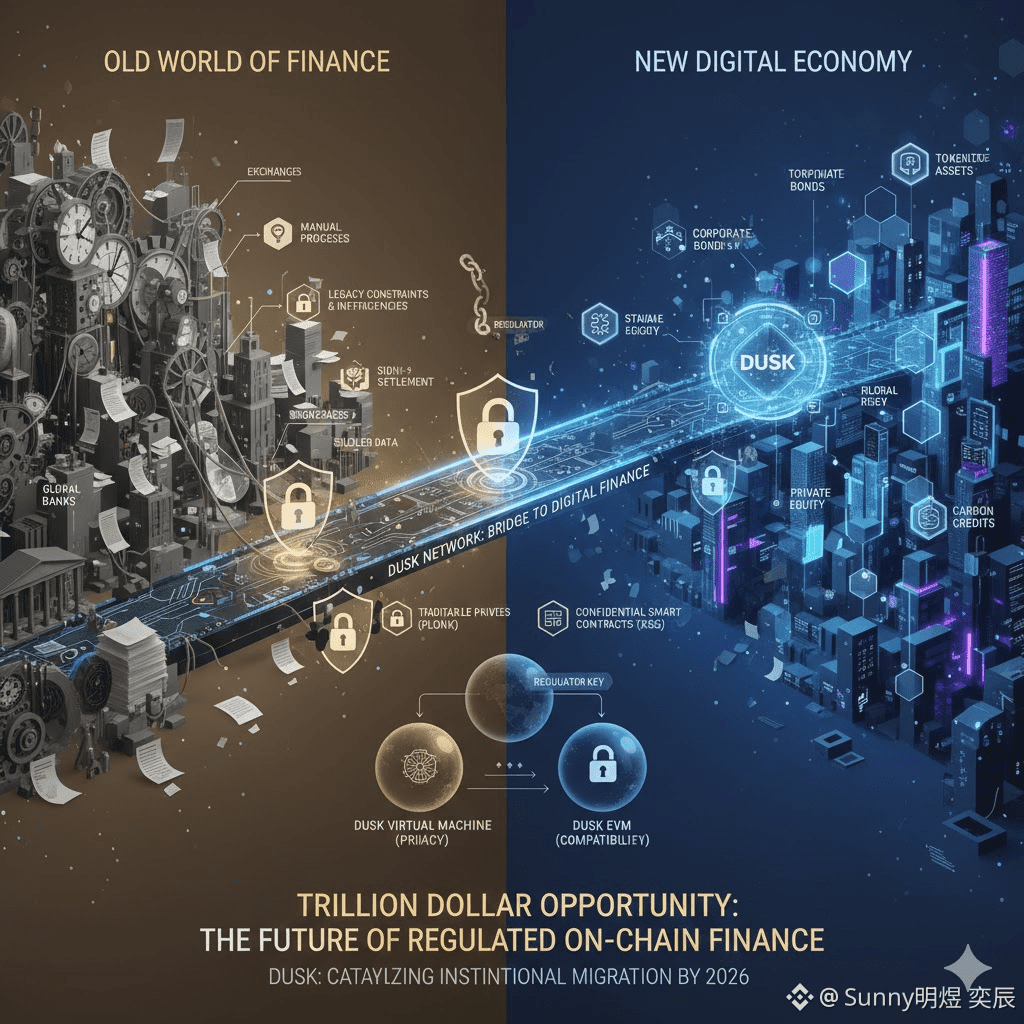

The financial world currently stands at a precipice that is similar to the early days of the internet. For centuries, the mechanisms of global trade and investment have relied upon a complex web of intermediaries, manual reconciliations, and antiquated settlement cycles. While consumer technology has evolved at a lightning pace, the underlying infrastructure of the financial markets has remained stubbornly rooted in the twentieth century. This research essay explores the systematic transformation of traditional financial instruments, including bonds, equities, and investment funds, into a new digital paradigm powered by blockchain technology. Specifically, this analysis focuses on the role of the Dusk token and the underlying network as the catalyst for this institutional migration. By examining the current inefficiencies of traditional markets and the technical breakthroughs of the Dusk protocol, we can observe how the vision of a private, compliant, and decentralized financial future is becoming a reality in 2026.

The Architectural Limits of Traditional Financial Markets

To understand the necessity of the $DUSK token, one must first identify the structural failures of the traditional financial system. Current markets for securities such as corporate bonds and private equity are plagued by a lack of transparency for participants and a simultaneous lack of privacy for sensitive institutional strategies. When a large investment bank issues a bond today, the process involves underwriters, legal counsel, clearing houses, and central securities depositories. Each of these participants adds a layer of cost and a potential point of failure. Furthermore, the standard settlement time for most securities is still forty eight hours or more. In an era where information travels at the speed of light, it is a significant contradiction that the ownership of a financial asset takes days to transfer.

Traditional markets are also characterized by siloed data. Every bank and brokerage maintains its own private ledger, necessitating constant reconciliation to ensure that accounts match. This fragmentation creates systemic risk and prevents the creation of a unified, liquid market for diverse asset classes. Small and medium enterprises are often locked out of these markets due to the high costs of compliance and issuance. This is the environment into which the Dusk protocol introduces a radical alternative: a single, shared, and cryptographically secure ledger where privacy is preserved but regulatory compliance is automated.

