During 2026’s shifting digital currency scene, Plasma (XPL) stands apart - built from the ground up to handle one job well: shifting stablecoins fast. Ethereum and Solana stretch wide, chasing DeFi leads and NFT attention, yet XPL took a different fork in the road. Its entire design leans into being invisible infrastructure, much like plumbing beneath concrete. Instead of flashy apps, it focuses on smooth transfers of USDT and USDC across borders. Think less spotlight, more backbone - the kind that lets money flow without friction. Email-level ease is the target; high fees and delays are what it avoids.

While others add features, Plasma strips them away, keeping only what moves value. Speed comes built-in, not bolted on after months of upgrades. No need to wait for patches when efficiency shapes the core code. Stablecoin traffic grows - and so does the quiet demand for dedicated pathways. General networks juggle tasks. This one doesn’t juggle. It delivers. Every update feeds throughput, never bloat. Fees stay low because complexity was left out by choice. It won’t host games or art auctions. That isn’t the gap it fills. Reliability matters most when trillions ride each second on tiny transactions.

Other chains reach higher. Plasma runs flatter, faster, closer to metal. Not every problem needs a Swiss Army knife. Some just need a wire.

What is Plasma (XPL)?

What if a blockchain put stablecoins first? That’s exactly what this network does. Gas costs often spike elsewhere - here they stay predictable. Speed matters too; confirmations happen faster than usual. Most chains treat dollar-linked coins as add-ons. Not this one. Built-in support changes how payments settle. Core functions handle stability by design. Transactions clear without waiting ages. The base layer speaks stablecoin fluently. Efficiency comes from architecture, not patches. Finality arrives sooner because the system assumes value must move smoothly. Other networks adapt slowly - this setup begins with clarity

