My friend told me Transactions is completed "but how ?" if you think this let's me explain you, How Transactions arrived quietly. Not announcements. Not confirmations. Just data, carrying its own weight. Privacy shields activated by default, audit trails lurking underneath. The ledger didn’t speak, it only waited. Observers sensed the friction before they saw the logs.

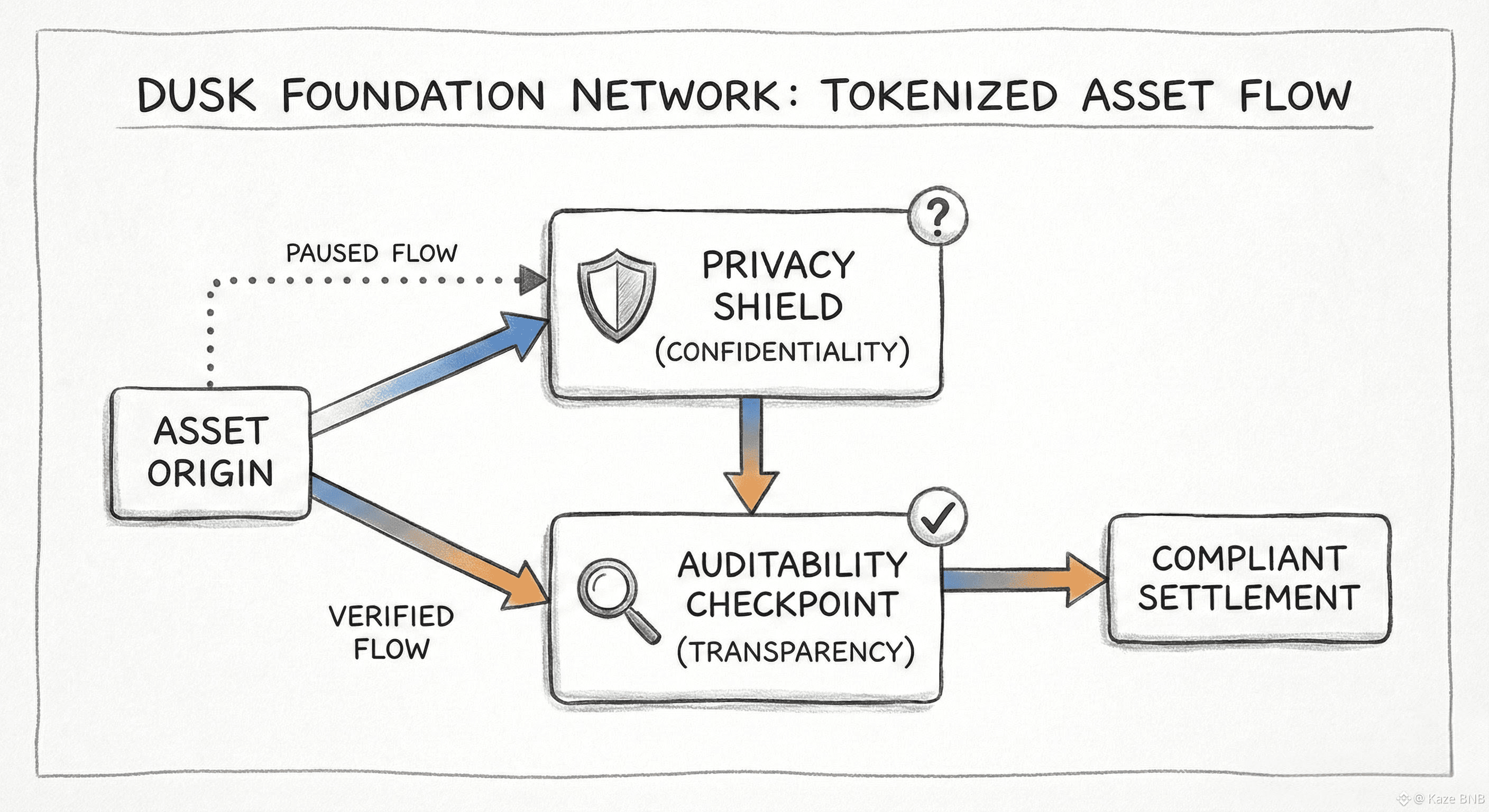

Each transfer had dual expectations. Confidentiality demanded discretion. Regulators demanded clarity. Somewhere between these two clocks, the system whispered its limits. A dividend movement or compliance check didn’t fail it paused, stretched, and asked a question no one could answer aloud: “Is this both private and verifiable yet?”

