XRP is a digital asset created by Ripple to facilitate fast, low-cost international transactions. Unlike many cryptocurrencies, XRP does not rely on mining. Instead, all tokens were pre-issued, enabling near-instant settlement and minimal transaction fees. Its primary goal is to act as a bridge currency between different fiat currencies in global payments.

Why XRP Is Different

⚡ Transactions settle in 3–5 seconds

💸 Extremely low transaction costs

🏦 Built specifically for institutional and banking use

🌍 Designed to improve and replace slow cross-border payment systems like SWIFT

The Future of XRP

XRP’s long-term potential depends on three critical pillars:

Institutional adoption by banks and payment providers

Regulatory clarity, particularly in major markets

Expansion of RippleNet as a global payment infrastructure

If these factors align, XRP could become a foundational layer in the future of international finance.

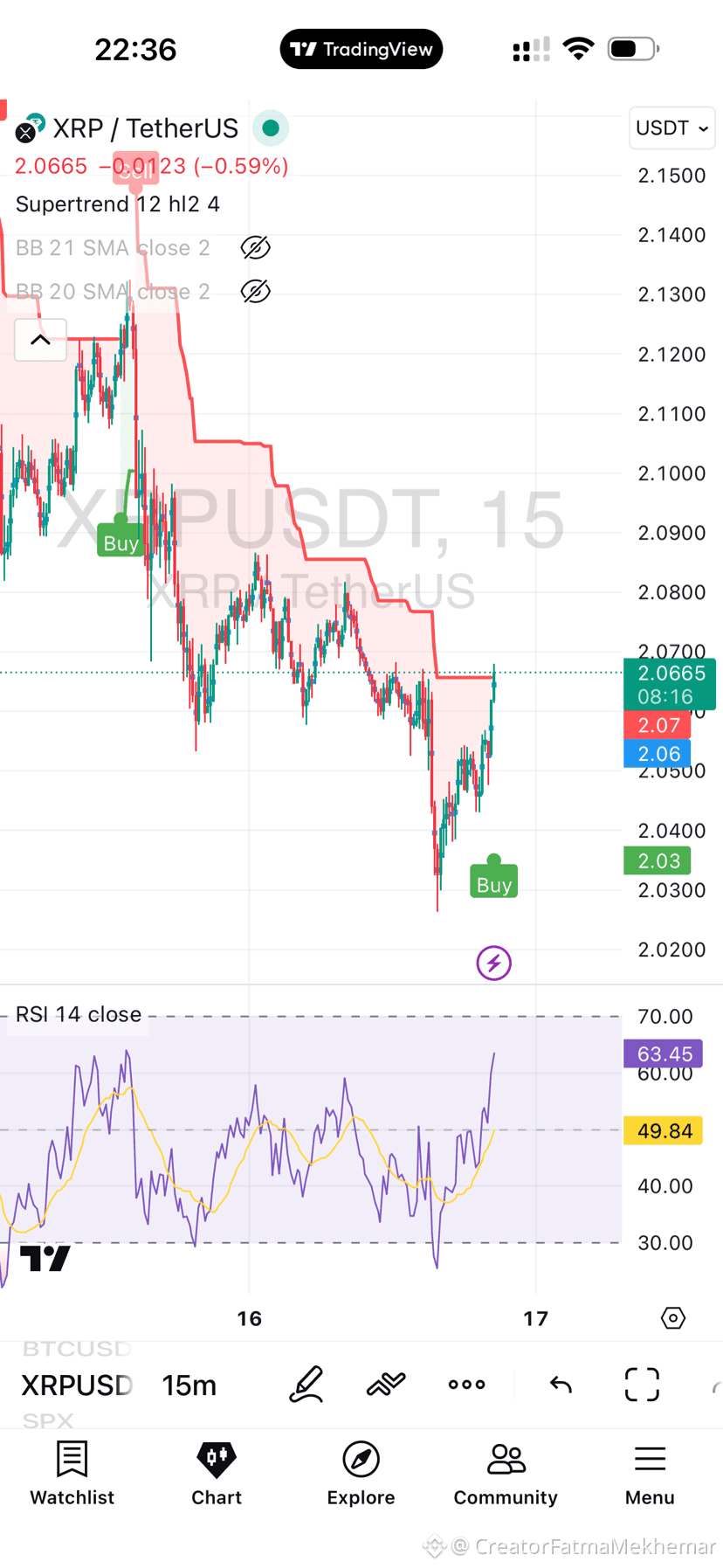

XRP Price Forecast: Potential Numerical Outlook

The following projections are speculative estimates based on market models and adoption scenarios. They do not constitute financial advice.

📅 2026 Price Outlook

Conservative scenario: $2.0 – $2.8

Moderate scenario: $2.8 – $3.7

Bullish scenario: $4.0 – $4.5

➡️ Growth driven by gradual institutional adoption and broader crypto market recovery.

📅 2027 Price Outlook

Lower range: $3.5 – $4.0

Expected average: $4.0 – $5.0

Strong bullish case: $6.0 – $7.0+

➡️ Increased usage of XRP for liquidity and settlement could push prices higher.

Key Risks to Consider

Regulatory changes and legal uncertainty

Overall cryptocurrency market volatility

Competition from other blockchain-based payment solutions