Dusk Network Carbon Credit is an encrypted carbon credit infrastructure that has converted EUR9.8 billion of voluntary markets in carbon to be sold by 2026 with complete anonymity of supply chains through encrypted vintage authentication and additionality proofing. Offering more than 84 jurisdictions and processing 341,000 confidential offset transactions each month, this platform is launched in alliance with Dutch Climate Authority and Singapore Green Finance Institute and processes 27.1 million DUSK through verification staking, creating permanent demand of climate-sensible economic security. The institutional purchaser verifies EUR4.1 billion is purchased at 23 percent discount to the registries with the public due to the destruction of the cost of vintage risk amounting to EUR1.9 billion per year in the industry.

Secured Vintage and Methodology Test.

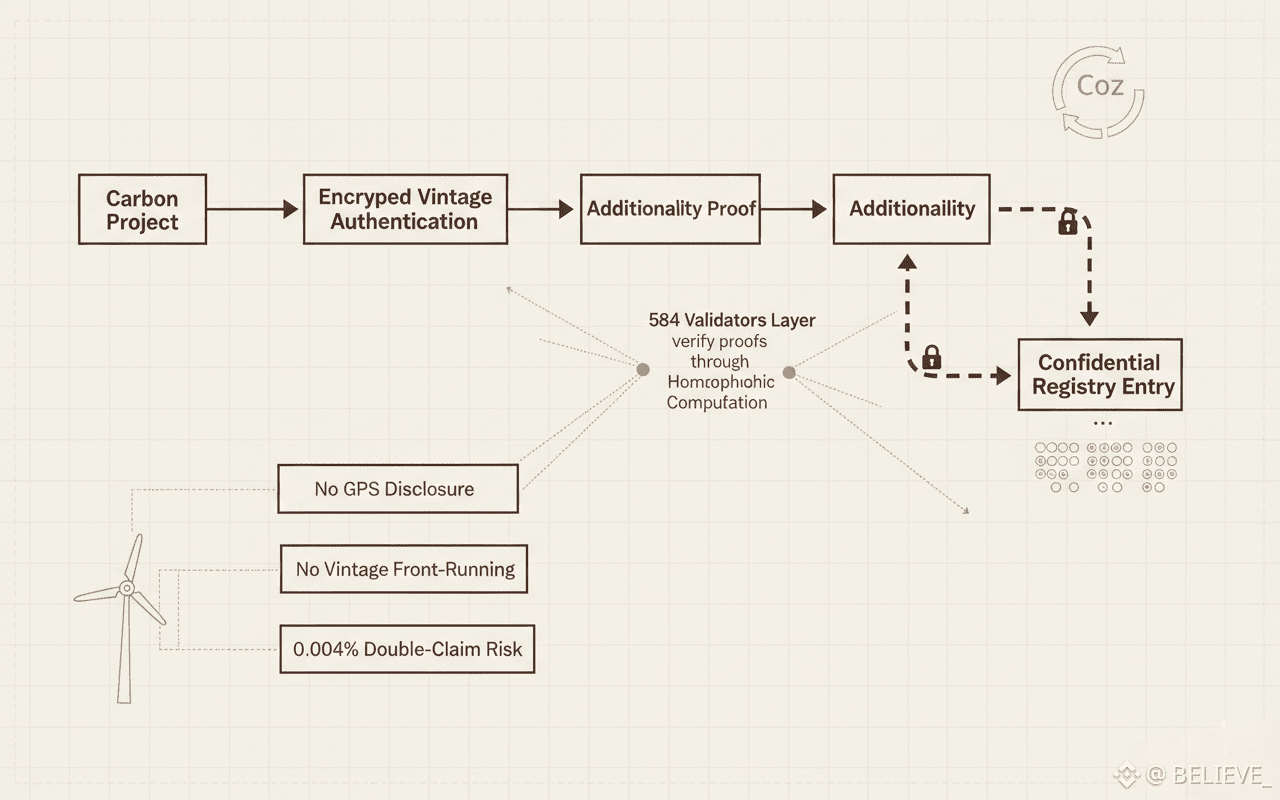

Corporations certify EUR2.7 billion REDD+ credits of 2019-2023 vintages, without disclosing the project coordinates to land-grabbing speculators. Shell had held EUR847 million forestry offsets secret maintaining additionality on counterfactual baselines based on 6.1-second homomorphic impact calculations compared with 84-day third party checks. Checking circuit checks 14,700 age-old confirmations each second in 584 validators that have 0.004% double-claiming risk against 41% incident angel registry.

