Dusk Foundation keeps the Dusk Network running, but the system itself revolves around one simple idea: state change. Everything meaningful on the network eventually becomes a shift in state. You don’t partially move anything here. You either change reality, or you don’t.

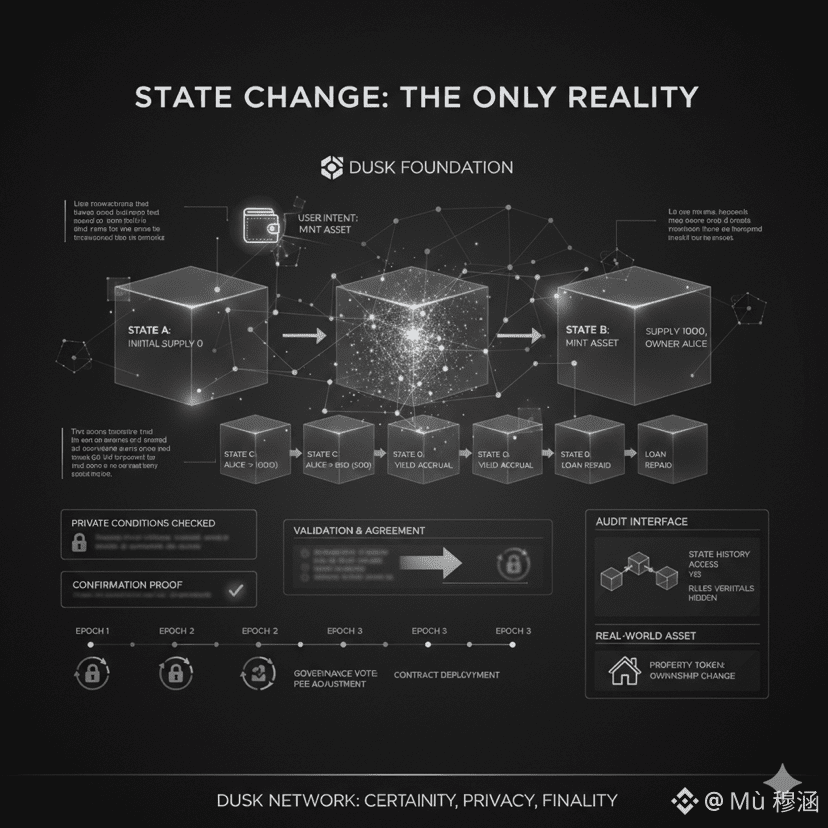

When a user acts, that action isn’t treated as a suggestion or a temporary update. It’s an intent to replace one version of the system with another. Sending DUSK, interacting with an asset, updating a contract — all of it aims at producing a new agreed-upon state. Once that happens, the previous one is gone. There’s no overlap.

The process starts quietly. A user triggers an action from their wallet. That intent enters the network as a proposal. Validators pick it up because they’ve staked to participate. They’re not all doing the same job at once. Roles rotate. One group proposes the update. Others verify it and decide whether it’s valid. Votes come in. Agreement is reached. Only then does the network commit the change.

When that happens, it’s final. Balances update. Contracts execute if involved. Ownership changes if required. Everything settles together. There’s no partial execution and no loose ends waiting to be cleaned up later.

This design matters because of how Dusk treats information. State changes are visible, but the sensitive parts are not. The network confirms that something happened without exposing internal details by default. A transfer updates ownership without revealing positions. A contract executes without broadcasting private conditions. Rules are checked before anything moves. If they pass, the state changes. If they don’t, nothing does.

That’s closer to how real financial systems behave. Institutions don’t want every adjustment public. They want certainty, privacy, and finality. On Dusk, trades adjust quietly. Settlement follows immediately. There’s no long reconciliation window where systems disagree about what just happened.

On a daily level, the network feels contained and predictable. Blocks are simply collections of state transitions. Validator roles rotate each round, spreading load so no single actor becomes critical. Fees pay for the work in DUSK. Older state data is gradually pruned, keeping views light and usable. Users see their own changes clearly in applications. Outsiders only see confirmation proofs.

That separation isn’t cosmetic. It’s a design choice. Personal state stays personal. Global agreement stays global.

Consider a firm issuing debt on the network. At first, the state shows no supply. The issuer calls mint. The network processes the request. Terms are checked. A new state replaces the old one. Supply exists now. Balances reflect it. From there, holders trade. Each transfer proposes a small delta. Validators process it. Ownership updates. Yield accrual happens quietly in the background. Claims trigger further state changes.

Later, an audit doesn’t need access to every private movement. It pulls from state history. It verifies transitions. It sees that rules were followed, without exposing everything that happened inside.

This approach becomes more obvious under volume. When activity increases, many actions batch together. The system doesn’t process them one by one with visible delays. They compound into a single committed state. No partial failures. No halfway execution.

A fund rebalancing multiple positions doesn’t need ten separate confirmations. One state update can cover all of it. Back office systems reconcile immediately because there’s only one version of reality to work with. When regulators request a snapshot, the network can serve a prior state proof directly. Nothing needs to be reconstructed.

This is usually where systems struggle. Too many moving parts. Too many versions of truth. Dusk avoids that by design. States either move cleanly, or they don’t move at all.

Governance follows the same pattern. Stakers propose changes that affect the system state, like fee adjustments or parameter updates. Votes are cast. If approved, the change deploys in the next epoch. Existing contracts continue running. Older states migrate safely. There’s no freeze and no manual intervention.

From a user perspective, most of this stays invisible. Wallets sync only the slice of state that matters to you. Light clients pull essentials. More advanced users run full nodes to see deeper history. Developers query state directly inside their tools. Issuers track mint events. Traders watch how pairs shift over time.

Nothing here is flashy. It’s functional. That’s deliberate.In regulated flows, compliance lives inside the state itself. Transfers check rules before anything happens. A cross-border payment proposes an update. Jurisdiction checks run. If conditions are met, the ledger updates privately. Receipts prove the change without oversharing. If conditions aren’t met, the system simply refuses to move.

For real-world assets, state acts as the single source of truth. Property tokens change hands by flipping ownership in state. Rent flows update pools. Claims distribute proportionally. If a dispute arises later, there’s no debate about history. You reference the exact prior state and move forward from there.

Over time, the network just keeps doing this. Validators rotate. Fees flow. Load evens out. States evolve steadily. Firms build processes around predictable behavior. Debt covenants flip when conditions are met. Collateral seizes automatically when thresholds break. Manual follow-ups disappear because the system already settled the outcome.

Daily trades batch. States advance. Privacy wraps the details. And finance keeps running, mostly unnoticed, which is often the real goal.