Crypto’s bridge to traditional markets gets stronger: Thoughts on the Nasdaq and CME partnership

Jan 24, 2026 · 5 min read

Every so often, an evolutionary leap occurs in the investment space. Today’s formal rebranding of the Nasdaq Crypto™ Index to the Nasdaq CME Crypto™ Index marks such a milestone for crypto investors—one that we believe will change how institutions think about crypto allocations.

This strengthened flagship index celebrates a trusted partnership between Nasdaq and derivatives financial services heavyweight Chicago Mercantile Exchange (CME) Group.

In merging their respective brands to strengthen this institutional-grade digital asset benchmark, the Nasdaq CME Crypto™ Index (NCI™) builds on its transparency and governance across the US, Europe, and Latin America. Exchange-traded products (ETPs) and other instruments tracking NCI™ can benefit from increased liquidity, tighter spreads, and smoother execution. And by leveraging decades of collective experience building modern financial infrastructure, NCI™ pairs traditional market expertise with digital asset innovation. For investors building crypto exposure for the first time, a benchmark like the NCI™ provides the same type of foundation that an index like the Nasdaq-100 or S&P 500 offers for equities.

Creating an institutional benchmark: Methodology matters

The Nasdaq and CME partnership is a clear sign that the NCI™ is becoming the definitive benchmark for the emerging crypto asset class. Why does this matter? Benchmarks enable portfolio construction, performance attribution, and allow institutions to allocate at scale. The NCI™ is providing the necessary criteria for these institutions to get exposure to the crypto market, including a replicable methodology, increased liquidity via ETPs and other instruments, and the institutional acceptance that comes along with two firms with extensive experience building sophisticated financial infrastructure.

When it comes to fortifying a category-defining index like the NCI™, a measured approach to curating a list of constituent companies is vital to reflecting trends in the broader crypto market. This is why, since 2020, Hashdex has taken a hands-on role in building this benchmark, co-developing the NCI™ in partnership with Nasdaq Global Indexes.