The Strategic Importance of the Dusk Token

The Dusk token serves as the fundamental unit of value and utility within this new financial ecosystem. Unlike earlier generations of blockchain assets that were primarily used for speculation, the Dusk token is designed for institutional utility. It is the fuel that powers a privacy preserving Layer 1 blockchain specifically engineered for regulated finance. The token fulfills several critical roles that make the on chain migration of assets possible. First, it serves as the medium for transaction fees, ensuring that the network remains spam resistant and that validators are compensated for maintaining the ledger. Second, the token is used for staking in a unique consensus mechanism known as the Segregated Byzantine Agreement. This ensures that the network remains decentralized and secure while providing the fast finality required for financial trading.

Perhaps most importantly, the Dusk token facilitates the creation and management of Confidential Security Tokens. In the Dusk ecosystem, a bond or a share of equity is not just a digital entry; it is a programmable asset that can enforce its own compliance rules. The Dusk token is the collateral and the utility required to deploy these smart contracts. By aligning the interests of regulators, issuers, and investors through a single economic unit, Dusk creates a cohesive environment where traditional assets can finally shed their legacy constraints.

Technical Breakthroughs in Privacy and Compliance

The primary reason why traditional finance has hesitated to adopt public blockchains like Ethereum or Bitcoin is the total transparency of those networks. For a regulated bank, revealing the identity of its clients or the details of its proprietary trading strategies on a public ledger is a legal and competitive impossibility. Dusk addresses this through a suite of advanced cryptographic technologies. At the heart of this system are Zero Knowledge Proofs, which allow a party to prove that a statement is true without revealing the underlying data.

Dusk utilizes a specific implementation called PLONK, which allows for the verification of transactions while keeping the sender, receiver, and amount hidden from the public. However, unlike "privacy coins" that aim for total anonymity, Dusk is built for "auditable privacy." The protocol includes features for selective disclosure. This means that while the general public cannot see the details of a bond trade, a designated regulator or auditor can be granted a cryptographic key to view the transaction details for compliance purposes. This balance of privacy and auditability is the "holy grail" for institutional adoption.

The network also employs a modular architecture, consisting of the Dusk Virtual Machine for privacy preserving smart contracts and the Dusk Ethereum Virtual Machine for compatibility with existing decentralized finance tools. This duality allows developers to build complex financial products using familiar tools while benefiting from the institutional grade privacy that only the Dusk native layer can provide. By integrating these features at the protocol level, Dusk removes the need for expensive third party compliance services, drastically reducing the cost of issuing and trading financial instruments.

Realizing the Vision Through DuskTrade

The theoretical potential of the Dusk token is now being validated by concrete real world applications. The most significant of these is DuskTrade, a platform designed to facilitate the trading of tokenized real world assets. As of 2026, the partnership between $DUSK and the Dutch regulated exchange NPEX has reached a critical milestone. It is estimated that over three hundred million euros worth of tokenized securities are currently transitioning onto the Dusk infrastructure. These assets include corporate bonds from European small and medium enterprises, as well as fractionalized real estate and private equity funds.

The goal of DuskTrade is to provide a seamless gateway for traditional investors to access the benefits of blockchain technology. When an investor buys a bond on DuskTrade, the settlement is near instantaneous. The legal requirements, such as "Know Your Customer" and "Anti Money Laundering" checks, are embedded into the token itself. If an investor from a restricted jurisdiction attempts to purchase the bond, the smart contract will automatically reject the trade. This level of automated enforcement reduces the risk for issuers and ensures that the platform remains fully compliant with European regulations such as the Markets in Crypto Assets regulation.

Future Outlook and the Trillion Dollar Opportunity

The long term outlook for the Dusk token and the broader tokenization movement is immense. Industry analysts suggest that the total addressable market for tokenized real world assets could reach tens of trillions of dollars by the end of the decade. As more institutions realize the cost savings and liquidity benefits of the blockchain, the demand for a compliant, privacy first infrastructure will only grow. The Dusk token is positioned at the center of this trend, acting as the bridge between the old world of finance and the new digital economy.

In the coming years, we can expect to see an expansion of the types of assets coming to the Dusk network. Beyond bonds and equities, we may see the tokenization of carbon credits, intellectual property, and even government debt. The ability to trade these assets twenty four hours a day, seven days a week, on a global and transparent ledger will redefine the meaning of market efficiency. For the student of finance, the rise of the Dusk token represents more than just a new technology; it represents the democratization of the capital markets and the birth of a more resilient, inclusive, and transparent global financial system.

The transformation of traditional financial instruments is not a matter of "if" but "when." Through its focus on regulatory compliance, institutional privacy, and advanced cryptography, the Dusk protocol provides the necessary foundation for this shift. The Dusk token is the essential element that makes this entire system function, providing security, utility, and value to a network that is poised to lead the next generation of global finance. As we look toward the future, the integration of traditional assets onto the blockchain through $DUSK remains one of the most compelling narratives in the evolution of money.