Detailed analysis of BNB🤑

📊 BNB Price🤑 & Market Snapshot (Jan 2026)

Current price: ~ $930 – $940 per BNB. (CoinMarketCap)

Market Cap: ~$127 billion (Top 4–5 crypto). (CoinMarketCap)

Circulating supply: ~136 million (maxed out). (CoinMarketCap)

All-Time High: ~$1,370 in Oct 2025. (CoinMarketCap)

$BNB price remains strong in the top tier of the crypto market, showing resilience after its all-time high late in 2025 and maintaining solid support above major moving averages. (CoinMarketCap)

Interpretation:

$BNB hit major highs in 2025 (~$1,370) before a pullback toward ~$930–$940. (CoinMarketCap)

Price action suggests robust support above $900–$920 with potential upside if bullish catalysts persist. (CoinMarketCap)

🧠 Fundamentals & Drivers

✅ Key Strengths

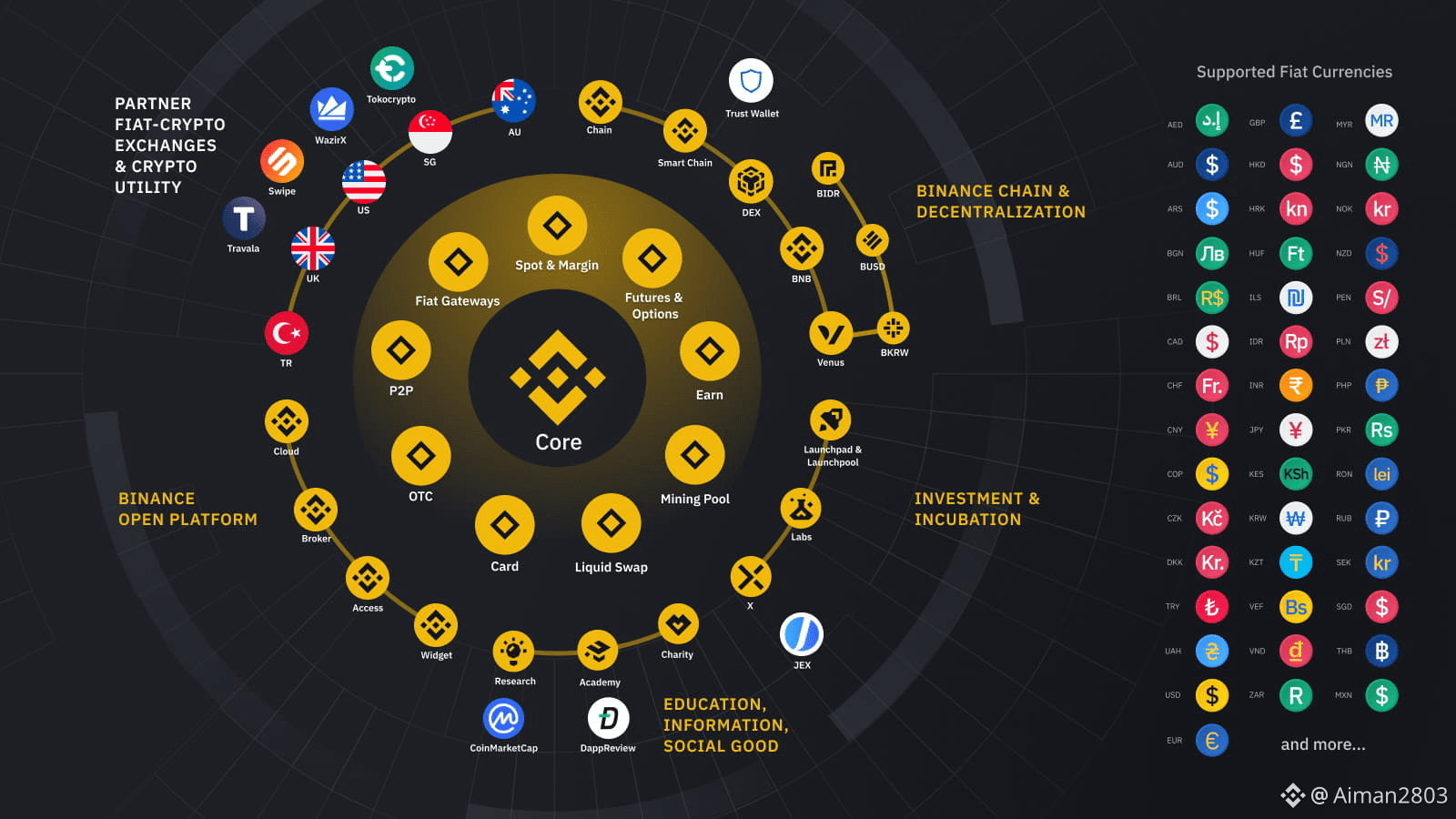

Utility Token: Native to Binance exchange and BNB Smart Chain (BSC) — used for trading fee discounts, gas fees, DeFi, NFTs, and more. (CoinW)

Deflationary Supply: Quarterly burns reduce total supply, supporting scarcity. (CoinW)

Network Activity: High transaction throughput and upgrades to reduce block times improve ecosystem use. (CoinMarketCap)

Institutional Interest: Strategic partnerships and institutional buys have boosted demand and sentiment. (The Economic Times)

⚠️ Risks & Challenges

Regulatory Scrutiny: Binance and BNB face ongoing compliance challenges globally. (CoinW)

Market Cycles: Cryptos are volatile — BNB might lag during risk-off phases. (CoinMarketCap)

Competition: Emerging tokens and meme assets sometimes outperform in short cycles. (Indiatimes)

🔎 Technical View (Jan 2026)

Bullish signals: Above key moving averages; RSI momentum positive. (CoinMarketCap)

Resistance to watch: ~$950 and above could trigger further upside. (CoinMarketCap)

Support levels: Price pivot ~ $900–$930 region. (CoinMarketCap)

🧩 Summary

$BNB remains a cornerstone crypto with strong real-world utility and ecosystem growth. While it has cycled down from its all-time high, fundamental upgrades and network use keep long-term outlook positive for many analysts. That said, volatility and regulatory risks still factor into price trajectories.