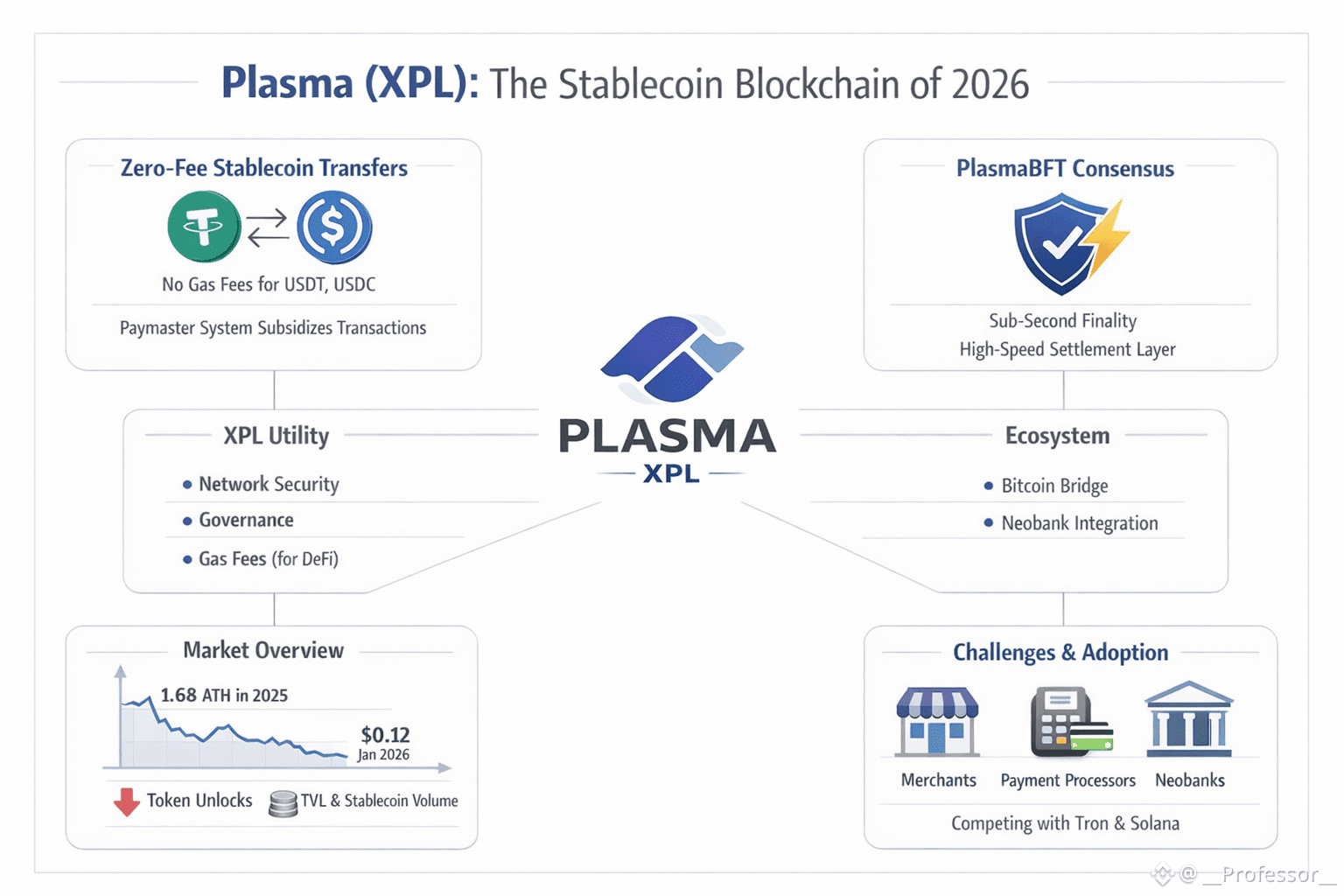

Faster than most systems out there, it uses something called PlasmaBFT to confirm transactions almost instantly. That kind of pace matters when your job is settling payments worldwide - think Visa or SWIFT - but without gatekeepers and open to anyone peeking under the hood

The "Zero-Fee" Proposition

What grabs attention about Plasma isn’t flashy - it’s how it handles fees. Instead of paying per transfer, users move certain stablecoins such as USDT without cost. This works because a built-in Paymaster, run by the protocol, covers charges behind the scenes

Sending 10 USDT on regular Ethereum means you need ETH too, for fees. Plasma handles it differently - no extra token needed upfront. Fees vanish when actions are approved by the system ahead of time. That ease isn’t accidental; it reflects how Paul Faecks sees payments evolving. He believes real adoption begins when people send money without learning crypto jargon first. Stablecoins work best, he says, only if the tech behind them stays out of sight.

Tokenomics and Market Reality January 2026

A single coin named XPL handles three separate jobs inside the system

Validators use XPL to support network security in proof of stake

Voting power sits with those who hold tokens when it comes time to decide updates or tweak settings.

Fees show up when doing tricky DeFi moves that aren’t covered. Instead of another token, you pay using XPL to keep things running. Not every action triggers this cost - only those heavier operations slip through the free layer

By late January 2026, feelings about XPL aren’t clear-cut. Though it hit a peak near $1.68 toward the end of 2025, prices have since dropped sharply, now hovering between $0.12 and $0.13. Such swings often show up in fresh Layer-1 tokens dealing with early unlock periods

Right now, eyes turn toward big token releases due mid-February 2026. Market watchers point out that while such events can flood supply temporarily - sometimes called inflation - they also signal growth, letting founders and early supporters access funds. What really tells a project's staying power? Look at how much value stays locked in its apps along with steady flows of stable money choosing that network, trends holding firm even when prices swing

The Ecosystem and What Comes Next

Outside forces shape what Plasma does. Major stablecoin players have taken notice, linking up through partnerships that pull resources toward shared goals. Its Bitcoin Bridge draws focus by channeling BTC value into decentralized finance activities under its control. Instead of trying to handle every task, it carves out a niche handling money movements specifically. High-speed networks built for games or chat platforms operate differently, aiming elsewhere entirely

Still, getting people to actually use it is tough. To catch on, Plasma needs shops, money apps, and digital banks to pick its system instead of older ones - say, Tron, which already moves most USDT today - or something super quick like Solana. By 2026, the plan leans hard into Plasma One, sort of a hybrid bank front-end meant to link regular finance habits with the Plasma chain.

Conclusion

What if usefulness wins after all? Plasma shifts focus. Not excitement, but steady function now matters most. The XPL coin still dances with risk - markets sway, unlocks happen. Yet beneath that noise lies something else entirely. Smooth, cost-free transfers of stablecoins might tap into vast financial demand. Price surges aren’t guaranteed just because people talk loud. Quiet performance could matter far more than any rally. Becoming an unseen backbone for money flows worldwide - that path may define what comes next. Success hides in plain sight, possibly.