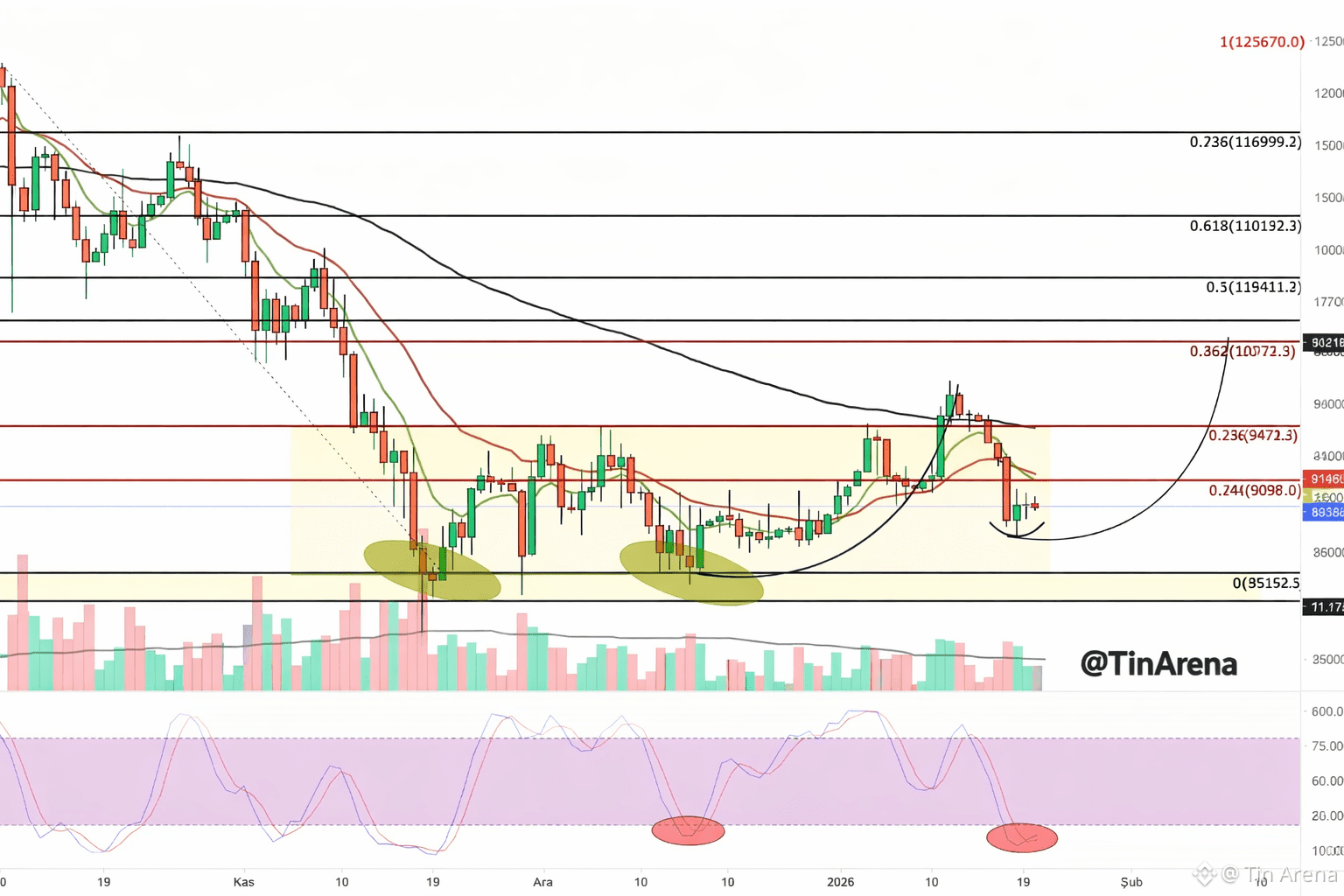

Bitcoin remains in a corrective phase within a broader bullish structure, as shown on the daily chart.

After failing to hold above the 0.236 Fibonacci level (~94,700), price retraced back into the key demand zone between 85,000 – 90,000, an area that has already acted as strong accumulation support twice in recent months.

🔑 Key Technical Observations

Major Support Zone: 85,150 – 89,000

→ This zone previously triggered strong rebounds, highlighted by volume absorption.Immediate Resistance:

90,987 (0.144 Fib)

94,714 (0.236 Fib)

Higher Resistance Levels:

100,630 (0.382 Fib)

105,411 (0.5 Fib)

110,192 (0.618 Fib)

📈 Momentum & Indicators

Stochastic RSI is deeply oversold, similar to prior reversal points marked on the chart.

Price is attempting to base above long-term support, suggesting sellers are losing momentum.

The larger curved projection implies a potential rounded bottom, not a breakdown structure.

🧠 Market Interpretation

As long as $BTC holds above the 85K support, the current move appears to be a healthy pullback, not a trend reversal. A reclaim of 94.7K would be the first confirmation for upside continuation toward the 100K–110K liquidity zone.

🎯 Summary

Structure: Bullish market, corrective phase

Bias: Cautiously bullish above 85K

Invalidation: Daily close below 85K

Patience > prediction — let price confirm.

Not financial advice. Always manage risk.

#Bitcoin #BTC $ETH $XRP #CryptoAnalysis #TechnicalAnalysis #TinArena