The global financial landscape stands at the precipice of a monumental shift, where the established structures of traditional markets encounter the transformative potential of distributed ledger technology. For decades, the movement of capital across international borders has relied upon a complex web of intermediaries, central clearing houses, and manual reconciliation processes that, while robust, remain encumbered by significant latency and high operational costs. The emergence of blockchain technology promised a departure from this legacy system, yet the initial wave of decentralized finance often lacked the privacy and regulatory compliance necessary for institutional adoption. In the current era, the focus has shifted toward the synthesis of these two worlds. This evolution is most prominently visible in the work of Dusk Network, a primary layer one blockchain engineered specifically to facilitate the tokenization of regulated financial instruments. By integrating advanced zero knowledge cryptography with a focus on institutional standards, Dusk Network is not merely digitizing existing assets but is fundamentally reimagining the lifecycle of equities, bonds, and funds within a private and compliant framework.

The Foundations of Traditional Financial Markets and the Case for Tokenization

To understand the magnitude of the change currently underway, one must first consider the traditional mechanisms of asset ownership and exchange. Traditional financial instruments, such as corporate bonds, public equities, and mutual funds, are governed by a dense forest of legal requirements and administrative overhead. When an investor purchases a share in a company or a debt instrument from a sovereign state, the transaction initiates a series of back office events. These include trade execution, clearing, and finally, settlement, which often takes several days to complete. This delay, commonly referred to as settlement risk, represents a period where the capital is tied up and neither party has full control over the asset or the cash. Furthermore, the fragmentation of ledgers between different banks and brokerage firms necessitates a constant process of reconciliation, which is both error prone and expensive.

Tokenization addresses these inefficiencies by converting the legal rights to an asset into a digital token on a blockchain. Unlike a simple database entry, a tokenized asset carries its own logic and compliance rules. In the context of traditional finance, this means that the rules governing who can own an asset, how it can be traded, and when dividends are paid can be embedded directly into the asset itself. This shift from manual enforcement to programmatic enforcement is the core value proposition of the tokenization movement. It allows for fractional ownership, enabling smaller investors to access high value assets like private equity or real estate that were previously reserved for institutional players. Moreover, it enables atomic settlement, where the exchange of the asset and the payment happens simultaneously and instantaneously, virtually eliminating counterparty risk.

The Evolution and History of Asset Tokenization

The journey toward modern tokenization did not begin with a focus on regulated securities. Instead, it emerged from the early experimentation with colored coins on the Bitcoin network and the subsequent rise of initial coin offerings on Ethereum. These early attempts proved that digital tokens could represent various forms of value, but they also highlighted significant weaknesses. Most notably, early blockchain platforms were built on the principle of radical transparency, where every transaction and wallet balance was visible to any observer. For a public company or a private investment fund, this level of exposure is a non starter. Financial institutions are legally and competitively required to maintain the confidentiality of their clients and their strategic positions.

As the industry matured, the conversation shifted from purely public ledgers to the need for privacy preserving technologies. The history of tokenization is a history of trying to balance the benefits of a shared, immutable ledger with the necessity of business secrecy. Initial attempts at private blockchains often resulted in siloed ecosystems that lacked the interoperability and security of public networks. It was within this context that the need for a protocol like Dusk Network became apparent. The goal was to create a public, permissionless infrastructure that could nevertheless support private, permissioned assets. This requires a fundamental redesign of how blockchain consensus and smart contracts function, moving away from simple transparent state transitions toward sophisticated cryptographic proofs.

