For centuries, global financial markets have relied on layered systems of trust, intermediaries, and centralized record keeping to enable the exchange of value. Bonds, equities, and collective investment funds form the backbone of modern finance, supporting everything from government borrowing and corporate expansion to household savings and pension systems. Despite their importance, these instruments have always been constrained by operational inefficiencies, opaque processes, and fragmented regulatory enforcement across jurisdictions. In recent years, blockchain technology has emerged as a proposed solution to many of these structural weaknesses. However, early blockchain implementations often prioritized ideological decentralization over regulatory compatibility, limiting their relevance for institutional finance.

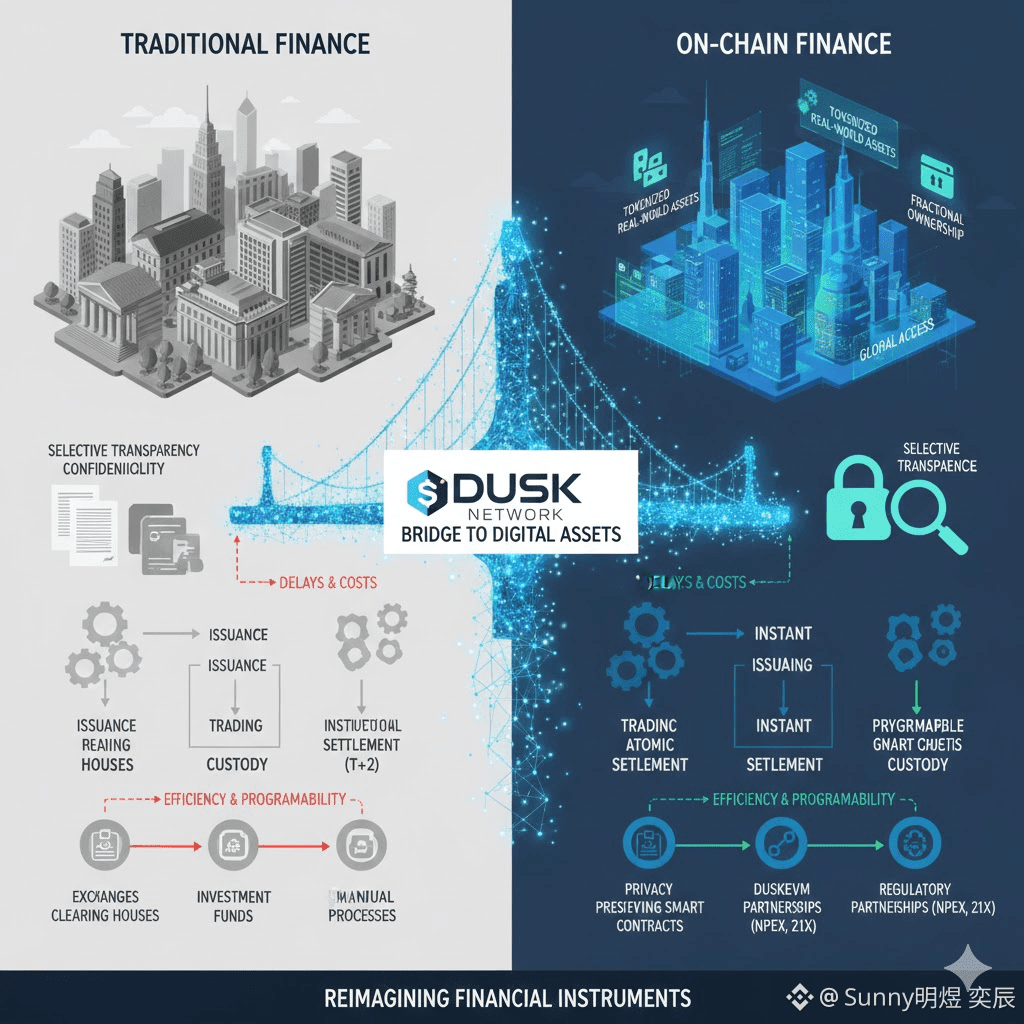

$DUSK Network represents a fundamentally different approach. Rather than attempting to replace traditional finance, it seeks to reconstruct it on-chain in a manner that preserves legal compliance, investor protections, and institutional standards while leveraging the efficiency and programmability of distributed ledger technology. Through privacy-preserving smart contracts, a purpose-built execution environment known as DuskEVM, and regulatory partnerships with licensed entities such as NPEX and 21X, Dusk Network positions itself as a bridge between traditional capital markets and blockchain-based infrastructure. This essay explores how traditional financial instruments are being reimagined through Dusk Network, beginning with an overview of legacy markets, tracing the historical evolution of tokenization, and analyzing how Dusk technology and regulatory alignment enable real-world asset markets to move on-chain at scale.

