When I think about the long-term outlook for the WAL token in 2026, I don’t approach it like a typical short-term trading narrative. For me, WAL is fundamentally tied to how decentralized storage infrastructure evolves and how real usage translates into sustainable economic demand. To understand its potential over the next year, it’s essential to consider both the tokenomics — including total and circulating supply — and the broader ecosystem dynamics that underpin its utility.

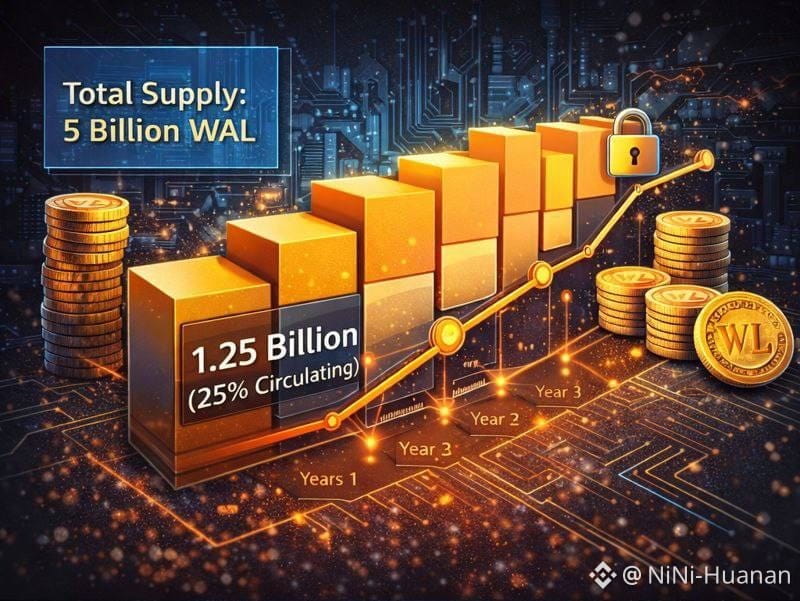

First, looking at the token supply structure gives important context. WAL has a total capped supply of 5,000,000,000 tokens, which means that there is a fixed upper limit on how many tokens will ever exist. At launch, around 1.25 billion WAL — or roughly 25% of the total supply — became circulating on the market. Over the coming years, additional tokens are released gradually according to a vesting schedule designed to reduce sudden sell pressure. This multi-year unlock plan helps provide supply discipline, smoothing potential dilution and giving the market time to absorb tokens as adoption grows.

From a demand perspective, WAL is not merely a speculative asset. It is the payment token for decentralized storage services on the Walrus Protocol. Users pay WAL to store data — including high-volume datasets for AI, media files, NFT metadata, and application state — and this utility is the first pillar of long-term demand. The more data that flows through the Walrus network, the more WAL is consumed as a form of payment. This mechanic ties the token to real economic activity, contrasting sharply with many tokens that derive value primarily from sentiment rather than usage.

Secondly, WAL functions as a reward and incentive mechanism for network participants. Node operators and stakers receive WAL as compensation for providing storage capacity, maintaining performance, and helping secure the protocol. This creates a feedback loop where network growth — in terms of nodes and data stored — can translate into sustained demand for WAL. As decentralized storage adoption increases, so too could the value of the token as network participants accumulate rewards.

Governance is the third key pillar of utility. WAL holders can participate in protocol governance, voting on changes to system parameters, incentive structures, and future upgrades. This aligns token holders’ interests with the long-term health of the network rather than short-term price movements. As more stakeholders engage in governance, the community becomes more invested not just financially but also in the direction of the protocol itself.

However, demand is just one side of the equation. On the supply side, the vesting timetable matters. A significant portion of WAL is locked and released over an extended period, meaning that circulating supply will increase year over year throughout 2026. Even if total supply remains fixed at 5 billion, the amount that is tradable increases as various allocations unlock to contributors, investors, and community reserves. A growing circulating supply, if not met with proportional demand, can exert downward pressure on price. This is a classic macro dynamic in tokenomics, and it’s why I always consider both supply unlock schedules and demand catalysts in tandem.

Market context also plays a huge role. Even though WAL has strong fundamentals related to utility, its price in 2026 will still move with broader crypto market trends. If Bitcoin and equity markets enter a risk-on environment, capital tends to flow into infrastructure and utility tokens — benefiting projects like Walrus. Conversely, in risk-off periods, even tokens with strong use cases can see price stagnation or compression due to broader investor sentiment.

Looking ahead, I see several pathways for where WAL could go in 2026:

Bullish scenario: If decentralized storage truly becomes a bedrock layer for NFT ecosystems, AI data, and interoperable applications, real network demand for WAL could accelerate. This scenario would see WAL consistently used for storage payments and rewards, and governance participation increasing as more stakeholders deploy resources and data on Walrus. In that case, even with increased circulating supply, demand growth could outpace dilution.

Neutral scenario: If adoption grows steadily but without explosive momentum, WAL’s price could trade within a range that reflects underlying usage without significant appreciation. Here, utility keeps the token relevant and stable, but broader market conditions limit upside.

Bearish scenario: If decentralized storage adoption lags or if competing technologies siphon off demand, WAL could struggle to capture growing use cases. Coupled with increased circulating supply from vesting unlocks, this could exert soft pressure on price even if fundamentals remain intact.

In summary, my long-term view of WAL in 2026 is rooted in real usage, ecosystem growth, and tokenomics discipline. Total supply and vesting schedules create a framework that rewards patience, and demand drivers — storage payments, node incentives, and governance — anchor WAL in actual protocol operations. While price will never move in a vacuum and will reflect wider market forces, the underlying fundamentals give the token a solid basis for sustainable growth if the Walrus Protocol continues to expand its footprint in the decentralized storage landscape.