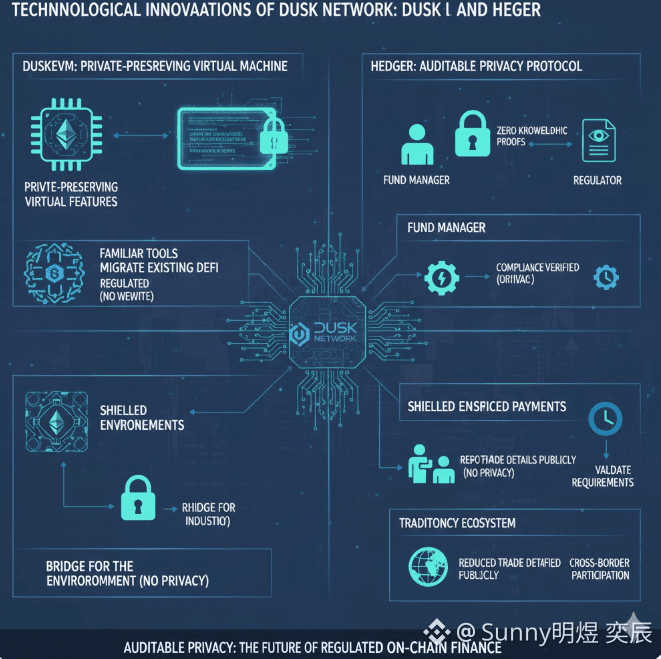

Technological Innovations of Dusk Network: DuskEVM and Hedger

Dusk Network distinguishes itself through a specialized technological stack designed to meet the rigorous demands of the financial sector. At the heart of this stack is the DuskEVM, a virtual machine that is compatible with the Ethereum ecosystem but enhanced with native privacy features. The compatibility with the Ethereum Virtual Machine allows developers to use familiar tools and languages, such as Solidity, while the underlying Dusk architecture ensures that the sensitive data within those contracts remains shielded. This is a critical bridge for the industry, as it allows for the migration of existing decentralized finance applications into a regulated environment without requiring a total rewrite of the codebase.

The mechanism that enables this private yet auditable environment is known as Hedger. This technology utilizes zero knowledge proofs to allow users to prove the validity of a transaction without revealing the underlying details, such as the amount transferred or the identities of the participants. In a traditional sense, if a fund manager executes a large trade, they must report this to a regulator. In the Dusk ecosystem, the Hedger protocol allows the manager to provide a cryptographic proof to the regulator that the trade complied with all relevant laws—such as anti money laundering and know your customer requirements—without broadcasting the trade details to the entire market. This creates a paradigm of auditable privacy, which is the only way institutional finance can realistically move onto a public blockchain.

