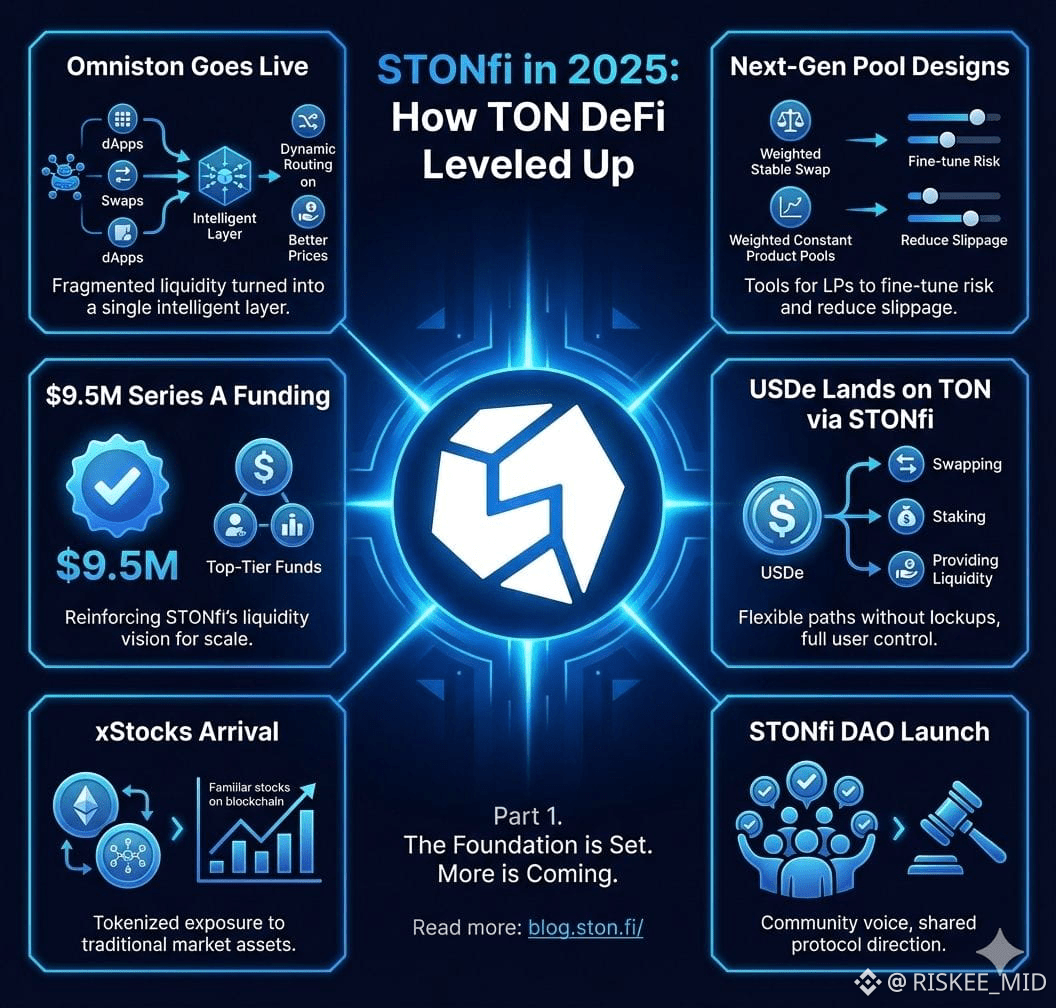

How TON DeFi Leveled Up

2025 was the year TON’s DeFi stopped being an experiment and started behaving like an actual financial stack. At the center of that shift was STON.fi — not just a bigger DEX, but a toolkit for making liquidity work smarter, faster, and with more options for users and builders. Below I break down the main building blocks STON.fi rolled out last year, why they matter, and what they mean for traders, liquidity providers, and the broader TON ecosystem.

Omniston — one interface, many liquidity sources

STON.fi launched Omniston, a liquidity aggregator that finds and routes trades across multiple DEXes and RFQ resolvers so a single swap can tap the deepest, cheapest path available. Instead of users jumping between apps or manually chasing liquidity, Omniston orchestrates routing and execution off a single integration — which directly reduces slippage and execution cost for ordinary swaps. This transforms how wallets and dApps can embed swaps: a single widget or API call now reaches far more liquidity than any single AMM ever could.

Why it matters (plain language): imagine buying sneakers — instead of checking three shops for stock and price, Omniston checks them all in milliseconds and gives you the best deal in one checkout. For traders that means better prices; for dApp builders that means easier integrations.

