While the crypto circus is busy seeing who can yell the loudest, promise the juiciest airdrops, and spin the wildest tales, Dusk Network is over in the corner being boring? Nah, they’re being brilliant in disguise. They’ve turned playing by the rules into their secret weapon, and honestly, it’s kind of genius.

This isn’t some flowery marketing spin. This is actually how they built the thing.

Dusk never bothered trying to make day traders swoon with moon memes. Instead, they went straight for the final boss: institutional money managers who are desperate to put traditional assets on the blockchain but are stuck behind a fortress of red tape, compliance headaches, and privacy paranoia. These folks want in on crypto, but they’re paralyzed because public blockchains are either too see-through or too wild-west for their comfort zones.

Dusk’s answer is surgical precision mixed with a healthy respect for rulebooks. They use zero-knowledge tech only when absolutely needed, no unnecessary flexing. Compliance is baked directly into the protocol DNA, not slapped on like a band-aid later. The whole journey of issuing assets, trading them, and settling deals happens smoothly on-chain while staying mysteriously private to outsiders. There’s a special little peephole left for regulators and auditors to peek through when needed, but nothing more gets exposed.

The payoff? When the mainnet fires up by late 2025, some of Europe’s stuffiest financial institutions quietly start experimenting. No press releases, no hype tweets, just real small-to-medium business bonds, accredited investor fund shares, and even private equity deals completing their entire lifecycle on Dusk. No middlemen needed. No awkward moments where everyone can see your transactions.

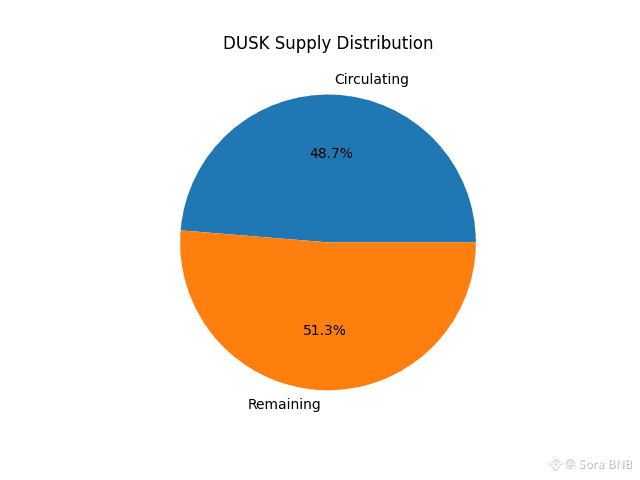

Here’s where it gets spicy for crypto natives. The value of DUSK doesn’t come from viral Twitter threads or influencer shilling. It grows through actual use. Every time a legit institutional asset moves on-chain, DUSK gets consumed, locked up, and recycled behind the scenes. It’s old-school tokenomics but with a twist, because real usage is rare, and institutional-grade real usage is unicorn-level rare.

Everyone’s screaming that RWA is the next trillion-dollar narrative. Sure, maybe. But the blockchain that actually wins RWA will be the one regulators don’t have nightmares about and that has privacy locked down tighter than Fort Knox. Dusk isn’t trying to be everything to everyone. They’re laser-focused on one mission, which is being the least scary bridge for institutions to move actual money on-chain.

It’s a narrow path. Not many are walking it. But that’s exactly why it matters.

When 2026 rolls around and regulators really crack down, most blockchains will be scrambling to figure out how they can stay Web3 and not get demolished. Meanwhile, Dusk will already be chilling at the finish line, watching everyone else play catch-up.

Not flashy. Not replaceable. Just quietly winning while everyone else is still figuring out the game.