On January 15, 2026 BNB Chain pulled off its 34th quarterly token burn scrapping 1,371,803.77 BNB for good. At the time, that was about $1.27 billion gone permanently. Not only was it the first burn of the year, it marked a huge step in BNB Chain’s ongoing push for a deflationary economy.

how it works: token burns mean sending coins to a black hole address, one that nobody can access. Once they’re there, they’re out of play forever. Fewer tokens in circulation means increased scarcity. If demand holds or grows, prices often find support from this kind of supply squeeze.

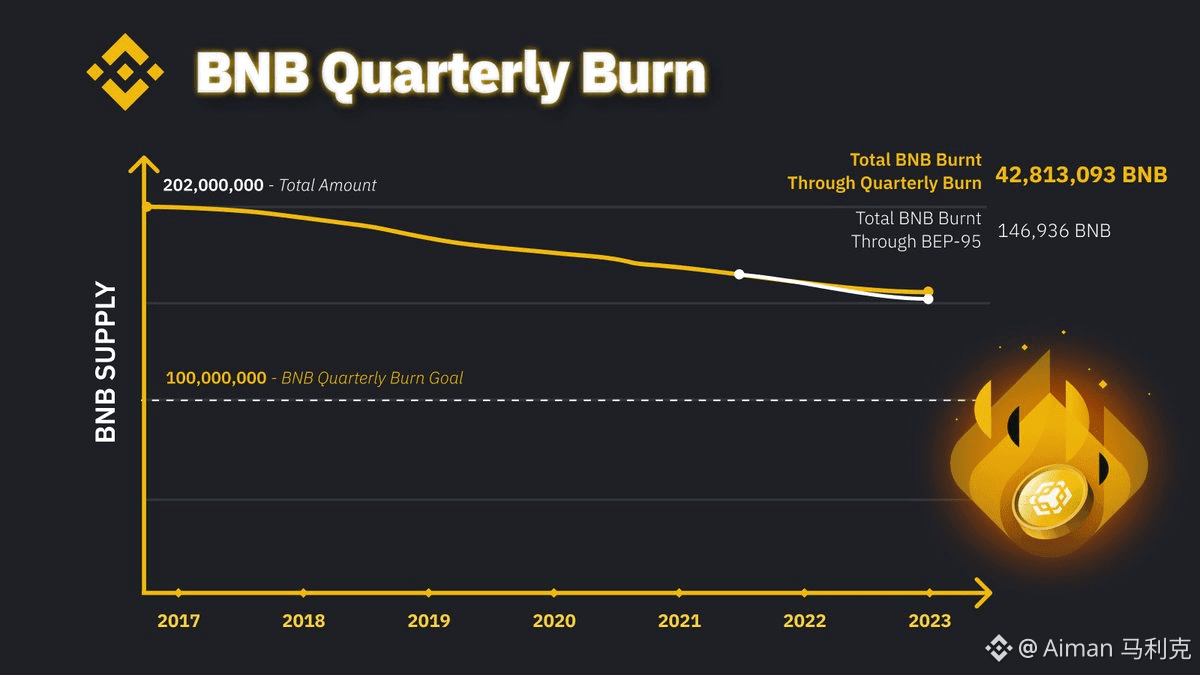

BNB doesn’t just burn tokens at random. It runs on an automated, transparent Auto-Burn system. No need to rely on profit numbers from exchanges. Instead, the formula looks at two things: BNB’s average price that quarter and how many blocks the BNB Smart Chain produced. The result? Predictable, verifiable, and no one pulling levers behind the curtain. There’s also a smaller “pioneer burn” tucked into each round, which covers tokens for BNB’s earliest ecosystem contributors.