Smarter pools: Weighted StableSwap & Weighted Constant Product

STON.fi didn’t stop at aggregation. They upgraded the AMM toolbox with next-gen pool designs: Weighted StableSwap (WStable) and Weighted Constant Product (WCPI) pools as part of STON.fi V2. These let liquidity providers tune both the curve (how price changes with trade size) and weights (how much of each token the pool holds). The practical results:

Lower slippage for correlated assets (e.g., stablecoins, liquid-staked tokens) with WStable pools.

Custom exposure and risk control with weighted pools — LPs can bias a pool toward a stable asset to reduce impermanent loss or design multi-token pools with tailored risk/return profiles.

More capital efficiency — swaps that used to need huge depths now execute with less price impact, while LPs get more precise tools to manage their positions.

Quick example: instead of a rigid 50/50 pool of USDT/ETH, a WCPI pool can be 75/25 (more USDT), reducing the LP’s ETH exposure while still earning swap fees when traders move between those assets.

USDe & tsUSDe — a native dollar arrives on TON

A major on-chain development was Ethena’s USDe coming to TON via STON.fi. USDe’s TON-native deployment (and the staking wrapper tsUSDe) allows users to swap, stake, and provide liquidity without bridge frictions — and opens up yield and reward programs denominated in TON. For users, that means a widely used synthetic dollar that behaves like any other jetton on TON: instant swaps, cheap gas, and on-chain staking mechanics.

Why that’s important: stable, familiar units of account (a dollar peg) unlock more predictable trading, easier LP strategies, and smoother user onboarding from fiat-oriented mindsets.

xStocks — bringing traditional markets into DeFi on TON

Tokenized equities (marketed as xStocks) landed on TON and were integrated into the STON.fi experience. These tokens represent exposure to real-world shares and are tradeable, transferable jettons that can be used directly in on-chain strategies — for example, swapping AAPLx for TON or using xStocks as collateral inside other DeFi primitives. This is a big step for on-chain access to regulated assets without forcing users into centralized brokerages.

Net effect: traditional-market capital and retail traders can now interact with stocks inside the same wallets and DeFi flows they use for crypto, lowering barriers and expanding utility across the whole stack.

Community control: the STONfi DAO

Governance moved from blog posts and off-chain chats into an on-chain reality as STON.fi launched a full DAO. Token holders who stake STON receive governance power, enabling proposals, voting, and a formal path for community-driven protocol changes. That shifts key product and incentive decisions from a centralized roadmap to a token-aligned community process.

Implication: more transparent decision-making, faster community-backed upgrades, and a governance layer that can fund integrations, grants, or treasury uses aligned with long-term stakeholders.

Capital endorsement: $9.5M Series A

Behind the product upgrades, STON.fi closed a $9.5M Series A from reputable funds — a signal that institutional capital sees TON DeFi as more than hype. That funding backs engineering, security audits, integrations, and growth — essentially giving the team runway to scale Omniston, build out pool types, and push integrations into wallets and dApps.

What this all adds up to — TL;DR for three audiences

For traders: better prices, less slippage, and faster in-wallet swaps thanks to aggregation and better pool curves.

For liquidity providers: finer risk controls and novel pool types let you design positions that match your risk tolerance and strategy.

For builders & wallets: Omniston + widget integrations mean plug-and-play access to deep liquidity and multi-source routing without heavy engineering lift.

Risks & what to watch

Progress isn’t risk-free. New pools and aggregators require audits and careful economic modeling; tokenized equities must be navigated with regulatory awareness; and DAO governance can be slow or capture-prone if voting power concentrates. Keep an eye on audits, multisig treasury controls, and any regulatory guidance around xStocks in your region. (STON.fi publishes audits, docs, and governance materials publicly.)

Where to read more

If you want the primary sources and deeper technical guides, STON.fi’s blog and docs are the authoritative places to explore Omniston, pool specs, USDe integrations, xStocks, and governance details.

Final thought

2025 turned TON’s DeFi from isolated tools into a coherent stack. STON.fi’s combination of aggregation (Omniston), more nuanced pool mechanics, native dollar liquidity (USDe), tokenized equities, community governance, and institutional backing didn’t just add features — it raised the baseline expectations for what a modern blockchain’s DeFi layer should offer. For anyone building or trading on TON, the new toolkit is a real step toward mainstream-grade UX and deeper on-chain capital markets.