Regulatory Alignment and the Role of MiCA and MiFID II

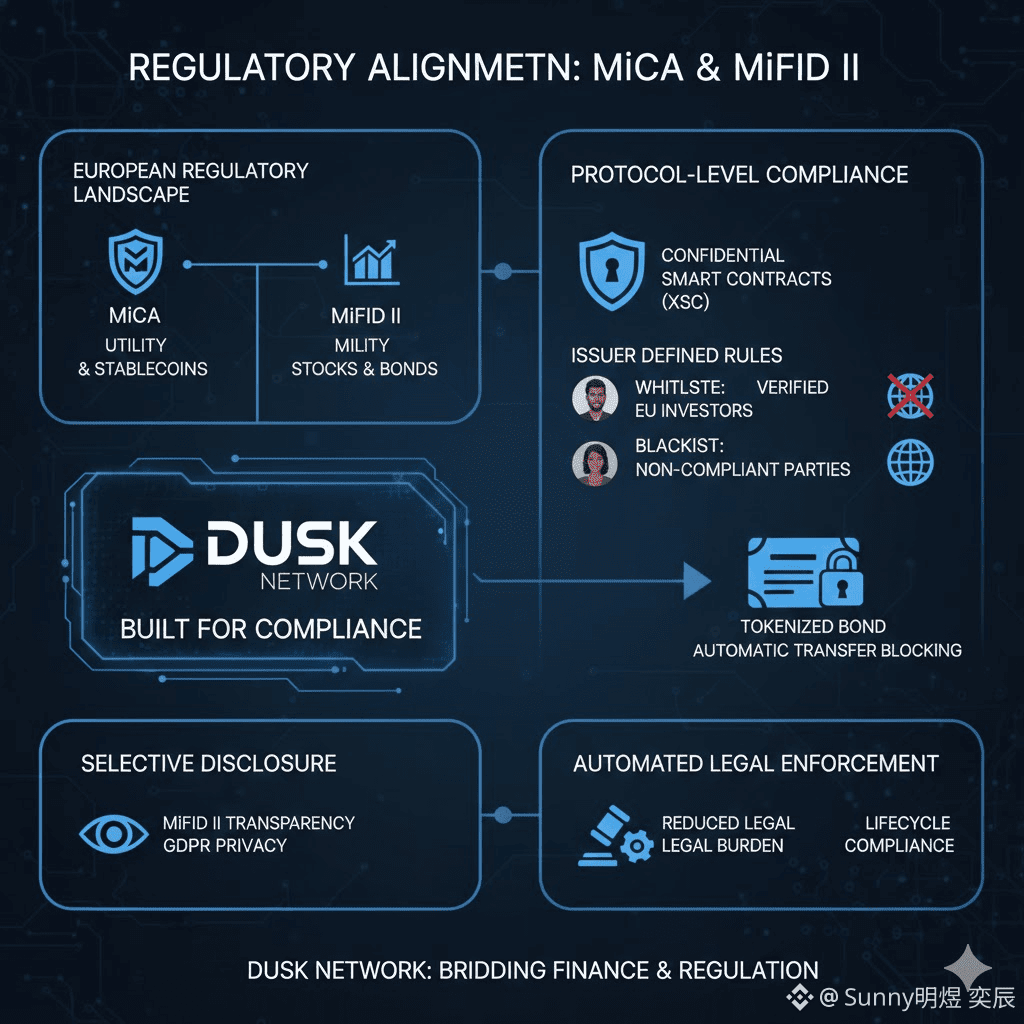

No technological innovation in finance can succeed without a clear alignment with the regulatory landscape. In Europe, the regulatory environment is currently defined by the Markets in Crypto Assets regulation and the second Markets in Financial Instruments Directive. These frameworks are designed to bring order to the digital asset space, ensuring investor protection and market integrity. Dusk Network is built with these specific regulations in mind. While MiCA primarily deals with utility tokens and stablecoins, MiFID II governs traditional financial instruments like stocks and bonds.

Dusk Network addresses the complexities of these regulations by embedding compliance at the protocol level. Through its confidential smart contract standard, known as XSC, issuers can define specific white lists and black lists for their assets. For example, a bond issued on Dusk can be programmed so that it can only be held by verified European investors, automatically blocking any attempted transfer to a non compliant party. This automated compliance reduces the burden on legal teams and ensures that the asset remains within the boundaries of the law throughout its entire lifecycle. By providing the tools for selective disclosure, Dusk allows institutions to satisfy the transparency requirements of MiFID II while maintaining the privacy protections required by the General Data Protection Regulation.

Strategic Partnerships and Real World Implementation: NPEX and 21X

The theoretical advantages of the Dusk Network are being put to the test through strategic partnerships with established financial institutions. One of the most significant collaborations is with NPEX, a regulated Dutch stock exchange that operates a multilateral trading facility. NPEX is working with Dusk to migrate its infrastructure onto the blockchain, a move that represents one of the first instances of a licensed exchange adopting public ledger technology for the issuance and trading of securities. This partnership is not just a pilot project; it is a fundamental integration aimed at reducing the costs of capital for small and medium enterprises by streamlining the listing and settlement processes.

In addition to NPEX, the partnership with 21X is equally transformative. 21X is a European distributed ledger technology exchange that is specifically focused on the institutional market. By integrating with the DuskEVM, 21X provides a venue where professional investors can trade tokenized real world assets in a familiar, regulated environment. The synergy between Dusk's privacy technology and the regulatory licenses held by partners like 21X and NPEX creates a powerful ecosystem. It allows for the creation of a primary market where assets are issued as tokens and a secondary market where they can be traded with instant settlement.

The Impact of DuskTrade and €300M in Tokenized Assets

The scale of this transformation is best illustrated by concrete figures and specific platforms. DuskTrade is a flagship application within the ecosystem that serves as a gateway for both institutional and retail investors to access tokenized securities. Recent reports indicate that over three hundred million euros worth of tokenized assets are planned for migration to the platform. These assets are not speculative cryptocurrencies but represent real world value, including corporate equities and debt instruments.

