STON Token — The Engine Powering TON’s DeFi Transformation

Abstract. Over 2025, TON’s decentralized finance landscape has evolved rapidly. Central to that progress is STON — the native token of STON.fi — which functions not merely as a speculative instrument but as a core utility asset that underpins swaps, liquidity provision, and cross-protocol integration across TON. This article evaluates STON’s role from market performance and tokenomics to real-world utility, liquidity, and risks, and explains why its trajectory appears tied to genuine adoption rather than hype.

Market performance: maturity over momentum

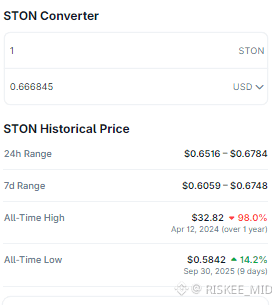

STON’s recent price history tells a story more consistent with maturation than mania. Yearly candle data shows repeated recovery from short corrections and progressively stronger trading structure — a pattern typically associated with expanding organic demand. Crucially, STON’s upward moves have tracked concrete platform milestones (new pool listings, Omniston integrations, higher on-chain activity) instead of purely market sentiment.

Two practical signals underline this maturity:

Correlation with on-chain activity. Volume and price moves appear to align with increased user interactions on STON.fi and TON DeFi generally.

Resilience through corrections. Rapid recoveries from drawdowns indicate buyer confidence tied to platform fundamentals rather than short-term speculation.

The combination of steady trading structure and milestone-driven rallies suggests STON’s market value is increasingly anchored to utility.

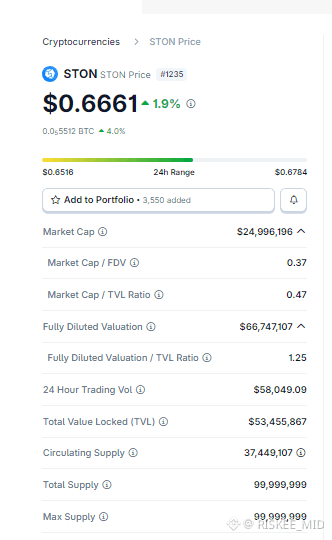

Tokenomics: designed for sustainability

A token’s long-term viability hinges on its economic design. STON’s tokenomics emphasize sustainability and alignment between users, liquidity providers, and long-term stakeholders. Key aspects include:

Transparent circulating supply. Clarity around circulating supply reduces uncertainty and helps professional participants model supply dynamics.

Balanced fully diluted valuation (FDV). An FDV that matches current adoption and utility helps avoid the dilution shock that sinks emerging tokens.

Built incentives for holding and liquidity. Mechanisms that encourage staking and liquidity provision deepen markets and stabilize slippage.

These features collectively discourage inflationary pressure, favor longer holding horizons, and improve on-chain liquidity quality — all of which attract both retail and institutional activity.

Utility: more than a trading token

STON’s value proposition is intimately tied to real usage. Every swap, stake, or liquidity action on STON.fi feeds STON’s ecosystem dynamics. This is important for two reasons:

Network effects. As more DeFi activity routes through STON.fi and Omniston, STON becomes a natural medium for coordination — fee accrual, LP incentives, and governance participation can create reinforcing demand.

Operational utility. Practical utility (reduced slippage, staking rewards, access to certain pools or features) embeds STON into everyday DeFi workflows rather than making it an optional speculation vehicle.

The reported $6B+ trading volume and millions of processed swaps are not vanity metrics; they reflect consistent user trust and transactional throughput that sustain token utility.

Ecosystem integration: Omniston and beyond

One of STON’s competitive advantages is its role within broader TON liquidity aggregation efforts like Omniston. By serving as a liquidity hub and settlement medium across integrated pools and protocols, STON benefits from:

Cross-protocol liquidity routing. Better prices and lower slippage attract volume, which in turn deepens liquidity for STON pairs.

Platform partnerships and listings. Wider availability across platforms and listings increases discoverability and on-ramps for new users.

Integration into a composable DeFi stack turns STON into an infrastructural asset rather than a single-use token.

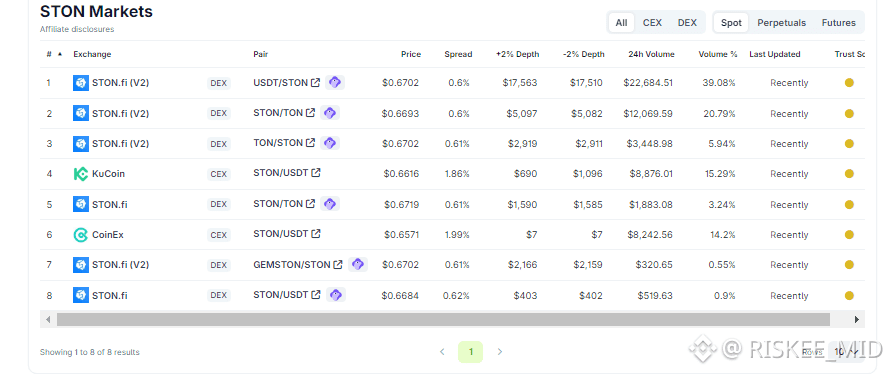

Liquidity & accessibility

High liquidity is essential for any token that aspires to be a primary exchange and settlement unit. STON’s presence across multiple platforms — combined with deep pools on STON.fi — supports market depth and reduces execution risk for large trades. Accessibility (ease of discovery and trading across venues) expands the user base and improves price efficiency.

Risk considerations

No asset is without risk. For a balanced perspective, potential concerns include:

Protocol risk. As with any DeFi protocol, smart-contract vulnerabilities or misconfigurations could impact user funds and token perception.

Market concentration. If a significant portion of supply is held by a few parties, price behavior could be more volatile.

Regulatory landscape. Changes in crypto regulation could affect platform operations and token listings in certain jurisdictions.

Competition. Other DEXs and liquidity aggregators on TON or cross-chain could capture market share.

Investors and participants should weigh these risks alongside the token’s fundamentals; this article is informational, not financial advice.

Conclusion — Engine, not ornament

STON’s narrative in 2025 reads as a practical one: a token whose appreciation and resilience are closely linked to real, measurable DeFi activity on TON. Its tokenomics promote sustainability, its integrations (notably Omniston) expand utility, and substantial trading volume demonstrates that users are actively interacting with the asset. While risks remain — as they do across DeFi — STON’s position as a core operational token within TON’s liquidity infrastructure makes it a standout example of how utility-driven design can produce more durable token economics.

For readers seeking deeper technical or financial analysis, examining on-chain metrics (active addresses, TVL, concentrated liquidity, holder distribution) and security audits for STON.fi is a recommended next step. For general reference, the project’s token page is available at: ston.fi/tokens/ston.

Disclaimer: This article is for informational purposes only and does not constitute investment advice. Always conduct your own research and consider professional guidance before making financial decisions.