🚀 🔥 📊

MARKET MOVER: BTC at $97K — Technicals + Sentiment Are Aligning 📈

Bitcoin holding near $97,000 isn’t random — it’s structured.

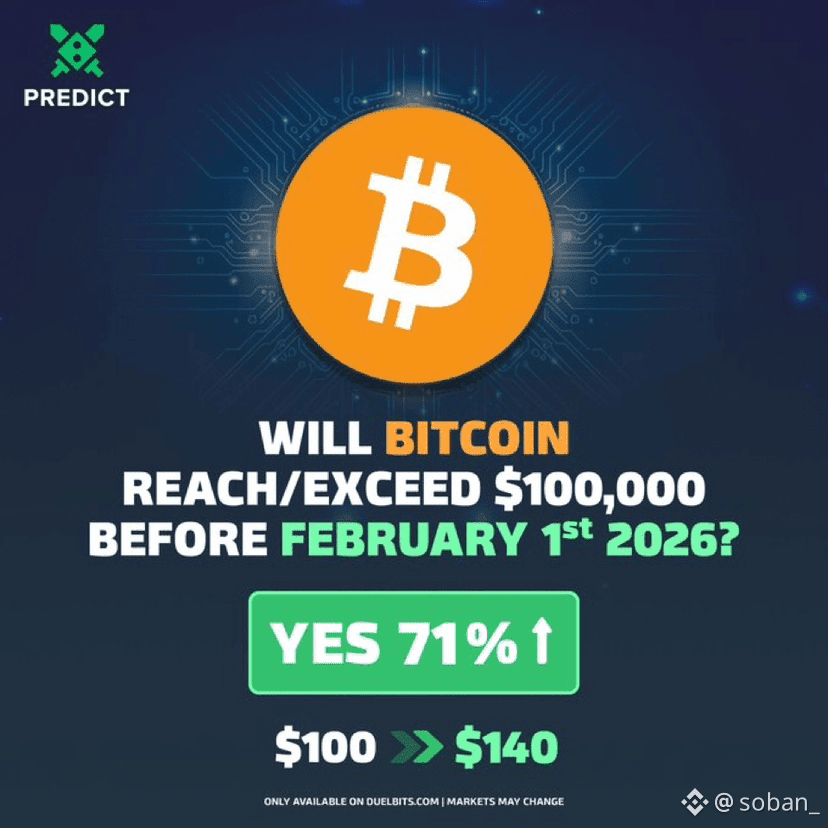

Market odds show a 71% probability of reclaiming $100K before Feb 1st, 2026, and both price action and sentiment data are backing that confidence.

🔍 Technical Snapshot (What the Chart Is Saying)

BTC is holding above the prior breakout zone ($95K–$96K)

Pullbacks are shallow and controlled

No aggressive sell candles on the daily close ❌

Structure remains higher low → higher high

This is not distribution behavior.

This is acceptance above range.

🧠 Sentiment Check (What Traders Are Doing)

Market confidence rising, not euphoric

No panic funding spikes

Dip buyers stepping in early

$100K no longer seen as “far away”

This is important:

Bull markets top on euphoria — not confidence.

🧩 My Real Trade Bias (How I’m Playing It)

📌 Trade Idea (Swing / Short-term Position)

Bias: Bullish continuation, not breakout chasing

Entry Zone:

👉 $95,800 – $96,300 (pullback into demand)

Stop Loss:

👉 Below $94,900 (daily structure invalidation)

Targets:

🎯 TP1: $99,500

🎯 TP2: $101,200

🎯 TP3 (extension): $104K if $100K flips to support

Risk–Reward: ~1:3+

⚠️ What Would Invalidate the Setup

Daily close below $95K

Strong sell delta with acceptance below support

High-volume rejection at $98K+ followed by weak bounce

If that happens, bias shifts to range continuation, not moon mode.

💡 Why I Like This Setup

Trading with structure, not headlines

Defined risk

No need to predict — just react

Aligned with rising confidence, not FOMO

🧠 Final Take

BTC at $97K is acting like a market that expects higher, not one that fears lower.

As long as structure holds and sentiment stays constructive, $100K is a matter of acceptance — not watch this coin carefully

#MarketRebound #Binance #cryptouniverseofficial