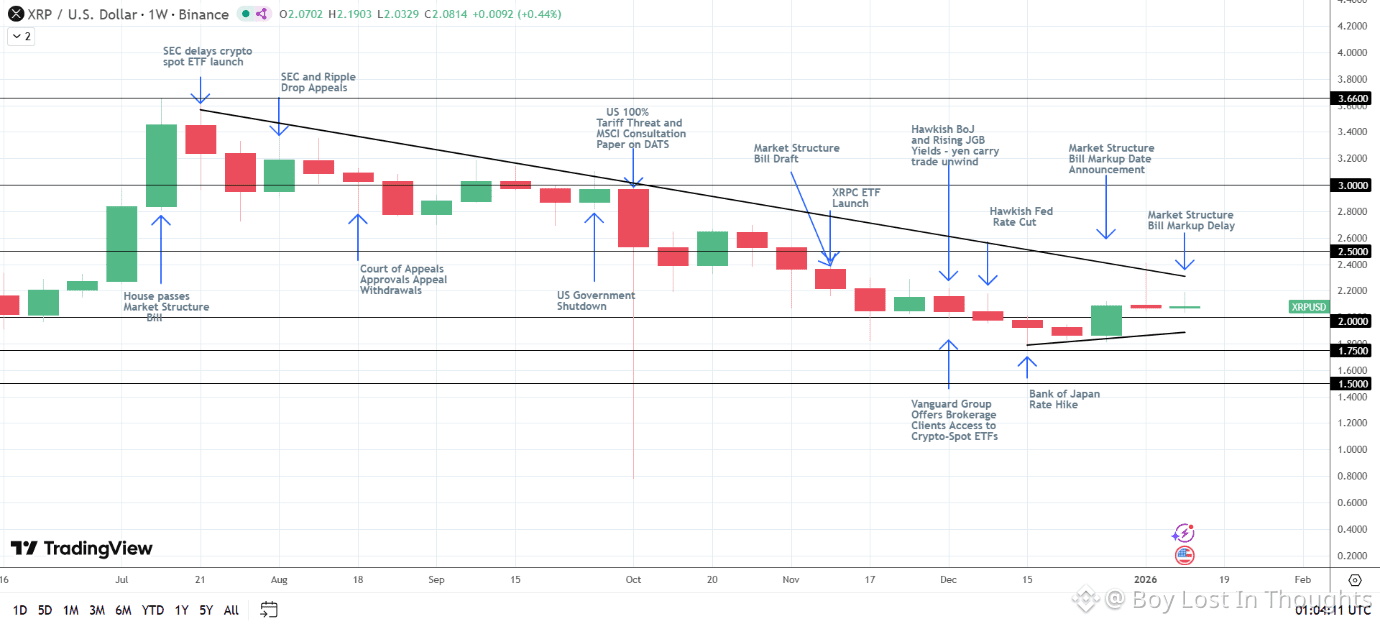

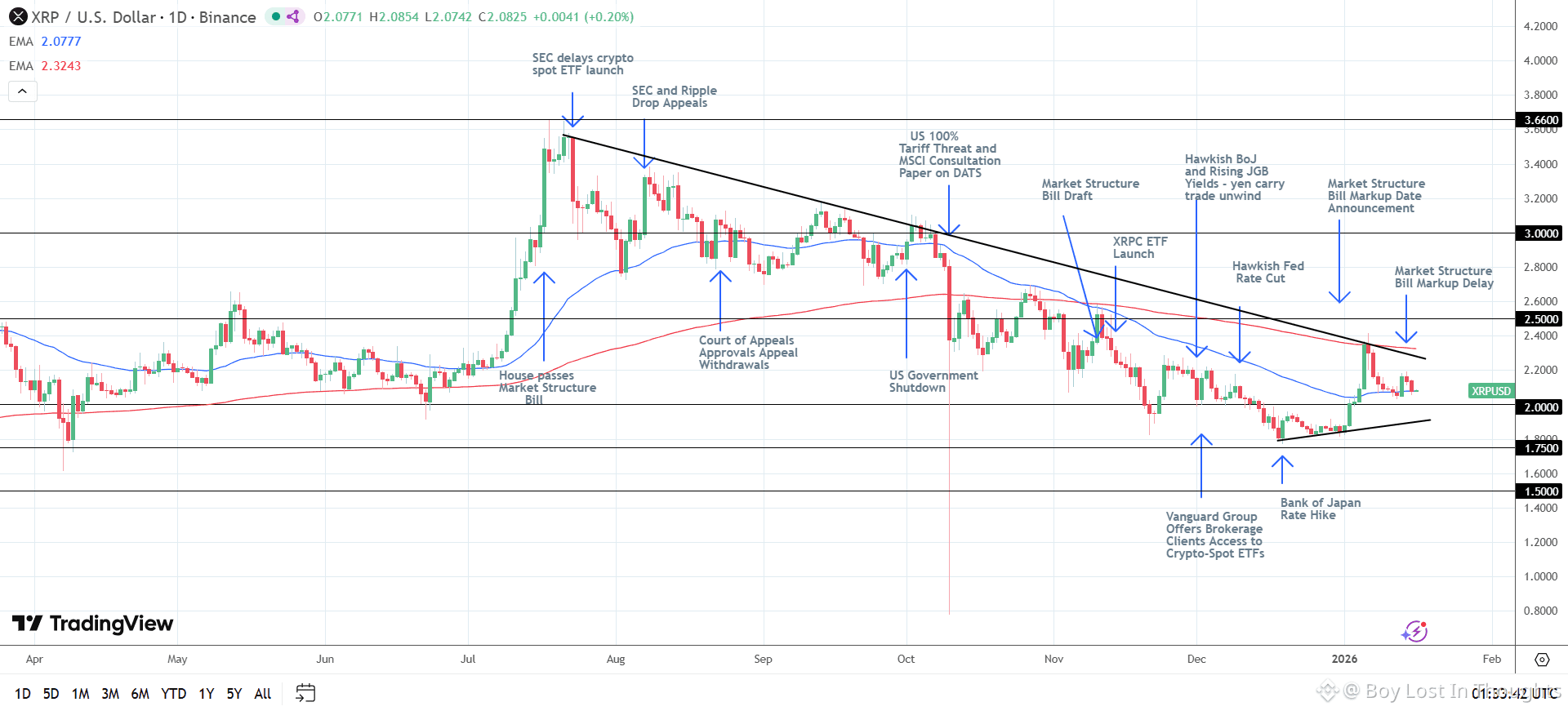

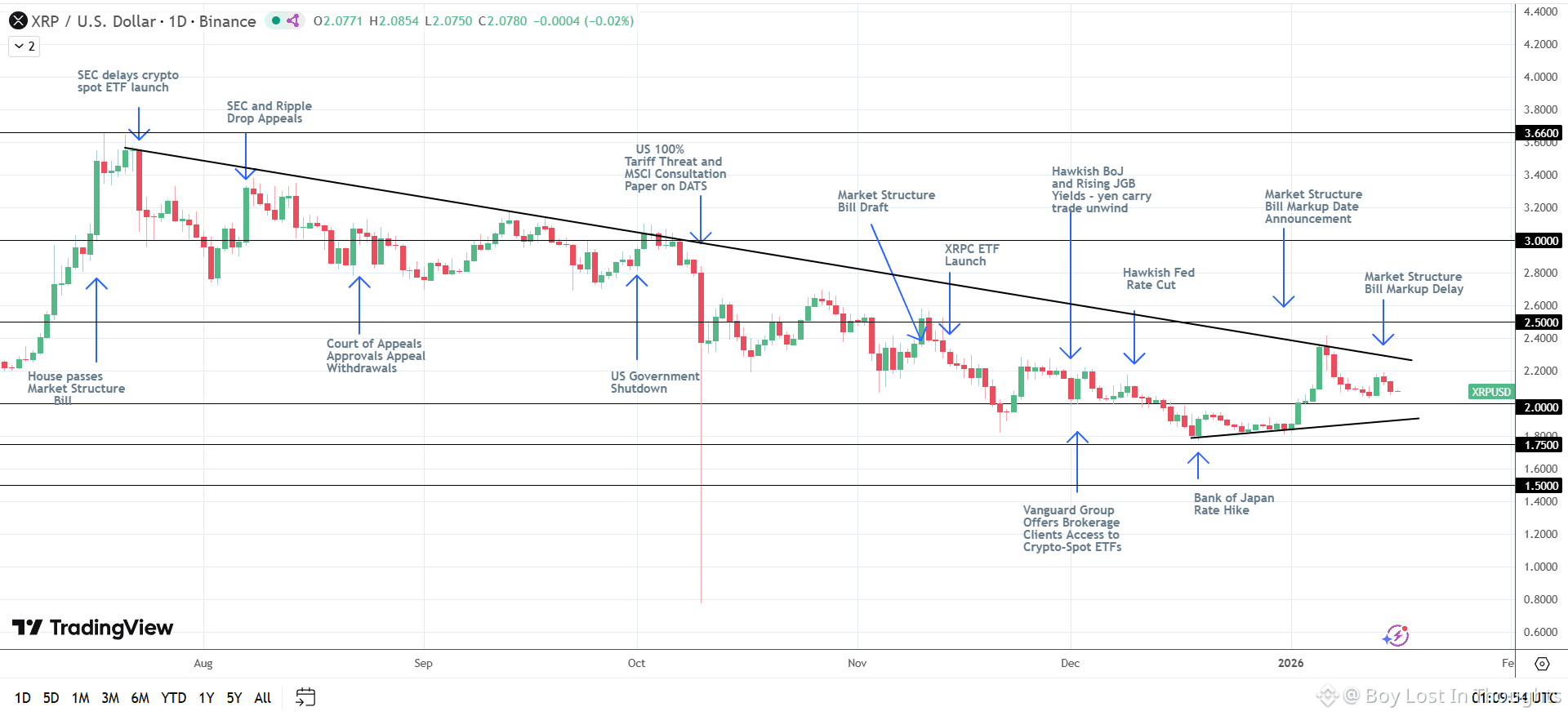

XRP faced selling pressure after the U.S. Senate delayed a pivotal crypto market structure bill, a move triggered by Coinbase's criticism and withdrawal of support. This underscores XRP's high sensitivity to American regulatory shifts. However, the decline was contained as bulls defended critical support at the $2.00 level. Underlying strength from significant XRP-spot ETF inflows and continued progress toward eventual legislation maintains a cautiously bullish outlook, with analysts holding firm on medium-term price targets between $3.00 and $3.66, provided the token stays above key support.

Major Points:

Regulatory Setback: The US Senate Banking Committee abruptly postponed a crucial vote on the "Market Structure Bill," a major piece of crypto-friendly legislation, delaying potential progress until summer.

Immediate Market Impact: XRP price dipped over 6% following the news, underperforming Bitcoin, highlighting its acute sensitivity to U.S. regulatory developments.

Catalyst for Delay: The Senate's action was a direct response to Coinbase withdrawing its support for the bill, with CEO Brian Armstrong criticizing key provisions as overly restrictive.

Bullish Defenses Hold: Despite the sell-off, XRP successfully defended the key $2.00 support level and remains above its 50-day EMA, keeping the near-term technical bias cautiously bullish.

Strong Fundamental Backing: Robust net inflows into U.S. XRP-spot ETFs ($1.27B since launch) provide underlying demand, countering regulatory headwinds and supporting a positive medium-term outlook.

Price Targets Intact: Analyst outlook projects a move toward $2.50 short-term, $3.00 medium-term (4-8 weeks), and $3.66 longer-term, contingent on avoiding a breakdown below $2.00.

Key Risks: The bullish scenario could unravel from a hawkish Bank of Japan, unfavorable U.S. economic data, a stalling of the crypto bill, or outflows from XRP-spot ETFs.