bomb 💣. Trump himself has already warned that $600 BILLION in revenue is on the line. But that’s only the surface. Beneath it sits broken contracts, supply-chain lawsuits, retroactive refunds, and liabilities that could snowball from hundreds of billions into trillions.

If those tariffs fall, a core U.S. revenue pillar disappears overnight 🏛️📉. The Treasury would be forced to plug the gap with emergency borrowing, pushing yields higher and cracking confidence across markets. Add to that the legal chaos — hundreds of lawsuits ready to fire the moment a negative ruling lands — and you get something no financial model can price.

In moments like this, markets don’t “rally.”

They freeze ❄️.

When a real shock hits, capital doesn’t rotate from one asset to another — it runs 🏃♂️. Stocks, bonds, crypto… everything becomes exit liquidity at the same time.

This isn’t relief.

This isn’t bullish.

This is forced tightening by surprise — the most dangerous kind.

When liquidity dries up, correlations go to one, and panic takes over ☠️.

Some are watching $FLY $WIF $BONK, but in a liquidity event, tickers barely matter.

This isn’t about hype.

This is about survival 🔥.

#MarketRebound #2026 #momentum #CPIWatch #Binance