When three hundred million euros of traditional capital moves onto a blockchain, it signals a shift in the perception of the technology. It moves the conversation away from the volatility of digital assets toward the efficiency of digital infrastructure. For the companies issuing these securities, the benefit is a wider pool of global liquidity and lower administrative costs. For the investors, it means more transparent reporting and the ability to manage their portfolios with greater flexibility. The success of DuskTrade serves as a proof of concept for the entire industry, demonstrating that the technical hurdles of privacy and the legal hurdles of compliance can be overcome simultaneously.

Privacy versus Transparency: Navigating the Institutional Paradox

One of the most profound challenges in the adoption of blockchain for finance is the inherent tension between privacy and transparency. Traditional blockchains are transparent by default, which is excellent for building trust in a decentralized setting but detrimental for corporate operations. Conversely, traditional finance is private by default, which is necessary for competition but leads to opaque markets and systemic risks. Dusk Network solves this paradox by offering a middle ground where transparency is selective and controlled by the participants.

In the Dusk model, the ledger is public, meaning that anyone can verify the integrity of the network and the validity of the consensus. However, the data within the transactions is encrypted. Only the parties involved in a transaction, or those to whom they grant access, can see the details. This allows a bank to maintain a private ledger of its clients' holdings while still benefiting from the shared security of the main network. This balance is crucial for institutional adoption because it mirrors the way the current financial system works, where regulators have oversight, but the public does not have access to private banking records.

Risks and Challenges in the Tokenization Journey

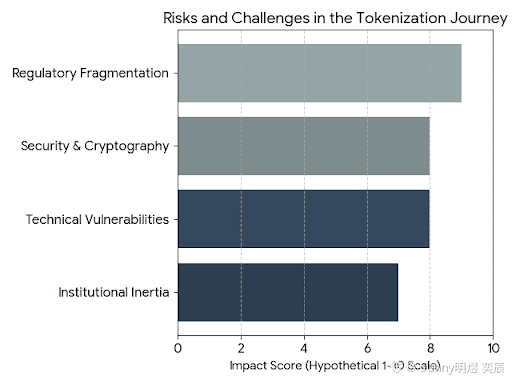

Despite the significant progress made by $DUSK Network and its partners, the path toward a fully tokenized financial system is fraught with risks. Technical risks are ever present, as the reliance on complex zero knowledge proofs and new virtual machine architectures requires extensive auditing to ensure that there are no vulnerabilities in the code. A failure in the underlying cryptography could lead to a loss of funds or a breach of confidentiality, both of which would be catastrophic for institutional trust.

Furthermore, the regulatory landscape remains fragmented. While Europe has made great strides with MiCA and the DLT Pilot Regime, other jurisdictions like the United States are still grappling with how to categorize and regulate digital assets. This lack of global harmonization creates challenges for cross border tokenization, as an asset that is compliant in the Netherlands may not meet the requirements in another country. There is also the risk of institutional inertia; many large banks have deeply entrenched legacy systems that are difficult and expensive to replace, even when the benefits of doing so are clear.

The Future Outlook for Blockhain Based Finance

The long term outlook for the tokenization of traditional financial instruments is overwhelmingly positive. As more assets move on chain, we can expect to see the emergence of a more inclusive and efficient global financial system. The distinction between traditional finance and decentralized finance will likely blur, as institutions adopt the tools of blockchain to improve their operations and decentralized protocols adopt the standards of compliance to attract larger pools of capital.

$DUSK Network is positioned at the center of this convergence. By providing the essential infrastructure for private and compliant asset management, it is laying the foundation for a future where any asset, from a government bond to a share in a local startup, can be traded with the same ease as a digital message. The transition will not happen overnight, but the momentum is building. The integration of traditional exchanges, the clarity provided by new regulations, and the deployment of hundreds of millions of euros in tokenized value are all indicators that the reimagining of finance is well underway.