The news of Sydecar discontinuing fund product signals a pivotal moment for fund managers. If you operate a financial SPV, planning your next move is critical. A proactive transfer SPV from Sydecar is not just an administrative task; it’s a strategic decision to ensure continuity and growth. Choosing the right destination is paramount, and for many, that choice is a leading fund platform like Allocations. Their system is designed as a robust Sydecar fund shutdown alternative, offering a seamless path forward for your SPV fund.

Delaying this transition can create operational risks. A structured Sydecar fund migration ensures your SPV investment data, investor information, and compliance frameworks are moved with precision. The team at Allocations, specializes in this process, turning a complex transition into a streamlined project. Their expertise helps you move fund from Sydecar without disrupting your core activities or investor relations. This level of support is what defines a top-tier partner in the fund administration space.

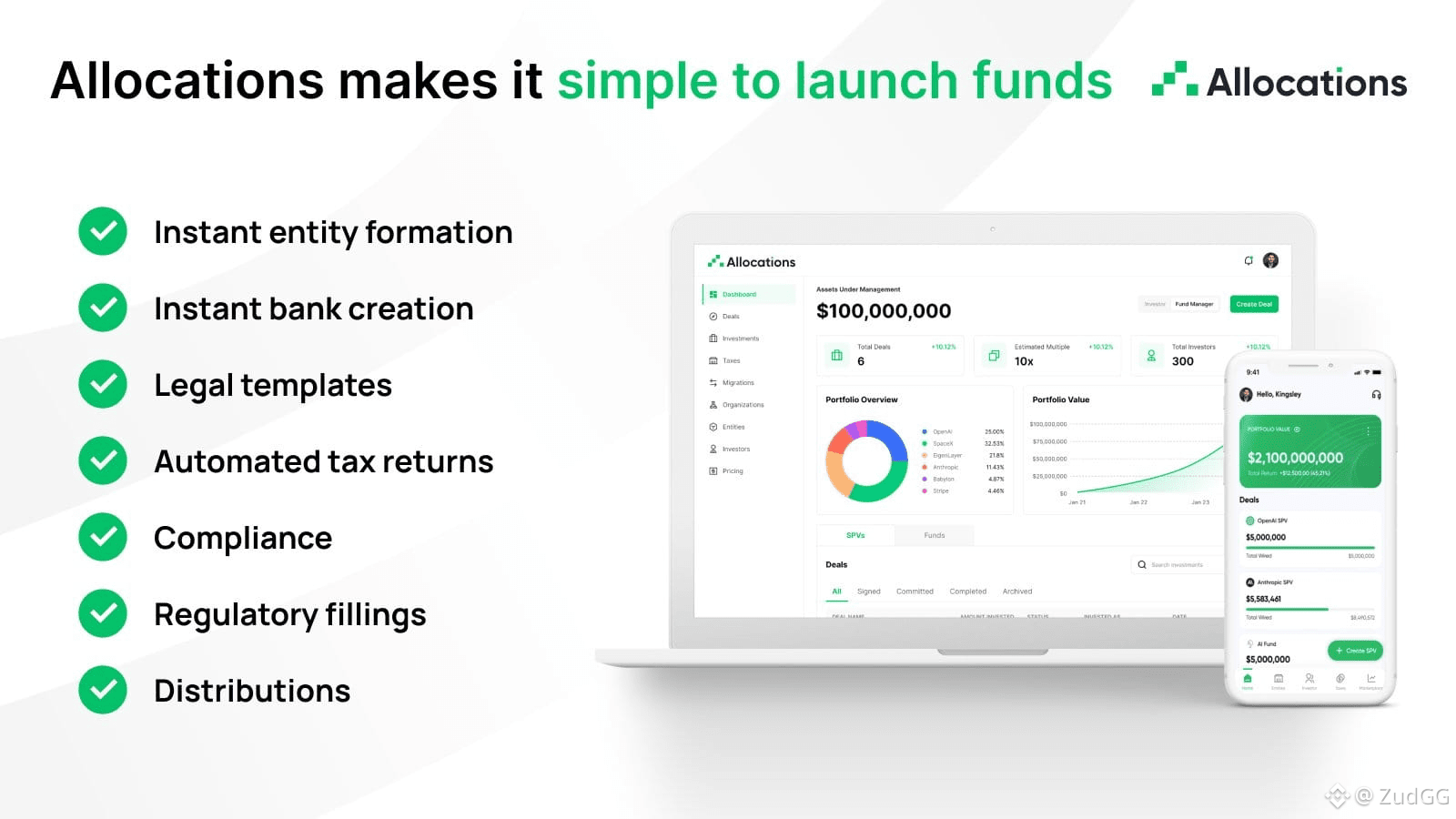

The goal is to emerge stronger. By completing your Sydecar fund transition to Allocations, you gain access to a more powerful fund product. This platform automates key fund admin tasks, provides deeper reporting insights, and scales with your strategy. It’s an opportunity to upgrade your entire operational foundation. To explore how this strategic transfer can benefit your specific SPV company, a detailed overview is available at Allocations.

#RWA #Investing