— Here’s What It Means for Bitcoin & Ethereum 📈

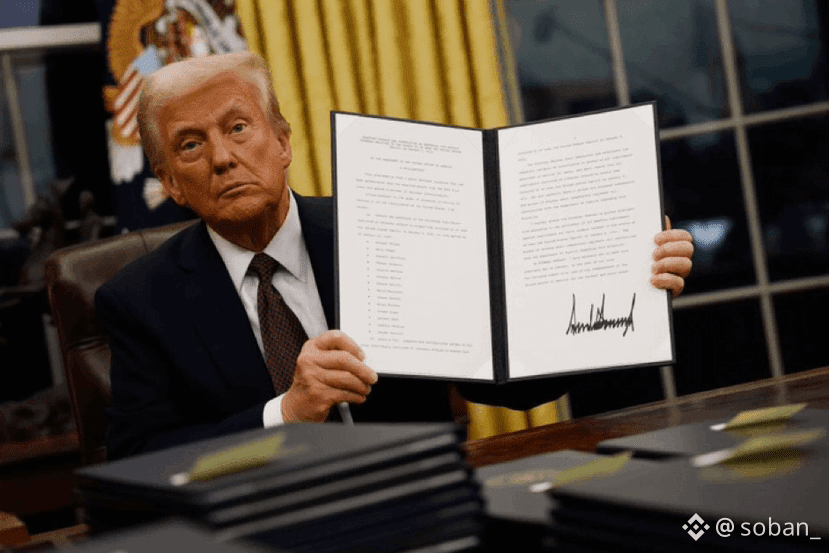

Today, U.S. regulators are rapidly closing in on what could become a landmark law for cryptocurrency markets, with calls from top officials that President Trump is expected to sign a long-awaited crypto market structure bill into law. (Bitcoin News)

This isn’t just another legislative headline — it’s potentially a structural shift that could shape how Bitcoin, Ethereum, stablecoins, and digital finance operate in the largest market in the world.

🧠 What This Bill Does

The market structure legislation being prepared aims to:

✅ Clarify regulatory roles between the SEC and CFTC

→ One agency will take the lead on spot crypto markets instead of ambiguous rules. (AInvest)

✅ Define how crypto assets are categorized (whether they’re commodities, securities, or digital tokens). (Reuters)

✅ Provide legal certainty, oversight, and market integrity standards. (CCN.com)

This has been one of the biggest sticking points for institutional participation and exchange structure development over the last several years.

📈 Immediate Market Impacts

Already today:

📊 Bitcoin rallied back toward key ranges on regulatory optimism — a move crypto analysts link directly to the structural clarity narrative. (Barron's)

📉 Meanwhile, Coinbase’s stock dipped slightly after earlier legislative controversy and a bill’s support pause — but industry leaders see this as short-term noise. (Barron's)

🪙 Why Traders Care About Market Structure

Market structure rules affect:

Exchange listings

Custody & settlement practices

Liquidity access for institutions

Derivatives and spot market alignment

Stablecoin clarity and use-cases

Put simply: this bill could reduce regulatory uncertainty — historically one of the biggest brakes on big money entering crypto.

📉 Why This Isn’t a Guaranteed Bull Run (Yet)

Political dynamics still matter:

⚠️ Implementation could take years even after signing, with full effects lingering into 2027–2029 according to market strategists. (Coin Edition)

⚠️ A separate bill providing even more clarity — the Digital Asset Market Clarity Act — is also moving through committees and could alter the final shape of the law. (CCN.com)

So while traders are cheering the possibility of certainty, the real test will be in implementation timelines and regulatory details.

💡 What Traders Should Watch Next

📍 Senate Banking Committee hearings — anticipate amendments that could impact spot vs derivatives definitions. (AInvest)

📍 Regulatory language on stablecoins & transparency — foundation for institutional capital flows. (Investing.com)

📍 BTC & ETH volatility around economic data / CPI prints — structure news + macro catalysts = amplified moves.

🧾 Bottom Line

This is not hype — it’s one of the most consequential regulatory developments for crypto markets in years. If the bill is signed and later passes the Senate/House fully:

🔥 Institutional demand could grow

🔥 Liquidity may expand sharply

🔥 Long-term structural confidence rises

But timelines matter — traders should remain agile and watch both price action and legislative developments side by side.

#BTC100kNext? #BTCVSGOLD #TrumpCrypto