Overview of Traditional Financial Markets

Traditional financial markets evolved over long periods of trial, regulation, and institutional development. Bonds represent contractual debt obligations, typically issued by governments or corporations to raise capital in exchange for periodic interest payments and principal repayment at maturity. Equities represent ownership stakes in companies, granting shareholders residual claims on profits and, in many cases, voting rights. Investment funds aggregate capital from multiple investors to gain diversified exposure to asset classes, managed according to predefined strategies and regulatory mandates.

While these instruments differ in risk profile and purpose, they share a common operational structure. Issuance, trading, settlement, and custody are handled by specialized intermediaries such as exchanges, clearing houses, custodians, registrars, and transfer agents. Each layer introduces delays, costs, and reconciliation challenges. Settlement cycles often take multiple days, corporate actions require manual coordination, and investor access is frequently restricted by geography, minimum investment thresholds, and accreditation requirements.

Transparency in traditional markets is selective rather than absolute. Regulators have access to detailed reporting, but investors and counterparties often rely on delayed disclosures and aggregated data. Privacy is maintained through institutional confidentiality rather than cryptographic guarantees. Compliance with frameworks such as MiFID II ensures investor protection, but enforcement depends on centralized oversight and post hoc audits rather than real-time verification.

These limitations have long been accepted as the cost of operating complex financial systems. However, as digital infrastructure advanced, the possibility of reengineering these processes became increasingly compelling.

The Historical Emergence of Tokenization

Tokenization refers to the representation of real-world assets as digital tokens on a blockchain. Early experiments with tokenization emerged alongside the first generation of public blockchains, where cryptocurrencies demonstrated that digital scarcity could be enforced without centralized control. Initial tokenized assets often took the form of simple representations, such as stablecoins backed by fiat currency or synthetic assets tracking commodity prices.

These early models faced significant challenges. Public blockchains prioritized transparency, exposing transaction details that conflicted with financial privacy requirements. Smart contract platforms lacked the ability to enforce jurisdictional rules, identity verification, or transfer restrictions. As a result, tokenized securities frequently operated in regulatory gray areas or were limited to private networks with reduced interoperability.

Despite these shortcomings, the conceptual advantages of tokenization were clear. On-chain assets could settle instantaneously, reduce counterparty risk, enable fractional ownership, and automate compliance through programmable logic. Over time, the focus of tokenization shifted from experimental representations to legally recognized digital securities, particularly within jurisdictions exploring regulatory clarity for distributed ledger technology.

Dusk Network emerged within this context as a purpose-built blockchain designed specifically for compliant financial instruments rather than generalized decentralized applications.

Why Tokenization Matters for Capital Markets

Tokenization is not merely a technological upgrade; it represents a structural transformation of how capital markets function. By encoding ownership, transfer rules, and compliance requirements directly into smart contracts, tokenized assets can reduce reliance on intermediaries while preserving legal enforceability.

Efficiency gains are among the most immediate benefits. Settlement can occur on-chain within minutes or seconds, reducing capital lockup and operational risk. Corporate actions such as dividend distributions, bond coupon payments, and shareholder voting can be automated with precision. Fractionalization allows assets traditionally reserved for institutional investors to become accessible to smaller participants under regulated frameworks.

