$XRP is flashing structural signals that have the market on high alert. Recent on-chain data suggests a shift in holder behavior that historically leads to heightened volatility.

🔍 The "February 2022" Fractal

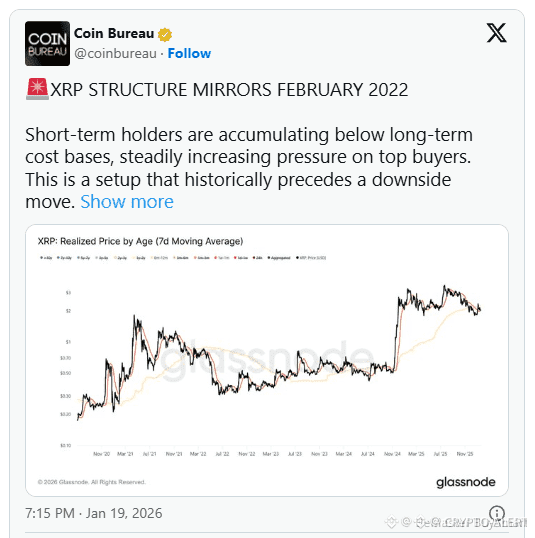

Analysis from Glassnode metrics highlights a specific dynamic: Short-Term Holders (STH) are currently accumulating XRP below the cost basis of Long-Term Holders (LTH).

Why does this matter? This exact setup mirrors February 2022, a period that preceded a sharp 20% drawdown (dropping from $0.90 to $0.70).

🧱 Understanding the Pressure Points

STH Accumulation: New buyers are entering at lower prices than the "old guard."

Imbalance Risk: If the price dips, long-term holders—who control significant volume—may react defensively to protect their positions.

The Realized Price Gap: When spot prices approach or fall below these realized levels, the probability of a "sell-off" event increases as unrealized gains evaporate.

💡 What This Means for Traders

While XRP's fundamentals and adoption remain strong, the technical "junction" we are in suggests caution.

Watch Support: Keep a close eye on immediate support levels to see if the STH cohort holds the line.

Volume Confirmation: Look for a spike in trading volume to confirm if a move (up or down) has real strength.

Risk Management: Historical parallels aren't guarantees, but they serve as a framework to prepare for potential corrections.

Is XRP preparing for a local bottom or a deeper retracement? Let me know your thoughts in the comments! 👇

#xrp #CryptoAnalysis #tradingtipsbangla #Write2Earn #Glassnode