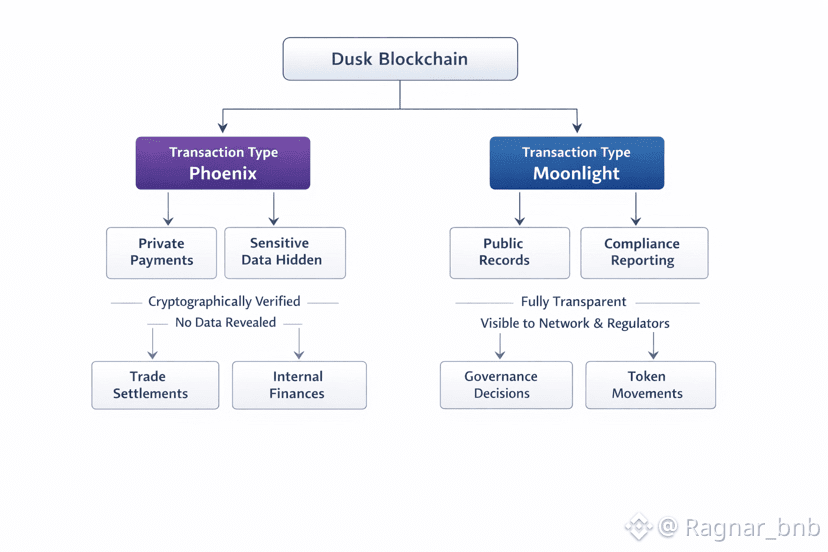

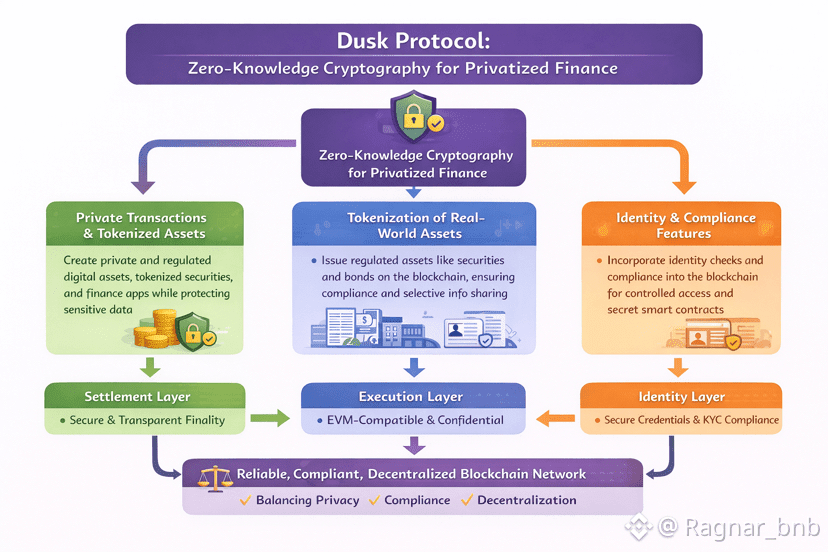

The Dusk Foundation approaches transaction design with a clear understanding that regulated finance does not operate under a single model of visibility. Some financial activities require strict confidentiality, while others demand openness and disclosure. Instead of forcing all transactions into one rigid framework, the Foundation introduced a dual transaction model that reflects how real financial systems function. This model is embodied in two complementary transaction types known as Phoenix and Moonlight. Together, they form a deliberate architectural choice that allows the Dusk protocol to serve both private institutional needs and regulatory transparency requirements without contradiction.

The Foundation’s motivation for dual transaction models comes from observing traditional financial infrastructure. In real markets, not all transactions are treated equally. Settlement between institutions, internal treasury movements, and client allocations are typically confidential. At the same time, regulatory filings, disclosures, and certain market operations require visibility. Public blockchains usually choose one extreme or the other. Either everything is transparent, which discourages institutional participation, or everything is private, which complicates compliance. The Dusk Foundation rejects this binary choice and instead designs a system that supports both modes natively.

Phoenix transactions represent the confidential side of this model. They are designed to protect sensitive financial data such as balances, transfer amounts, and participant relationships. In Phoenix transactions, information is shielded through cryptographic techniques that allow the network to verify correctness without revealing underlying details. This enables institutions to transact on-chain with the same discretion they expect from traditional financial infrastructure. The Foundation treats Phoenix transactions as essential for enabling real world financial activity such as securities settlement, confidential payments, and internal asset management.