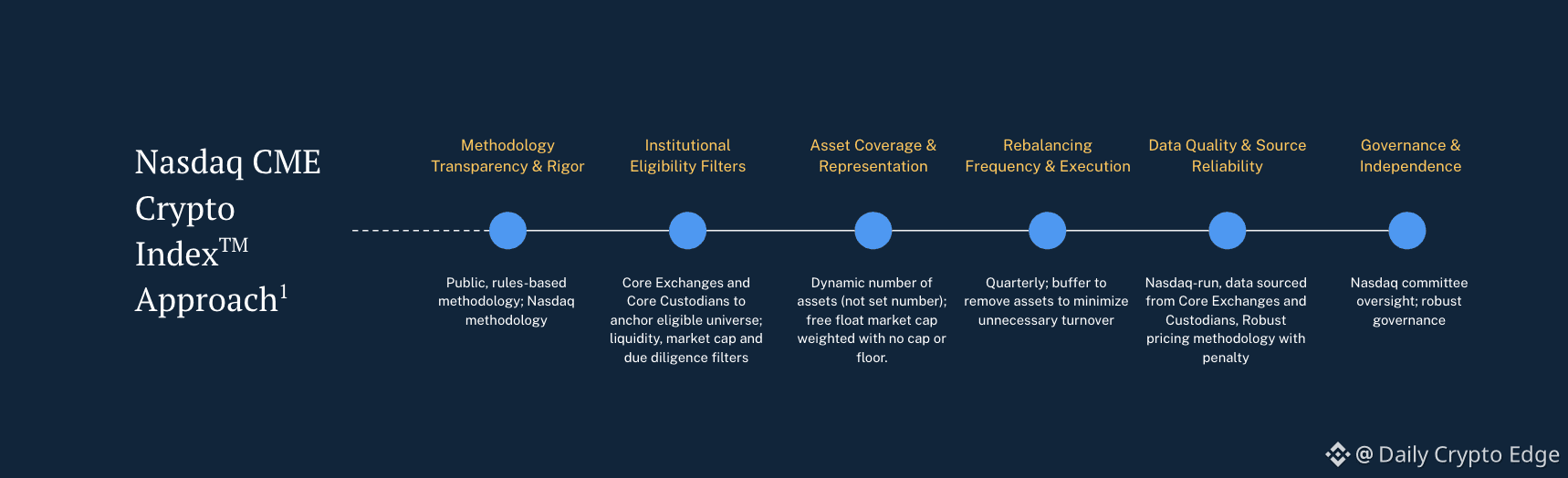

NCI’s™ methodology is designed to bring the same high standards for traditional market indexes to crypto. The benchmark’s quarterly reconstitution practices support a long-term culture of folding promising and emergent crypto assets into the mix. Only crypto assets that meet the requisite liquidity, exchangeability, and fungibility standards are eligible for inclusion. Candidates must likewise trade on at least two major exchanges for the entire period since the last index readjustment and prospective newcomers must be supported by reputable custodians with demonstrably efficient operational controls.

The Nasdaq CME Crypto™ Index: Key differentiators and institutional-grade criteria

Nasdaq, Nasdaq Crypto Index - Factsheet, accessed January 19, 2026.

Effective January 20, 2026, the index changed its name from Nasdaq Crypto Index (NCI) to Nasdaq CME Crypto™ Index.