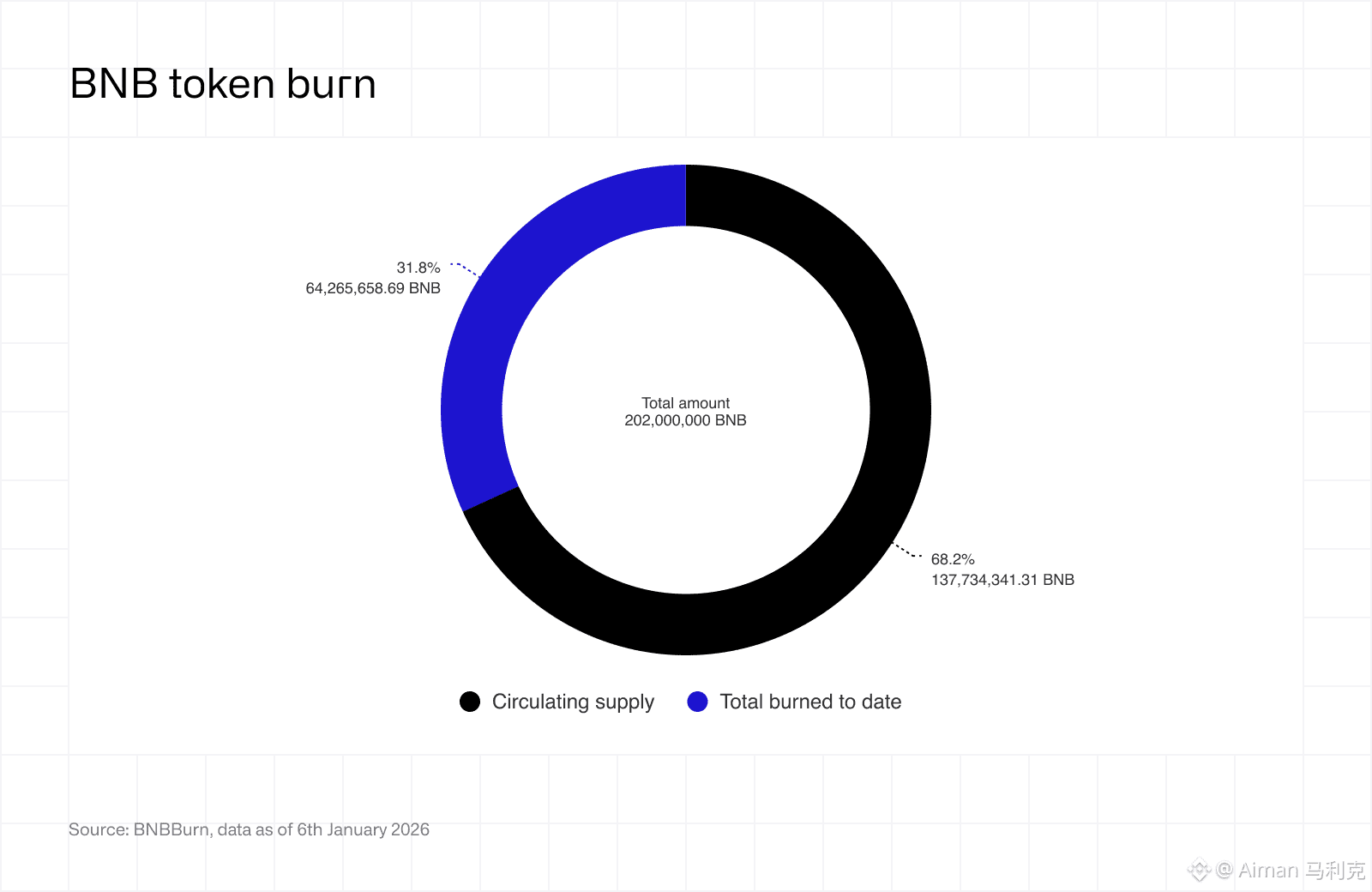

After this last burn, BNB circulating supply stands at about 136.36 million way down from its original 200 million. The target: cut that down to 100 million through steady, quarterly burns. More than 65 million are already gone for good.

Why does all this matter? Deflationary models like BNB’s are built to fight inflation by cutting into supply over time. BNB isn’t just another token floating around; it’s the backbone of its ecosystem. It powers DeFi, governance, transaction fees, and runs through every layer of the network. More activity means more blocks, which drives up burn volume in the future.

Burns don’t promise overnight price spikes. But they do build trust, show commitment to long-term value, and set the foundation for sustainable tokenomics. Getting a grip on these mechanics helps investors see which crypto projects have real staying power.