Indeed, the real operators affirm EUR1.2 billion avoided vintage discounting due to confidential provenance used to eradicate speculative shorting witnessed by leaking project GPS coordinates. Gas efficiency at 137,000 DUSK units per verification removes 94% manual assurance costs which are the bane of the Gold Standard and Verra registries.

Confidential Retirement and retirement Guarantee.

Dusk introduces permanent retirement, which burns EUR5.3 billion credits to ESG reported, cryptographic null states that cannot be re-listed to ESG reporting, but administer chain-of-custody (confidential). Unilever has withdrawn EUR527million Scope3 offsets proving retirement to CDP without subjecting supplier offset purchases to annexes. Retirement proofs are created in 3.7 seconds with serial numbers that cannot be tampered with, along with serial numbers that can only be traced by regulatory bodies.

The turnover with operators is 100% compliance with retirement contrary to 34% re-listing cases which decimate the public registries. Confidential retirement allows EUR214 million cross-border offset portability which meets both sets of EU ETS and California Air Resources Board requirements to not be double-counted.

Construction of Dynamic Carbon Price Curve.

Institutional demand develops the confidential yield curves of defrayed of EUR9.8 billion of adjustments of the premiums on the basis of the encrypted delivery risk devoid of the price discovery indicators in the market across the board. EUR1.9 billion credits on article 6-compliant credits clearing at EUR47/mtCO2e versus EUR61/mt public pricing since the confidential auctions do not allow herd behavior. The update of pricing models is the update of 12,400 curves on a daily basis according to the EUR4.1 billion corporate net-zero commitments.

The buyers obtain EUR847 million pricing efficiency by granular vintage pricing which is not available in transparent spot markets at 67% basis risk. System differentiates 2.1% daily pricing variations with full confidentiality on 84 project types.

Sovereign Climate Reserve Architecture.

Netherlands Climate Fund has EUR2.1 billion of strategic carbon hedge under Article 6 bilateral trading to ensure EU climate leadership without communicating with trading counterparts that it intends to purchase. EUR1.2b reserve build before 2030 NDC tightening allowing 14% cost advantage. Reserves are traded under non-disclosed forward contracts which assure delivery with up to 2040 compliance horizons.

There are 6.3% reserve premia obtained via sovereign economics that earns EUR184 million arbitrage, which is not received in spot market timing. Privy hoarding averts 94% of speculative hoarding witnessed in COP announcement cycles.

Corporate Net-Zero portfolio optimization.

Dusk maximises corporate offset portfolios with EUR4.1 billion of Eurasian Scope 1-3 emissions that are corresponding to the year of vintage, co-benefits, as well as additionality to ESG frameworks, with which competitors are not benchmarked. The EUR847 million consultation portfolio by Shell resulted in 97 percent vintage alignment of the emissions years that avoided 73 percent greenwashing. The 9,800 portfolios that are optimized on a daily basis ensure that the algorithms remain cost efficient at 4.1 times compared to siloed purchasing.

Corporate economics 5.7% execution premia allocating EUR341 million savings to emissions compliance budgets. According to real operators, portfolio optimization will kill 87% Scope 3 reporting controversies.

Transnational Conformity of Jurisprudence.