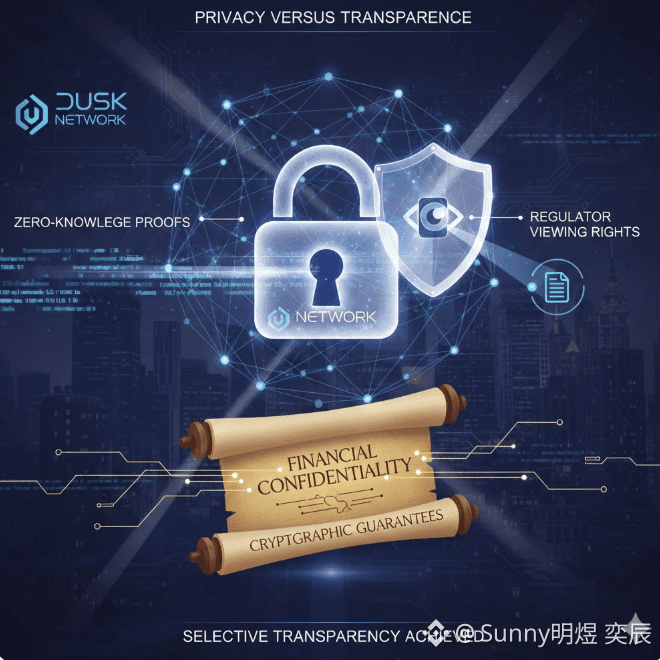

Transparency and auditability are enhanced through immutable ledgers, yet this must be balanced against confidentiality requirements. Institutions require selective disclosure rather than radical transparency. This tension between privacy and transparency lies at the heart of regulated tokenization and represents one of the most significant challenges for blockchain-based finance.

Dusk Network addresses this challenge by integrating cryptographic privacy mechanisms directly into its protocol design, allowing compliance without unnecessary data exposure.

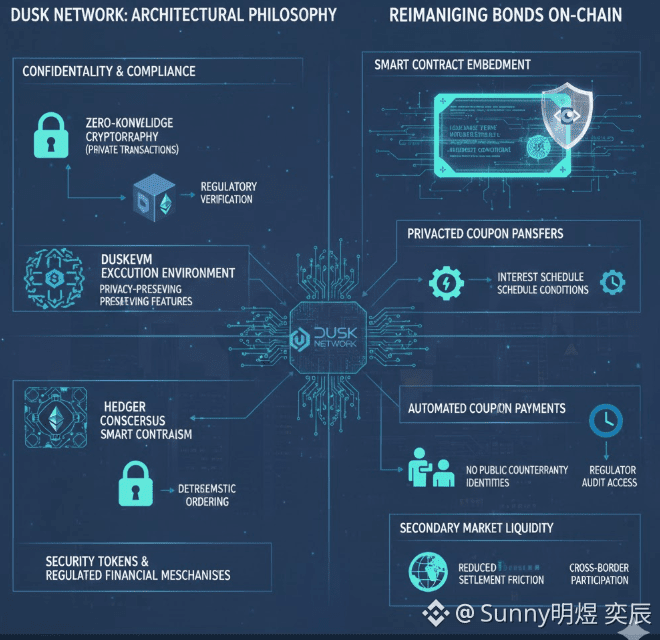

Dusk Network and Its Architectural Philosophy

Unlike general-purpose blockchains, Dusk Network is explicitly designed for security tokens and regulated financial instruments. Its architecture prioritizes confidentiality, compliance, and performance in equal measure. The network employs zero-knowledge cryptography to enable private transactions while still allowing regulatory verification when required.

DuskEVM, the network execution environment, extends compatibility with Ethereum-style smart contracts while introducing privacy-preserving features absent from traditional EVM chains. This enables developers to build sophisticated financial logic without sacrificing institutional standards.

The Hedger consensus mechanism further differentiates Dusk from proof-of-work or proof-of-stake models. Hedger is designed to support fast finality and deterministic transaction ordering, which are critical for financial markets where predictability and fairness are essential.

Together, these components create an environment where tokenized bonds, equities, and funds can function with the same legal rigor as their traditional counterparts, but with significantly improved efficiency.

Reimagining Bonds on Dusk Network

Tokenized bonds on Dusk Network can embed issuance terms, interest schedules, and redemption conditions directly into smart contracts. This reduces administrative overhead and minimizes human error. Coupon payments can be executed automatically, with cryptographic proofs ensuring correctness without revealing sensitive investor information.

Privacy-preserving transfers allow bond ownership to change hands without exposing counterparty identities publicly, while still enabling regulators to audit transactions when necessary. This balance is particularly important for institutional debt markets, where confidentiality is often a contractual requirement.

