I went through Binance Research’s Full-Year 2025 report, and it doesn’t read like a hype piece at all.

It reads like a recap of what actually worked.

2025 wasn’t loud. It was practical.

And that’s exactly why 2026 is shaping up to be an adoption-led year.

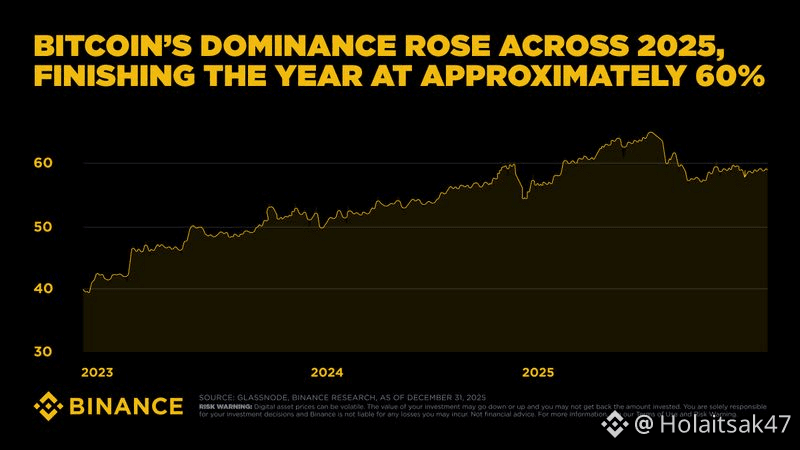

Bitcoin Dominance ~60%

Bitcoin quietly told its own story in 2025.

Dominance climbed to ~60% not because everything else collapsed — but because capital consolidated around what felt safest during macro uncertainty.

Less speculation, more positioning.

That’s what maturity looks like.

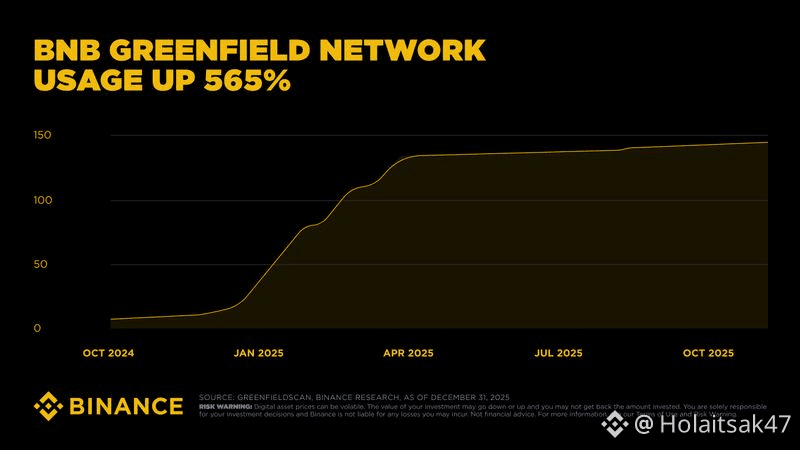

BNB Greenfield Network Usage +565%

This one stood out to me.

BNB Chain’s greenfield network usage jumped over 565% in 2025. Not from hype cycles — from real users showing up and staying. Scale isn’t about announcements anymore.

It’s about whether people actually use the product.

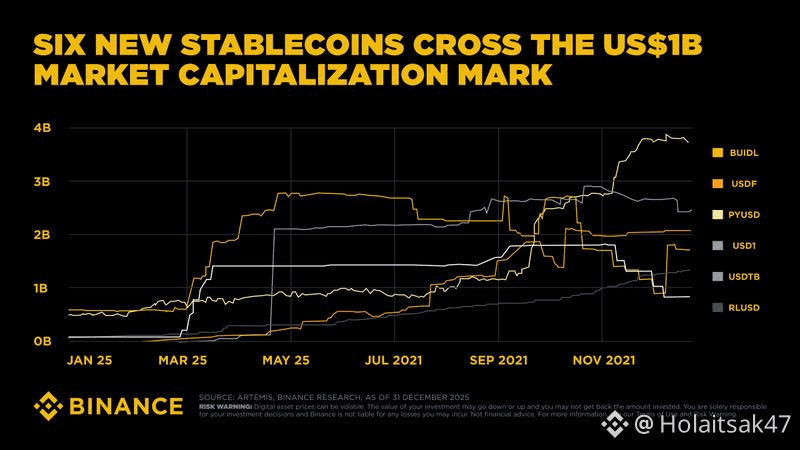

Six New Stablecoins Cross $1B Market Cap

Stablecoins quietly had one of their biggest years ever.

Six new stablecoins crossed the $1B market cap mark, driven by real use cases, yield, and settlement demand.

This isn’t about “which one wins.”

It’s about stablecoins becoming infrastructure.

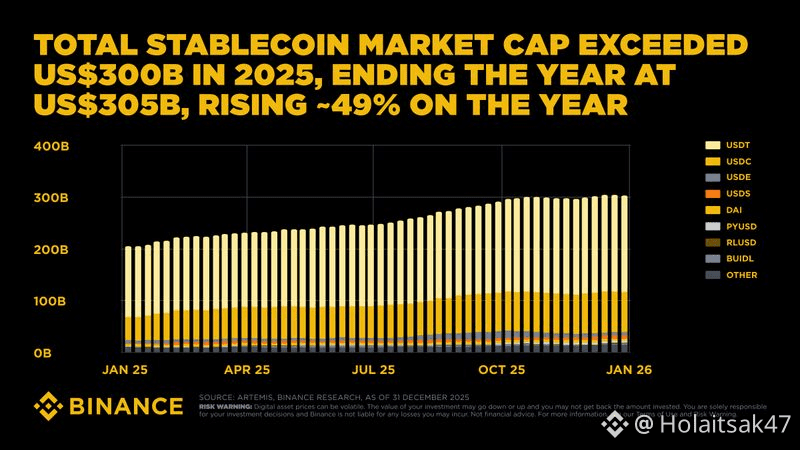

Total Stablecoin Market Cap $305B (+49%)

This chart says more than most headlines.

Total stablecoin market cap crossed $300B in 2025, ending the year at ~$305B, up nearly 49%.

Even when speculative activity cooled, stablecoins kept growing.

That’s adoption, not hype.

My biggest takeaway from this report?

2025 separated narratives from reality. DeFi generated real revenue. Stablecoins became the default settlement layer. Bitcoin behaved like a macro asset. And usage mattered more than noise.

2026 doesn’t need excitement to work. It’s building on what already did.