Bitcoin fell below the $90,000 psychological level as onchain data showed increasing sell-side pressure from whales and long-term holders. The move raises the risk of a deeper pullback toward the $84,000–$86,000 support zone.

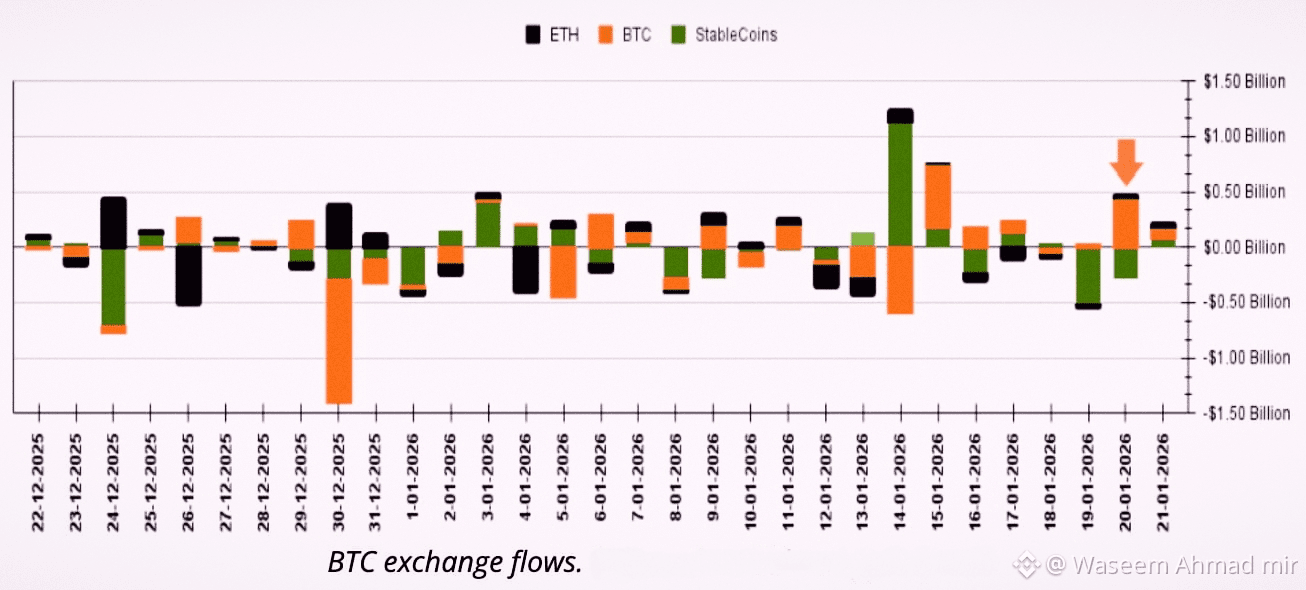

Whale Exchange Deposits Signal Distribution

According to CryptoQuant data, large wallets deposited more than $400 million worth of BTC into spot exchanges on Jan. 20. Historically, such spikes in whale inflows often indicate preparation to sell or increased market liquidity. This follows a similar $500 million deposit event recorded on Jan. 15, reinforcing concerns of sustained distribution.