By operating on-chain, tokenized bonds can also benefit from secondary market liquidity enhancements, as settlement friction is reduced and cross-border participation becomes more feasible under compliant frameworks.

Tokenized Equities and Corporate Governance

Equities present additional complexity due to governance rights and disclosure obligations. Dusk Network enables tokenized shares to incorporate voting mechanisms, dividend distributions, and transfer restrictions aligned with shareholder agreements and regulatory requirements.

Privacy-preserving voting allows shareholders to participate without revealing positions publicly, while still producing verifiable outcomes. This addresses long-standing concerns around proxy voting transparency and shareholder anonymity.

By encoding compliance rules at the protocol level, issuers can ensure that only eligible investors hold shares, and that secondary transfers adhere to jurisdictional restrictions. This is particularly relevant under MiFID II, where investor classification and reporting obligations are stringent.

Funds and Collective Investment Vehicles On-Chain

Tokenized funds represent one of the most promising applications of blockchain in finance. Fund units can be issued, redeemed, and transferred with automated net asset value calculations and compliance checks.

$DUSK Network allows fund managers to maintain confidentiality around portfolio composition while providing regulators with necessary oversight. This addresses a critical barrier to institutional adoption, as fund strategies often rely on proprietary information.

On-chain fund administration reduces reconciliation costs and enables near real-time reporting, improving risk management and investor confidence.

Regulatory Alignment Through Partnerships

A defining feature of Dusk Network strategy is its emphasis on regulatory partnerships rather than regulatory avoidance. Collaboration with NPEX, a regulated Dutch exchange holding MTF, Broker, and ECSP licenses, provides a compliant venue for tokenized securities trading. The launch of DuskTrade, with more than three hundred million euros worth of tokenized assets expected on-chain, represents a tangible milestone rather than a theoretical promise.

Similarly, engagement with 21X reflects alignment with emerging European market infrastructure for digital securities. These partnerships demonstrate that Dusk Network is not operating in isolation, but as part of an evolving regulatory ecosystem.

MiCA and MiFID II form the regulatory backdrop for this transformation. While MiCA provides a framework for crypto assets, MiFID II governs financial instruments, including tokenized securities. Dusk Network approach acknowledges that tokenization does not exempt assets from existing laws. Instead, it integrates compliance into the technology stack.

Privacy Versus Transparency in Regulated Markets

The tension between privacy and transparency is often framed as a binary choice, but Dusk Network demonstrates that selective transparency is achievable. Zero-knowledge proofs allow transaction validity to be confirmed without exposing underlying data. Regulators can be granted viewing rights without making information public.

This model aligns closely with traditional financial confidentiality practices while leveraging cryptographic guarantees rather than institutional trust alone.

Risks and Challenges

Despite its promise, tokenization through Dusk Network is not without risks. Technological complexity introduces potential vulnerabilities in smart contract design. Regulatory interpretation may evolve, requiring continuous adaptation. Institutional adoption depends not only on technology but also on market education and operational integration.

Liquidity fragmentation remains a concern, as tokenized markets must reach sufficient scale to compete with established venues. Interoperability with existing systems is essential to avoid siloed infrastructure.

Future Outlook for Real-World Asset Markets on Dusk

The convergence of compliant blockchain infrastructure and traditional finance suggests a gradual rather than revolutionary transition. Dusk Network positions itself as an enabling layer rather than a disruptor, allowing institutions to adopt blockchain benefits without abandoning regulatory safeguards.

As DuskTrade brings substantial tokenized assets on-chain, the network will serve as a real-world testing ground for regulated decentralized finance. Success in this domain could influence broader adoption across capital markets, redefining how value is issued, traded, and governed in the digital age.

$DUSK Network illustrates how blockchain technology can be adapted to the realities of traditional finance rather than forcing finance to conform to ideological decentralization. By reimagining bonds, equities, and funds through privacy-preserving, compliant infrastructure, Dusk offers a credible path toward tokenized capital markets. Its emphasis on regulatory partnerships, technological specialization, and real-world deployment distinguishes it within the broader tokenization landscape. As real-world assets increasingly move on-chain, Dusk Network stands as a case study in how this transformation can occur responsibly, efficiently, and at institutional scale.