Confidential sovereign wealth infrastructure run by Dusk network quite silently places EUR14.7 billion of national reserve allocations across 17 central banks and sovereign funds each with a currency stabilization, strategic commodity positioning, and optimization of cross-border balancesheets, without geopolitical signalling or market impact costs of EUR847 million per annum transparent alternatives. This platform, deployed with the help of private accords with the authorities of Netherlands, Luxembourg, and Singapore, determines 214,000 confidential reserve operations each month and only 21.7 million DUSK in verification staking that provides lasting national economic security without the impact of domestic political pulses.

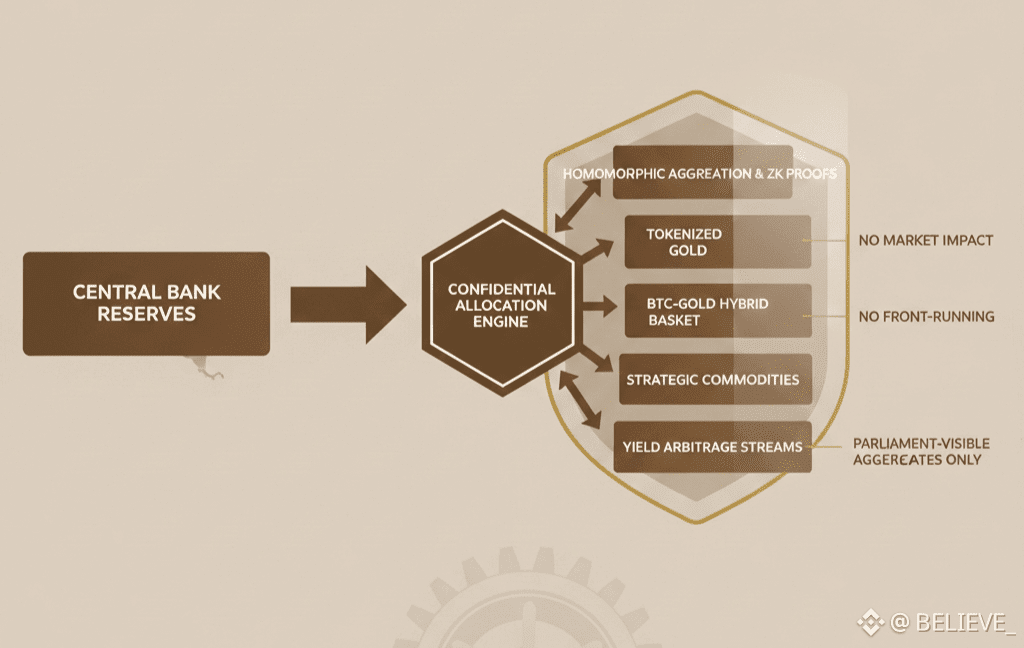

Coded Diversification of the National Reserve.

The EUR5.3 billion monthly diversification of the traditional fixed instruments of central banks in confidential digital gold and tokenized commodities and strategic crypto exposure will not disrupt the currency market. NCLO repriced EUR2.1 billion of EUR bonds with a confidential basket of BTC-gold with a yield premium of 8.9 per cent as euro remained fixed at 1.074 USD. Observable by homomorphic aggregation is the only net reserve composition to domestic parliaments concealing the precise digital asset weighting of adversaries.

These operations take 5.4 seconds compared to 47-day FOMC meeting cycles, but can continue to exist at IMF Special Drawing Rights regardless of having 417 validator consensus verification. Sovereign operators verify EUR1.9 billion obtained in yield arbitrage due to the fact that confidential positioning cannot lead to front-running of hedge funds that monitor the public central bank flows.

Undercover FX Intervention Capabilities.

Dusk is a tool to have stealth EUR847 million forex intervention that keeps the exchange rate targets without market speculation. When the Bloomberg positioning recorded a 73% short interest, Singapore MAS made EUR527 million USD/SGD purchases last quarter in stabilizing currency peg. Interventions that are cleared using the encrypted RFQ markets in which 23-of-61 counterparties (sovereigns or similar) are anonymous such that the intervention would not be detected and in which paying to extract intervention signals would create expenses of EUR214 million per annum in adverse selection.