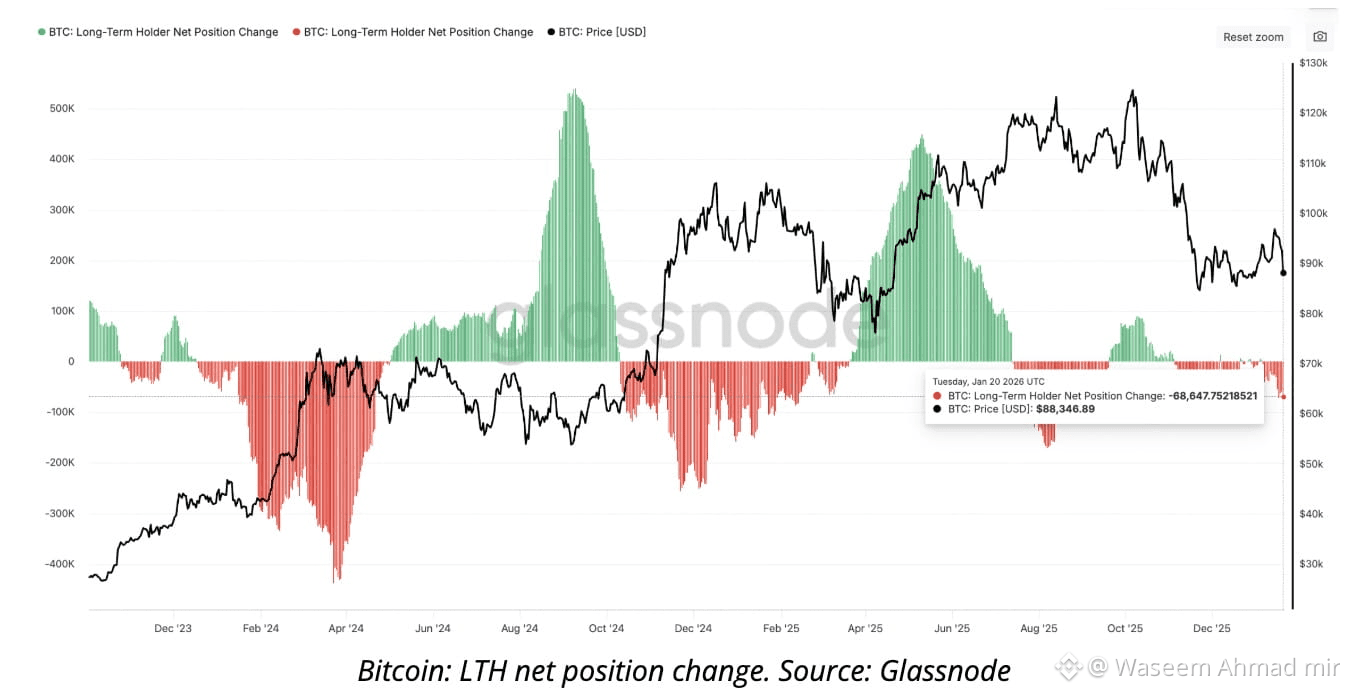

Long-Term Holders Accelerate Profit-Taking

Glassnode data shows that long-term holders have sold approximately 68,650 BTC over the past 30 days, keeping net position change negative since early January. Instead of accumulating during pullbacks, long-term investors appear to be locking in profits after Bitcoin’s rally toward $97,000.

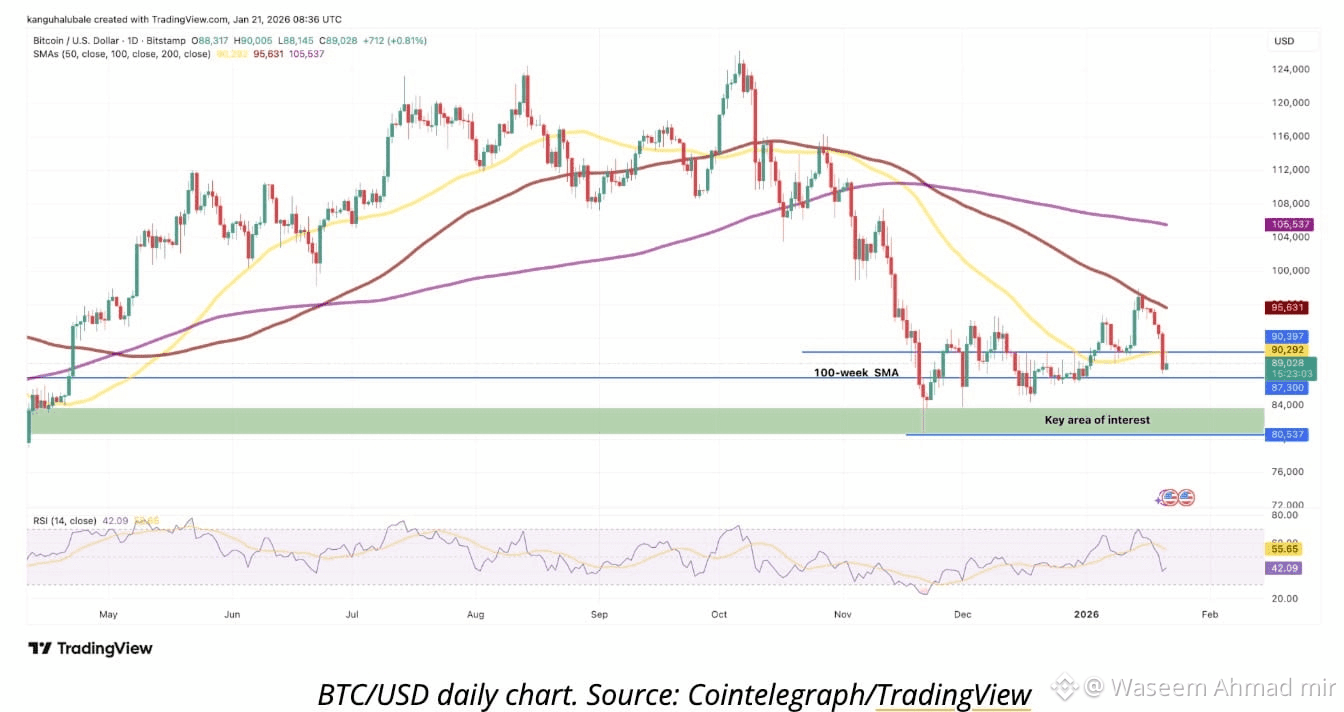

Key Bitcoin Support Levels to Watch

With BTC trading near $89,000, analysts are closely monitoring several technical zones:

