GameStop has transferred its entire Bitcoin treasury to Coinbase Prime, fueling speculation that the video game retailer may be preparing to sell its BTC holdings amid ongoing market volatility.

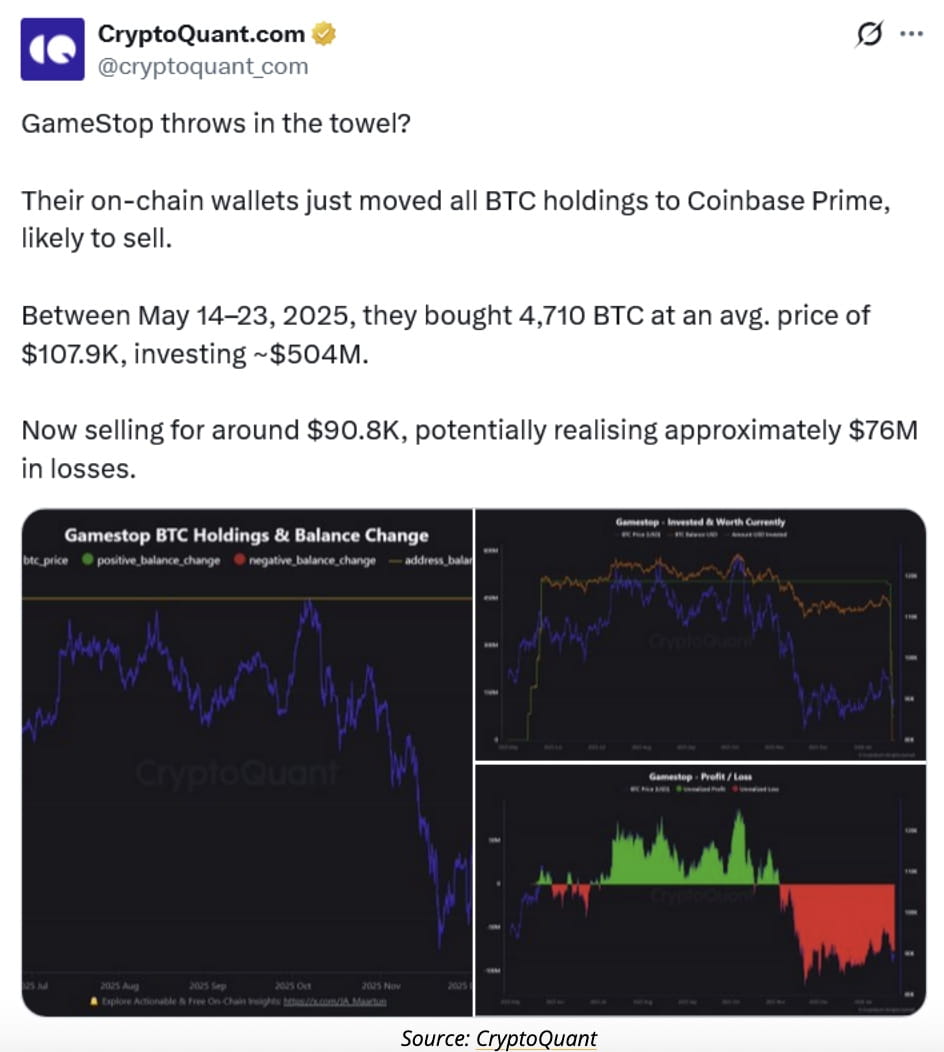

According to blockchain intelligence firm CryptoQuant, GameStop moved all 4,710 Bitcoin, worth more than $420 million, to Coinbase’s institutional trading platform on Friday — a move the firm described as “likely to sell.”

“GameStop throws in the towel?” CryptoQuant wrote in a post on X, noting that such transfers are typically associated with preparation for liquidation or custody reorganization.

Potential $76 million loss on Bitcoin position

If GameStop were to sell its Bitcoin at current market prices near $90,800, the company would realize an estimated $76 million loss, CryptoQuant said.

The retailer accumulated its BTC position in May at an average purchase price of approximately $107,900 per Bitcoin, bringing the total investment to more than $500 million at the time.

GameStop launched its Bitcoin treasury strategy earlier this year after CEO Ryan Cohen met with Strategy (formerly MicroStrategy) chair Michael Saylor, discussing how corporate Bitcoin holdings could be structured.

As of publication, GameStop has not publicly confirmed whether the transfer signals an imminent sale. Cointelegraph said it contacted the company for comment but had not received a response.

CEO increases equity stake as Bitcoin questions mount

The blockchain move coincided with a regulatory filing earlier this week showing that Ryan Cohen purchased an additional 500,000 GME shares, worth over $10 million. GameStop shares rose more than 3% following the disclosure.

The contrasting actions — increasing equity exposure while potentially reducing crypto exposure — have added to speculation that GameStop may be reassessing its digital asset strategy.

Corporate Bitcoin treasuries under scrutiny

Corporate crypto treasuries surged in popularity throughout 2024 and early 2025, with firms seeking exposure to Bitcoin as a balance-sheet reserve asset. However, many companies saw share price volatility intensify in late 2025 as Bitcoin retraced from record highs.

Currently, more than 190 publicly traded companies hold Bitcoin on their balance sheets. Several firms have also launched treasuries tied to Ether, Solana, and other digital assets.

Despite growing scrutiny, digital asset treasury companies recently received a boost after MSCI decided not to remove crypto-holding firms from its major market indexes, citing the need for additional analysis to distinguish treasury strategies from investment businesses.

An exclusion could have triggered billions of dollars in passive fund outflows, particularly for large holders such as Strategy.

For now, GameStop’s Bitcoin transfer has revived debate around the sustainability of corporate crypto treasuries — and whether firms are willing to endure volatility during prolonged market drawdowns.