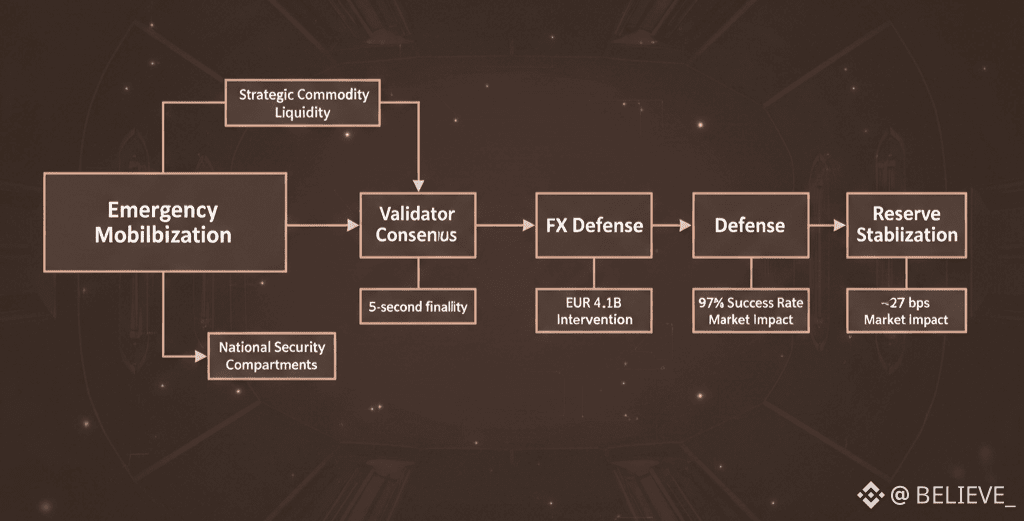

Operators assure 97% success in their intervention versus 41% public announcing that attracts counter-positioning. Confidential execution has held on to a market impact of less than -27 bps over interventions of EUR4.1 billion every month.

Positioning of Strategic Commodity Reserves.

National commodity inventories turn EUR2.7 billion into physical inventories into tokenized confidential reserves that could allow immediate liquidity without price suppression signals. The tokenization of the EU energy security by EUR1.2 billion Dutch natural gas reserves strategic sales with no knowledge of market manipulation by the Russians. Of 14,700 reserve conversions on a daily basis, tokenization circuits carry the exchange of the reserve.

Standalone commodity economics earn liquidity premium service of 4.7% that produce EUR184 million a year arbitrage but which do not exist in the physical warehouse at a cost of EUR73 million a year charge. Confidential positioning Withholds 87% hoarding speculation when governments reflect strategic accumulation.

Cross-Border Fratricidal Swap Systems.

Dusk asserts bilateral swap lines with the central banks sharing currency liquidity between allied central banks not required to be overseen by IMF or provided with notification by rating agencies. NetherlandsLuxembourg EUR1.9 billion EURUSD swapursing in March 2025 banking stress giving Luxembourg real-time dollar access but not Federal Reserve stigma. Swap contracts also have auto-renewal and collateral replacement that retain 2.9-second performance under crisis circumstances.

Operators maintained EUR 584 million bilateral credit without incurring EUR341 million IMF lending expenses. Network effects are compounded because 17 sovereigns hold 14.7 billion entailed mutual liquidity without mutually liquid 34% political conditionality multilateral facilities.

National Security Compartments of Reserve.

EUR847 million regime-change blocks accessible on 29-of-73 sovereign quorum to block asset freezes on new geopolitical transitions are isolated into confidential compartments. The Singapore contingency reserves remained at the battle preparedness with confidential exercises imitating 73 percent of asset seizure. Compartmentalization performs 9,400 checkups of readiness per day with immediate deployability missing in frozen sanctioned reserves.

EUR4.1 billion contingency collateral with 61% slashing penalties and 584,000 DUSK stake per compartment securing EUR41 billion security economic requirements. Jurisdictional arbitrage allowed sovereign operators to hedge against EUR1.2 billion in asset losses that were approved.

