This wasn’t about hype or token pumps. It was about habitual usage.

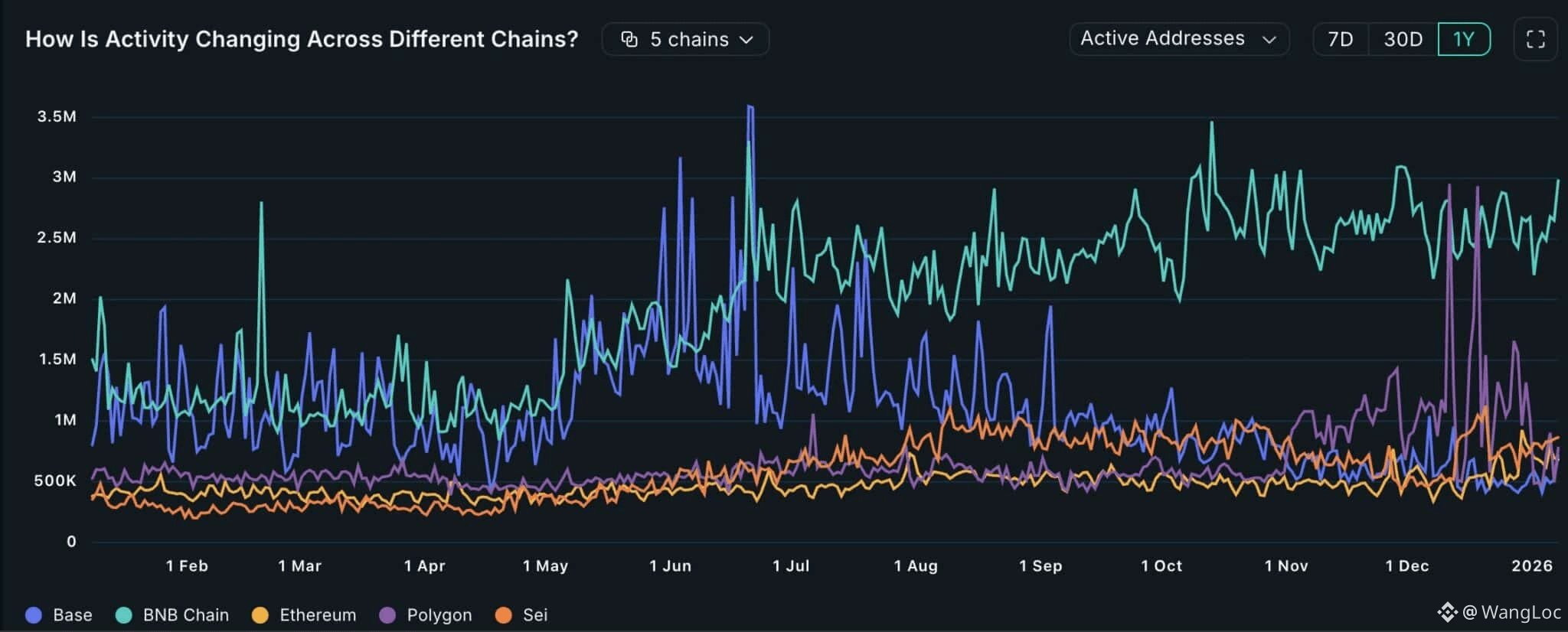

While most EVM chains chased short-lived incentive spikes, $BNB Chain kept activity high and steady after July 2025 a sign of real retention, not speculation.

Key shift:

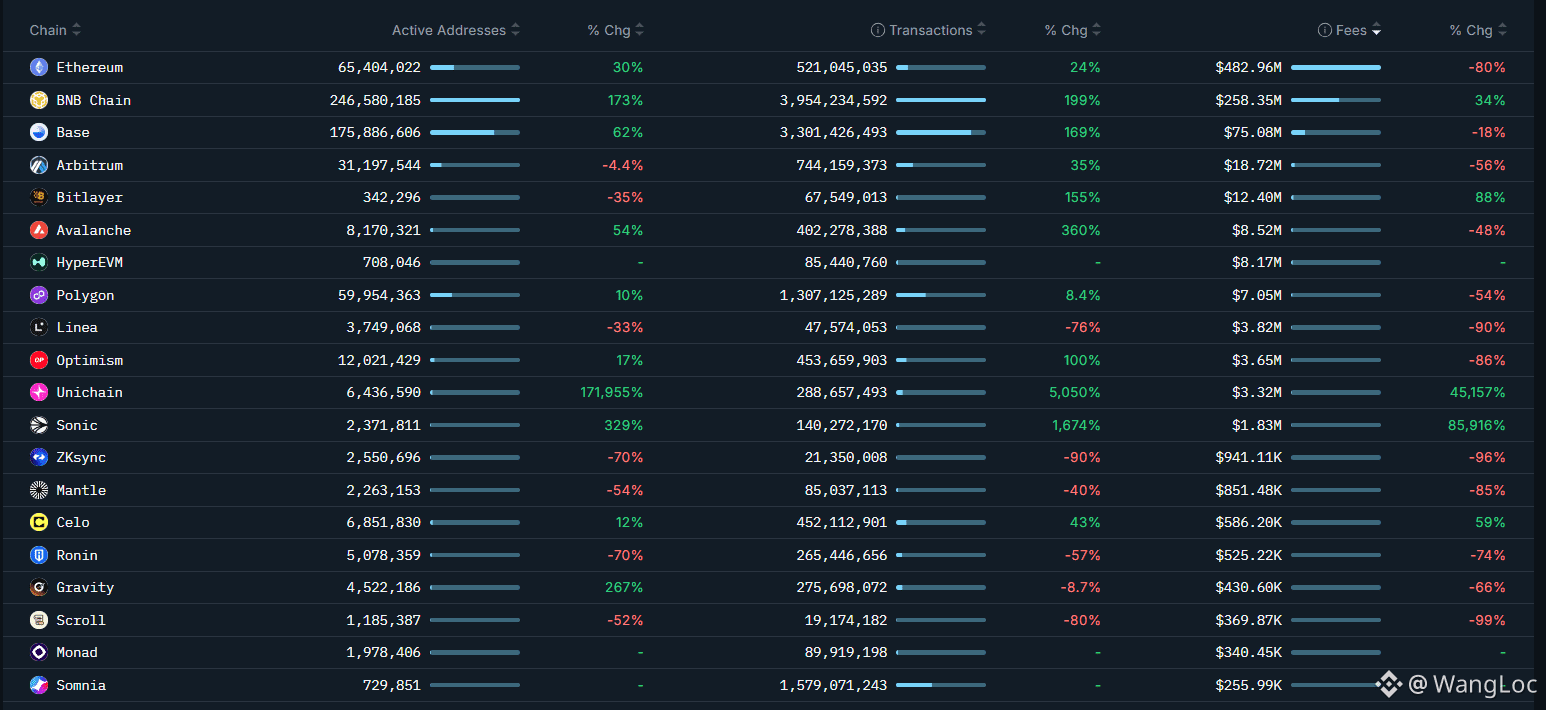

• BNB Chain → daily users & transactions

• Ethereum → settlement & fees

• Base / others → incentive-driven spikes that faded

BNB logged:

• 246M active addresses (+173%)

• ~4B transactions (+199%)

• Rising fees despite low costs

That’s not viral growth. That’s quiet compounding.

Ethereum still anchors value settlement, but raw activity has moved elsewhere. And markets heading into 2026 will reward retention, not bursts.

Hype gets attention. Usage builds empires.

The EVM race isn’t over but the rules have clearly changed.