$87,300 – 100-week simple moving average

$84,000–$86,000 – Major demand and psychological support

$80,500 – November local low and deeper downside level

A sustained move below short-term moving averages could increase downside risk.

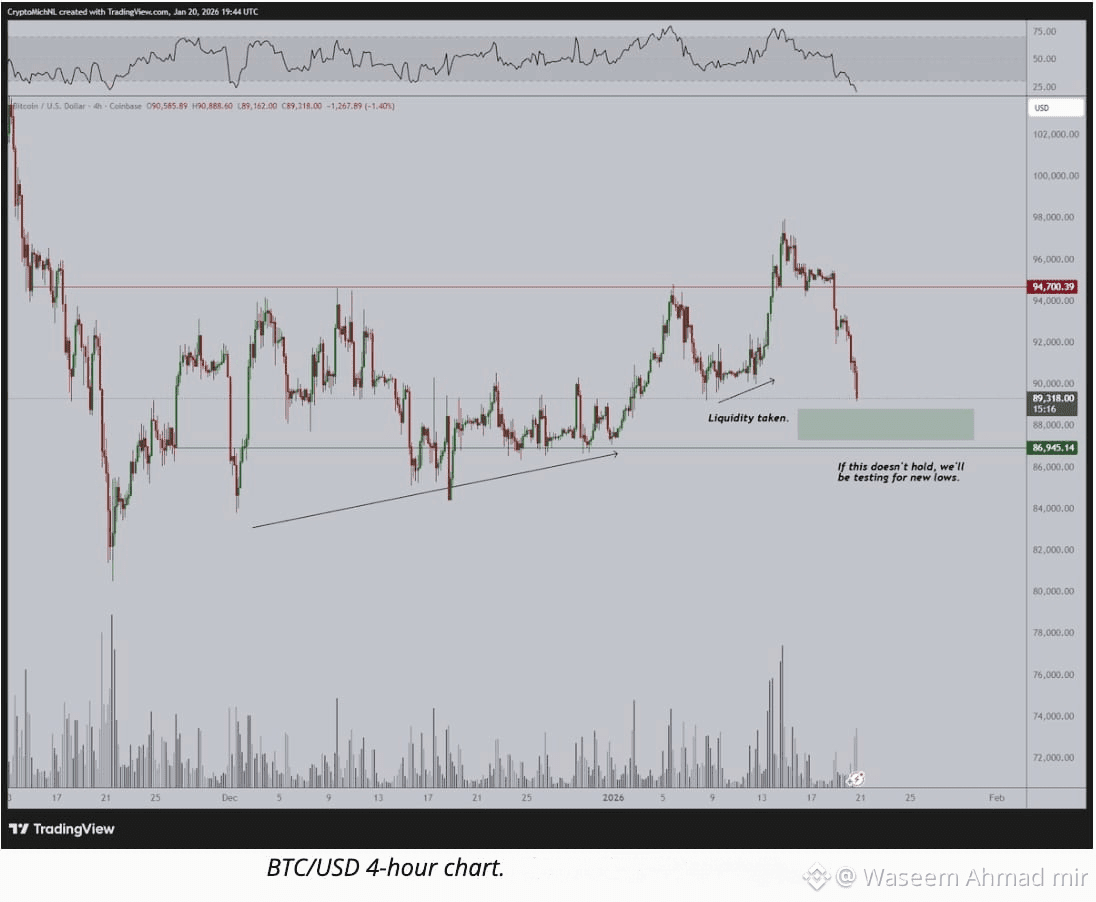

Analysts Warn Any Bounce May Be Temporary

Market analysts note that momentum indicators are approaching oversold conditions, which could trigger a short-term relief bounce. However, without a slowdown in whale exchange inflows and long-term holder selling, a full trend reversal remains unlikely.

Can Bitcoin Reclaim $90K?

For bullish momentum to return, Bitcoin must reclaim and hold above $90,000. Until then, ongoing distribution and broader macro uncertainty leave BTC vulnerable to further volatility, with the $84,000 zone acting as a critical structural level.