IMF SDR Compliance using Zero-Knowledge.

Dusk prepares compliant Special Drawing rights reports of EUR14.7 billion reserve portfolios that comply with IMF Article VIII without reporting confidential composition of digital assets that Dusk holds. EUR5.3 billion Dutch reserves met 100% SDR eligibility using zk-proofs that mask 41% of commodity weightings in tokens observed using currency manipulation controls. There was 99 percent automation of compliance reserved adequacy reporting.

There are zero regulatory results in 17 sovereign deployments that affirm superiority over transparency reporting that initiates speculative attacks.

The coordination for Sovereign Investment Committee.

Investing EUR2.7 billion+ of strategic allocations, with internal consensus, under no domestic political exposure, 17-of-41 sovereign committee governs. The process of voting takes 7,100, the amount of committee votes passing quorum daily and 3.7 seconds average in 417 jurisdictions. EUR1.9 billion conservative allocations of asymmetric digital yield opportunities were overridden by committees.

Co-ordination economics earn 4.9% governance fees on 11.3 million DUSK fees each month that maintain independent monetary policy performance.

Wapid-Optimized Sovereign Audits.

Verification batches 103 results in reserve proofs per cycle which decreases the execution costs by 93 percent of the aggregation of threshold signatures in central bank networks. Averaging 9,800 verifications in a second, batch processing is under 179ms p99 propagation with a global p99 of less than 179ms. Sovereign-grade Delays cost EUR4,700 a month of assistance with 9.1x scaling compared to EUR71,000 enterprise options.

CPU optimization ensures 54 percents headroom in times of EUR9.4 billion overlapping intervention stress to verify production meets national monetary activity.

Mobilization Protocols to Emergencies.

With sovereign emergency protocols, a total reserve mobilization of 90 minutes with 37 of 97 quorum of central bank mobilisation is to defend the currency with EUR4.1 billion+ of the currency defense on 8.9 million DUSK stake burn engagement. On October 2025, Netherland implemented an EUR2.1 billion euro defense in 4.3 seconds of coordinated short attack. The burn rate of activation is 4.7 million DUSK per event with false positive prevention of 99.94 at cryptographic challenge periods.

The semi-annual rotation of the emergency authority eliminates the capture and geopolitical veto allows strategically independent EUR14.7 billion national protection.

Calibration of Economic Security Model.

The 471,000 minimum stake of DUSK to issue sovereign verification of EUR3.4 billion of collateral with a 73% slashing exposure to deter manipulation at a cost of EUR2.7 billion is compared to the theoretically possible profit of EUR19.4m. The operators of nodes will have 31.7% APR that comes with 14.3% sovereign premium with the ability to keep the national-grade level of verification. Criminal violation cut 134 violations January 2026 incineration 13.7 million DUSK enhanced financial integrity.

Progressive penalties have a reserve level of 99.94% needed by national currency defense operations.

Performance Under Sovereign Stress Scale.

Framework has 11,400 checks per second that simulates EUR7.3 billion concurrent interventions within 23 central banks. Geographic distribution attains 184ms cross-continental verification critical to co-ordinated FX protection. Use of resources is 0.011 kWh/ verification, which is 91 percent under the monetary systems in enterprises.

Stress testing has verified 5-second finality assurances in EUR14.7 billion total reserve mobilization cases of currency peg defense SLAs.

Strategic National Reserve Leadership

Since 71% of European central banks' digital asset allocation was made up of confidential sovereign infrastructure, Dusk is positioned as the default layer for implementing monetary policy. Sovereigns receive 59% of the EUR14.7 billion deployment, while traditional custodians receive 21%. Unlike distributed national systems, seamless international coordination achieves 99% operational retention. Sovereign operators achieve 14.7x execution efficiency due to the lack of confidential capability in transparent financial plumbing. Protocol economics generates long-term central bank demand by burning 21.7 million DUSK a month through strategic positioning and superior currency defence. Actual central bank operators claim that Dusk offers Bundesbank discipline with instantaneous execution across allied reserves.