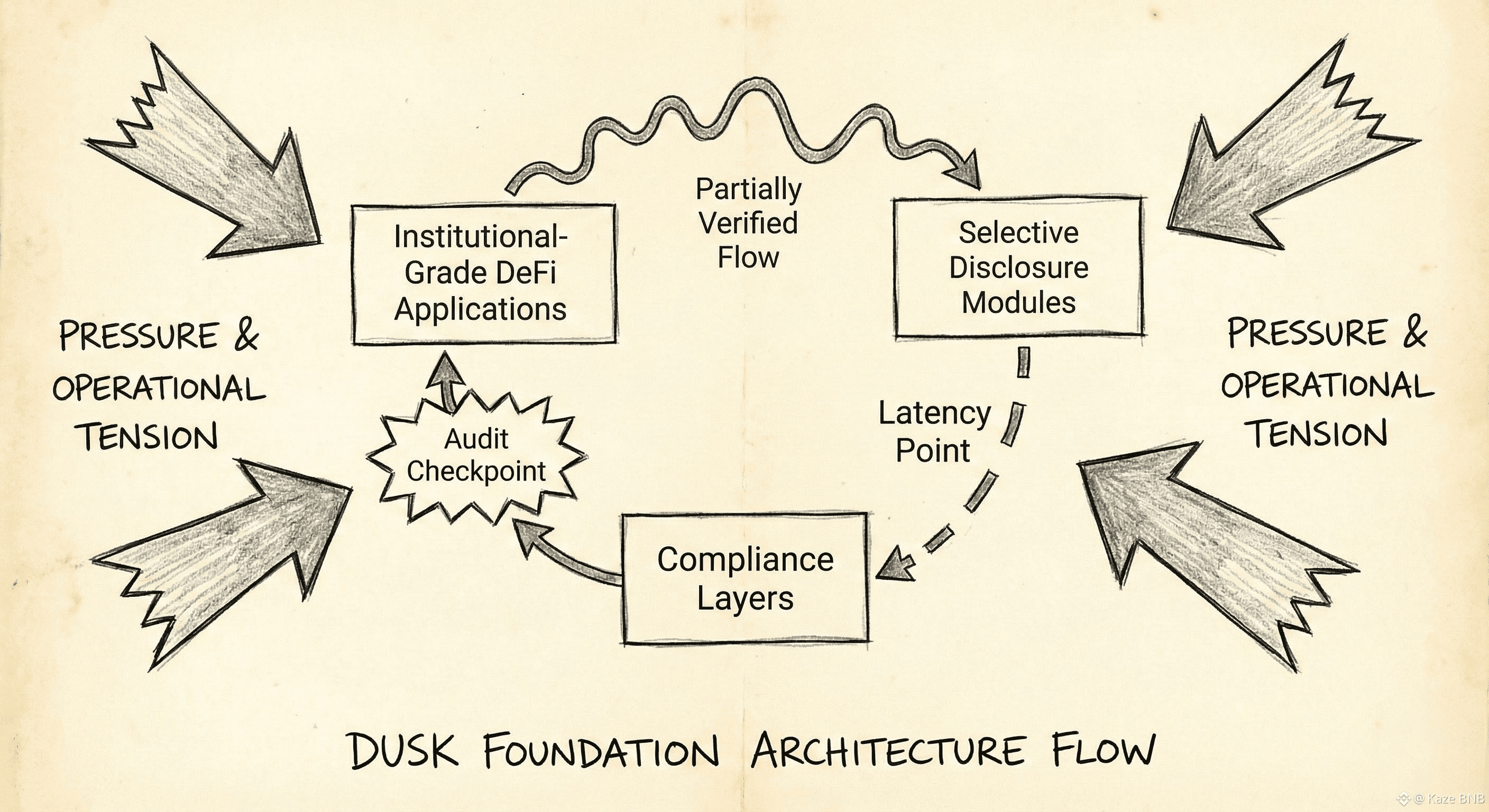

Dusk Foundation (@Dusk ) modules shifted under load. Identity proofs verified themselves only in part. Some selective disclosures glimmered through, others lagged. It wasn’t error. It was pressure. The tension surfaced in micro-delays: a token not fully auditable, a balance verified only halfway. “The record exists,” a compliance observer said, “but I’m not sure if it tells the whole story yet.”

Institutional participants felt it immediately. Confidential Security Contracts, tokenized assets, and DeFi interactions all intersected in the same space, but none followed a single rhythm. One module confirmed eligibility, another awaited regulatory acknowledgment, and a third waited silently, holding privacy tight. Latency revealed responsibility. Not in numbers, but in the pause between action and recognition.

The system’s silence was instructive. Auditability wasn’t a report. It was friction you could feel in decisions. Should a transaction settle now, or wait until all privacy constraints are reconciled? Who decides when a partial disclosure suffices? No answers appeared, only choices that mattered under the weight of institutional scrutiny.

Privacy and transparency collided subtly. A $DUSK token representing a bond lingered, partially visible, partially verified. A developer muttered, “It’s like watching a shadow of certainty move through the ledger.” The ledger didn’t respond. It only recorded, neutrally, the rhythm of verification. Responsibility sharpened with each observation.

DeFi pools were no easier. Liquidity appeared, then slowed, sensing that privacy protocols weren’t yet complete. Selective disclosure had its own cadence. Compliance checks weren’t passive they were insistently present, quietly forcing actors to reconcile risk with opportunity. Even a simple transfer carried the echoes of regulatory frameworks.

Participants learned that friction wasn’t a flaw it was the system speaking. Time, privacy, and transparency created a triangle where no corner could dominate. A partially audited transaction or a delayed selective disclosure revealed tension, showing what mattered most: trust under pressure.

Some teams noticed early. Others assumed auditability was passive. They discovered that partial proofs or invisible privacy shields forced real decisions. Responsibility wasn’t abstract. Compliance wasn’t an afterthought. And the ledger never explained itself it only held the weight of choices.

Across the ecosystem, the Dusk Foundation network demonstrated that institutional-grade privacy isn’t seamless. Every module, every verification, every selective disclosure carried its own pressure. Real-world consequences appeared not as failures, but as reflections: delays, hesitation, incomplete confirmations. The friction was the story.

And yet the tension persisted. Should a transaction finalize under partial visibility? Should liquidity move when regulatory proofs are incomplete? Dusk Foundation didn’t hand answers. It only enforced the environment where responsibility and scrutiny coexisted quietly, insistently, unflinchingly.