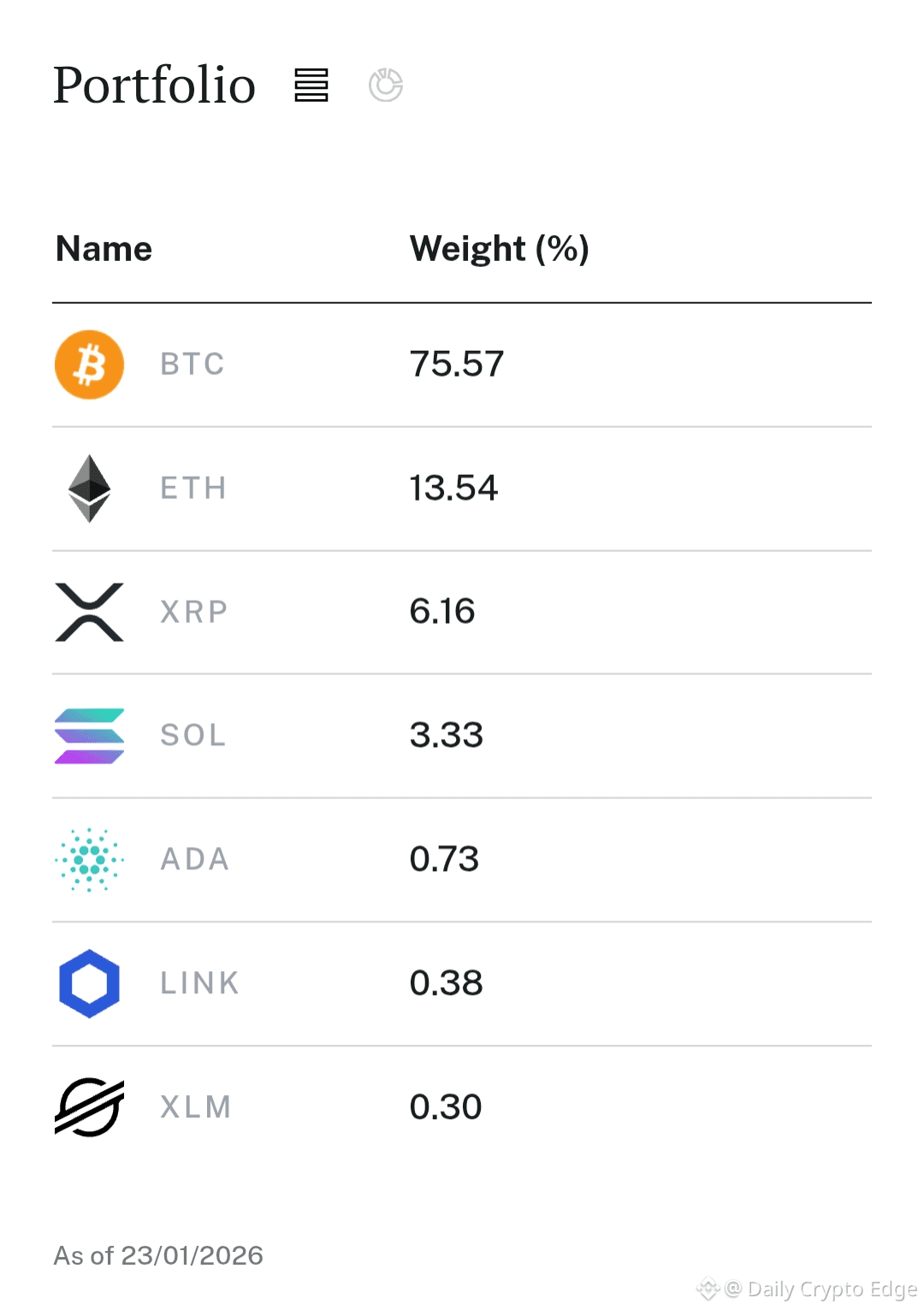

Fortunately, the pool of crypto assets runs deep. And what does NCI’s™ constituent breakdown look like today? As you might imagine, industry stalwarts Bitcoin (BTC) and Ethereum (ETH) factor prominently as the index’s two largest assets. And while their foundational roles will likely keep these names around for a while, NCI™ additionally features evolving set of crypto assets, presently including XRP (XRP), Solana (SOL), Cardano (ADA), Chainlink (LINK), and Stellar (XLM). Of course, these weightings are subject to change every quarter, to keep their representations on track amid macroeconomic changes and evolving investment theses.

What lies ahead for crypto in 2026?

With the Nasdaq/CME partnership signaling crypto’s shift from a speculative, niche ecosystem into a sophisticated asset class, digital assets may offer uncorrelated returns that complement traditional investments. This is one of the reasons why Hashdex is now endorsing increasing crypto allocations to 5%-10% for most investors, as we outlined in our 2026 Crypto Investment Outlook. Many predictive metrics support this recalibration:

The rise of the “cryptodollar”: Stablecoins—digital assets linked to fiat currencies like the US dollar or the euro may spike in global market cap from $295 billion to $500 billion or more this year, and into the trillions of dollars within five years.

AI catalyzing crypto: As blockchains rise in prominence to buttress the increased verification, coordination, and economic autonomy AI demands, so too will rise investment opportunities in the AI crypto space.

Scaling tokenization: Financial services behemoths like BlackRock and JPMorgan have begun using blockchain technology to overhaul their infrastructure and more efficiently compete for capital. This could spike tokenized assets tenfold this year alone.

Demand outpacing supply: This fundamental economic principle may materially influence crypto asset pricing. As demand for these assets increases while supply remains limited, prices tend to rise—a benefit to those who opt in early.

Final thoughts

Hashdex has nearly $1B in global products that track the NCI™ and we’re excited to continue to help drive investor interest in the crypto asset class. Effective today, the names of Hashdex’s products that track the NCI™ will be updated to reflect the index rebranding. For more information on how this rebranding will impact specific products.

As crypto continues to mature from a once-niche technology play into an indispensable building block of the global economic food chain, institutional investors seeking diversified and dynamic exposure to non-traditional investments can no longer overlook this asset class. And without question, tradable and transparent indexes like the Nasdaq CME Crypto™

#Index will continue to help facilitate the adoption of this asset class for investors big and small.

#cryptocurreny #NasdaqTokenization #ETFs