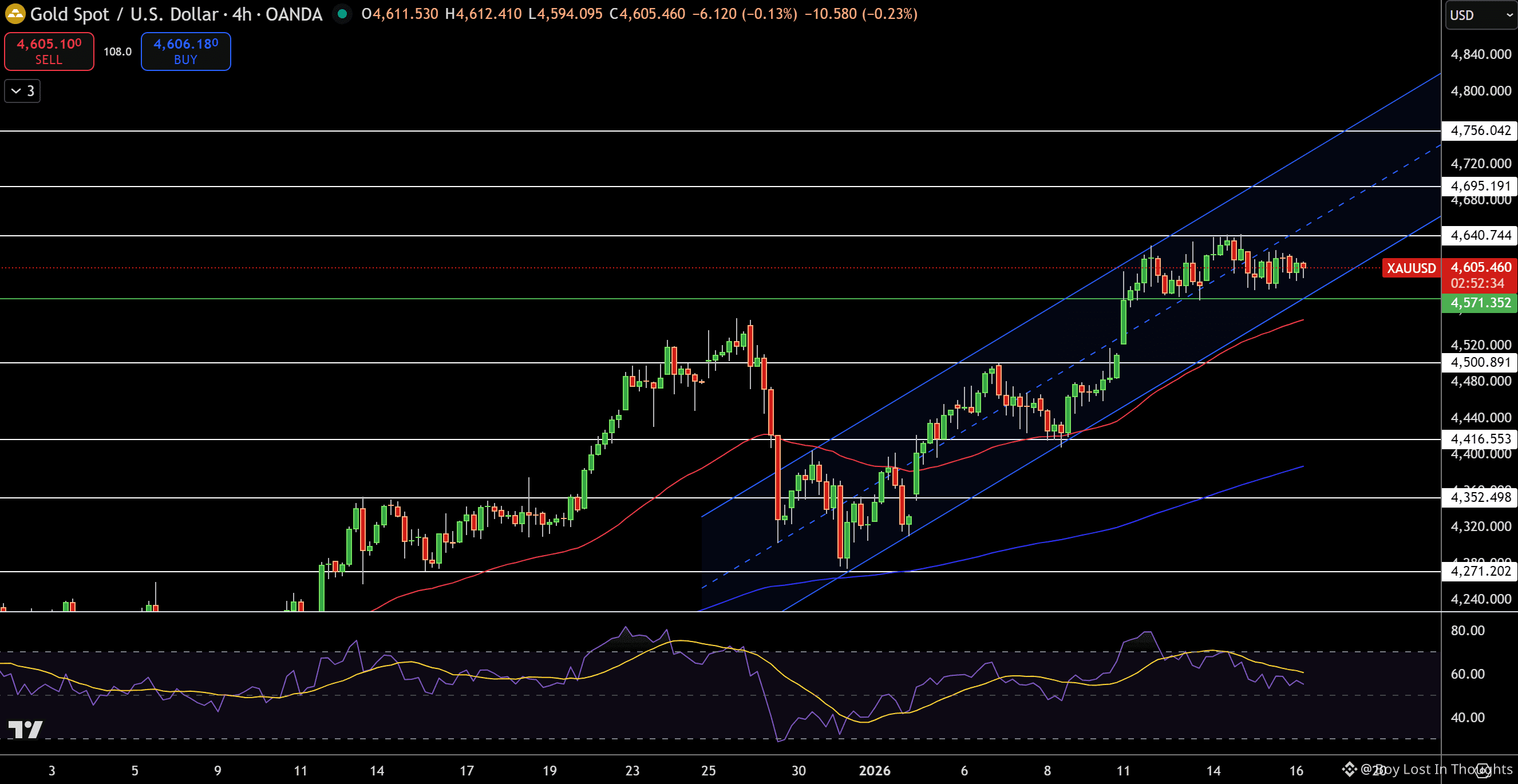

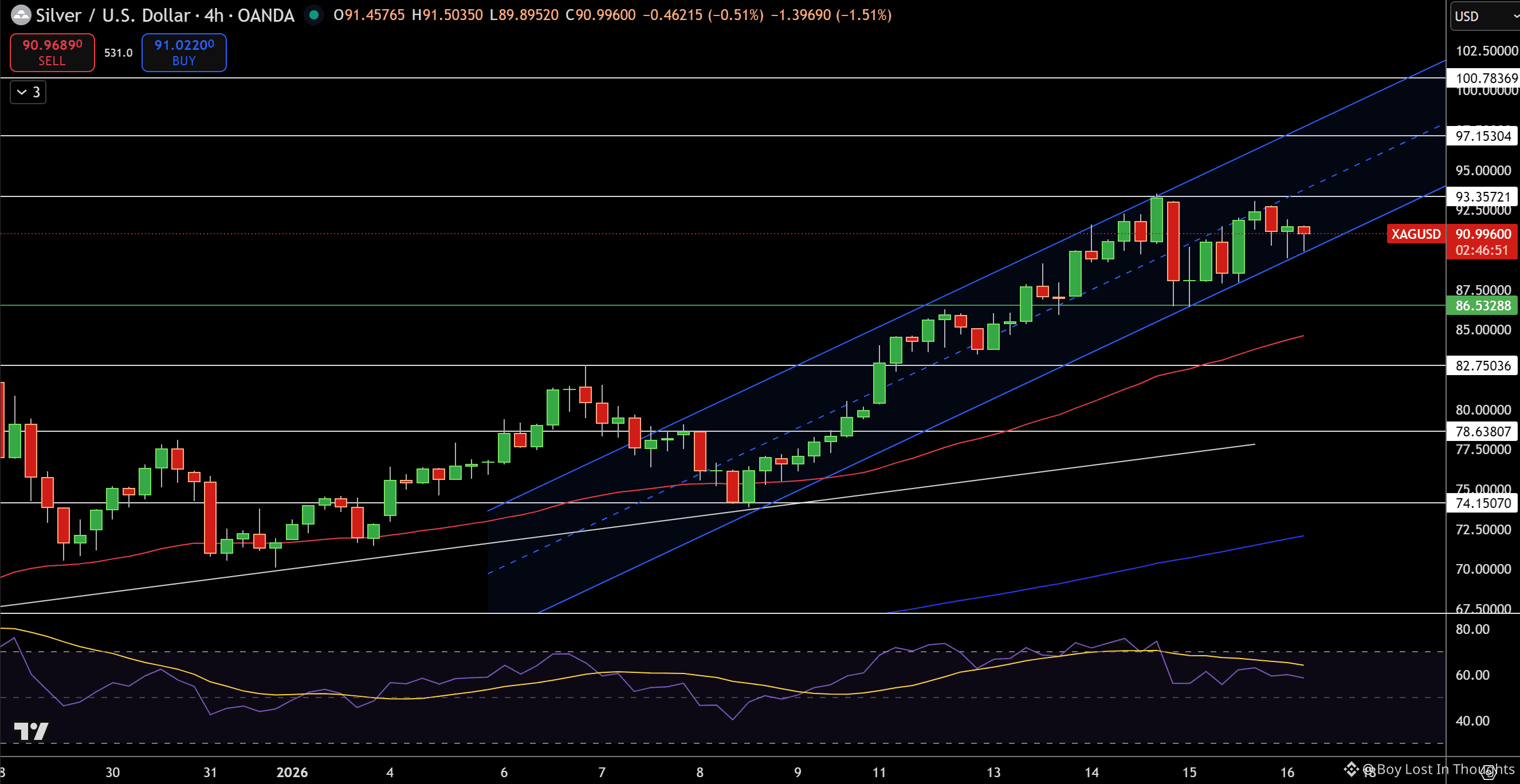

Gold and silver prices fell sharply as a surge in the U.S. dollar and easing U.S.-Iran tensions reduced safe-haven demand. Gold broke below $4,600, while silver dropped over 1% toward $91, with both metals now testing critical technical support levels.

Major Points Highlighted:

Strong Dollar Weighs on Metals: The U.S. Dollar Index (DXY) strengthened after U.S. jobless claims unexpectedly fell to 198K, boosting the dollar and lowering demand for dollar-denominated gold and silver.

Geopolitical Calm Reduces Safe-Haven Appeal: Softer rhetoric from the U.S. toward Iran eased immediate conflict fears, reducing the urgency for investors to hold precious metals.

Gold Technical Outlook: Gold faces resistance near $4,640–$4,695, with support at $4,571 and $4,500. A break below $4,571 could trigger a sell-off toward $4,500.

Silver Technical Outlook: Silver is testing support near $87.50, with a break lower potentially opening a move toward $86.50. Resistance sits near $93.35–$97.15.

Fed Policy Expectations: Strong labor data has reduced expectations for Fed rate cuts in early 2026, supporting the dollar and pressuring metals.

Trader Takeaway: Short-selling opportunities may emerge if gold breaks below $4,571 and silver below $87.50, with defined stop and target levels in place.