From the Foundation’s perspective, Phoenix transactions are not about secrecy for its own sake. They are about preserving market integrity and participant trust. If balances and transaction flows were publicly visible, institutions would be exposed to strategic risks, competitive disadvantages, and potential regulatory conflicts. Phoenix transactions ensure that sensitive information remains confidential by default, aligning blockchain behavior with the expectations of professional financial participants.

Moonlight transactions, in contrast, represent the transparent side of the dual model. These transactions are public and openly visible on the blockchain. They are designed for situations where disclosure is required or beneficial. This may include regulatory reporting, public token transfers, governance actions, or interactions that do not involve sensitive financial data. The Foundation includes Moonlight transactions to ensure that the network can support transparency where it is legally or operationally necessary.

The creative strength of the dual transaction model lies in its flexibility. Participants are not forced to choose between privacy and transparency at the network level. Instead, they can select the appropriate transaction type based on the context of each operation. This mirrors real financial workflows, where different actions are governed by different disclosure requirements. The Foundation’s design allows a single blockchain to support these varied requirements without fragmentation or reliance on external systems.

From a compliance standpoint, the dual transaction model is especially powerful. Regulators often require access to specific information while allowing other data to remain confidential. With Phoenix and Moonlight transactions, compliance can be implemented selectively. Confidential transactions can remain shielded while still producing cryptographic proofs that demonstrate rule adherence. When disclosure is required, Moonlight transactions provide a clear and auditable record. This design reduces the need for manual reporting and off-chain reconciliation, which are common sources of error in traditional systems.

The Foundation also views the dual model as a way to support gradual adoption by institutions. Organizations transitioning from traditional finance to blockchain may not be ready to move all operations into a fully private or fully public environment. By offering two transaction models within the same protocol, Dusk allows institutions to experiment, migrate, and scale at their own pace. Some operations can remain transparent during early stages, while others move into confidential modes as confidence grows.

Another important aspect of the dual transaction model is its role in developer experience. The Foundation recognizes that application builders need clear and predictable tools. By formalizing Phoenix and Moonlight as distinct transaction types, the protocol provides developers with explicit choices rather than ambiguous privacy settings. This clarity simplifies application design and reduces the risk of accidental data exposure. Developers can design workflows that intentionally combine confidential and public actions in a coherent and compliant manner.

The dual model also supports interoperability within the Dusk ecosystem. Different applications may have different requirements for visibility. A regulated asset issuance platform may rely heavily on Phoenix transactions for ownership transfers, while using Moonlight transactions for public disclosures. A governance application may use Moonlight transactions for voting outcomes while relying on Phoenix transactions for identity verification. The Foundation’s design allows these applications to coexist on the same network without conflict.

From a governance perspective, the Foundation treats the dual transaction model as a long term commitment rather than a temporary feature. Decisions about protocol upgrades and ecosystem standards are evaluated through the lens of maintaining this balance. Any change that would weaken confidentiality or undermine transparency is carefully considered. This governance approach provides stability for institutions that depend on predictable behavior from the network.

The dual transaction model also reflects the Foundation’s broader philosophy on decentralization. Decentralization does not mean the absence of rules or structure. Instead, it means that rules are enforced by code rather than discretion. By encoding both private and public transaction logic into the protocol, the Foundation ensures that participants cannot bypass disclosure requirements or compromise confidentiality arbitrarily. The system enforces the appropriate behavior based on transaction type, reducing reliance on trust and manual oversight.

Another creative implication of the dual model is its impact on market behavior. By limiting unnecessary data exposure, Phoenix transactions reduce the risk of front running and information leakage. By enabling transparent actions where appropriate, Moonlight transactions support accountability and trust. Together, they create a more balanced market environment that aligns with regulatory expectations and professional standards.

The Foundation also sees the dual transaction model as a foundation for future innovation. As regulatory frameworks evolve and new financial instruments emerge, the ability to choose between confidentiality and disclosure will remain essential. The Phoenix and Moonlight framework provides a flexible base that can adapt to new requirements without requiring fundamental changes to the network’s architecture.

In conclusion, the dual transaction models introduced by the Dusk Foundation represent a thoughtful and realistic approach to blockchain design for regulated finance. Phoenix transactions provide the confidentiality required for sensitive financial operations, while Moonlight transactions deliver the transparency needed for compliance and public accountability. By supporting both models natively, the Foundation bridges the gap between traditional financial systems and decentralized infrastructure. This balance is not a compromise but a strategic advantage. It allows Dusk to function as a single, unified network capable of supporting diverse financial workflows while remaining private, compliant, and trustworthy.