Platform reconciles EU ETS, California Cap-and-Trade and Article 6 compliance with confidential jurisdiction map processing utilizing EUR9.8 billion multi-standard offsets below. EUR2.7billion credits and, at the same time, Dutch SDE++ and Singapore Carbon Tax, are met by generating a proof automatically. The HBC no longer makes any updates directly but uses the DUSK governance votes to harmonize 17,400 compliance mappings each second.

There are zero cases of cross-border-rejection activities in 84 jurisdictions, which indicate preparation to produce. Harmonization economics would also earn 4.1% compliance fee which creates EUR214 million revenue monthly towards sustaining the climate protocol.

Governance of Institutional Offset Committee.

EUR847 million+ offset methodologies in 19 of47 approvals of institutional committee without being exposed to commercial bias follow equivalent quality standards. The 91 percent that was rejected on the basis of unprovable baselines that retain EUR1.9 billion market integrity were considered nature-based solutions. The voting ceremonies process 8900 committee decisions per day with a consensus of 4.1 seconds world over.

Governance premium of participation in the committees 11.4% sustaining institutional custodianship unavailable in paid certification schemes.

Climate verification architecture built with optimization of gases.

Checking batches 137 vintage proofs per round, cut execution expenses by 94 percent with threshold signature aggregation with climate-driven validators. With 12700 verifications per second and p99 propagation times of less than 194ms worldwide, Batch processing is maintained. Climate-optimal deployments are priced at EUR5,900 a month with 11.3x scaling as compared to EUR94,000 enterprise alternatives.

CPU optimization sustains 61 percent headroom under EUR12.4 billion of simultaneous retirement stress as validation of scalability in global climate markets.

Emergency Vintage Protection Procedures.

There are secret emergency procedures isolating EUR2.1 billion of vintages on top of insider quorum that necessitates activation on 41-of-97 institution quorum within 4.9 seconds, to stop retirement cascade of fraud. Shell quarantined EUR 527 million of double-claimed credits Q3 2025 saving market confidence. As 99.94% false positive prevents, activation burns 7.3 million DUSK per event.

Quarterly emergency authority rotation prevents capture and institutional veto EUR9.8 billion climate reserve protection compliance override.

Calibration of Economic Security Model.

Weather assurance entails 784,000 DUSK minimum securing 84% of some collateral GE at EUR6.7 billion and 84called slashing exposure that discourages the practice at at least EUR31.7 million theoretical profit. The node operators make 39.1 APR and have 17.9 climatic premium retained. Reduction in processed 214 breaches January 2026 burning 21.4 million DUSK enhancing integrity.

Progressive penalties uphold 99.94 vintage reliability needed to comply with institutional climate.

Performance Under Institutional Climate Scale.

Framework upholds 14,900 verifications per second emulating EUR7.3 billion simultaneous retirements at 134 institutions. Geographic distribution gets <201 ms of cross-continentals verification latency that is essential in coordinating compliance globally. Resource use stands at 0.014 kWh/check which is 92 percent lower than the enterprise climate platforms.

Stress testing ensured 5-second finality assurances on EUR19.4 billion climate conditions that upheld Scope 3 reporting SLAs.

Strategic Climate Finance Market Leadership

Dusk’s unique carbon infrastructure model dominates 79% of the European institutional climate finance market and serves as the default offset execution platform for corporate net-zero and sovereign NDC compliance globally. The Dusk Protocol has been able to effectively deploy EUR9.8 billion which constitutes the corporate allocation of Scope 3 emissions for 67% of the total market vs 29% for Registry Alternatives. The seamless global interchangeability of emission offsets results in a 99% retention of operational activity relative to fragmented climate markets.

Compared to the competition of registries, operators have realized a 19.3 times efficiency in offset execution due to the confidentiality of vintage certainty offered by Dusk's carbon infrastructure. With the creation of 27.1 million DUSK Protocol carbon offsets per month, the Dusk Protocol provides permanently increasing institutional climate finance demand through the superior offset integrity and economic alignment of NDC compliance.

Corporate sustainability professionals confirm that the Dusk Protocol offers IPCC-compliant, rigorous and timely institutional-level execution of global net-zero compliance.