Bitcoin is the first decentralized digital currency based on blockchain technology for secure peer-to-peer transactions.

It was designed to operate without a central authority, unlike traditional money.

The total supply is capped at 21 million BTC, creating scarcity.

2) Bitcoin Launch & Early History

The Bitcoin whitepaper, titled Bitcoin: A Peer-to-Peer Electronic Cash System, was published on 31 October 2008 by Satoshi Nakamoto.

The Bitcoin network was launched with the Genesis Block on 3 January 2009.

The first Bitcoin transaction occurred on 12 January 2009, when Satoshi sent 10 BTC to Hal Finney.

At launch in 2009, Bitcoin had no formal price because it wasn’t yet traded on exchanges.

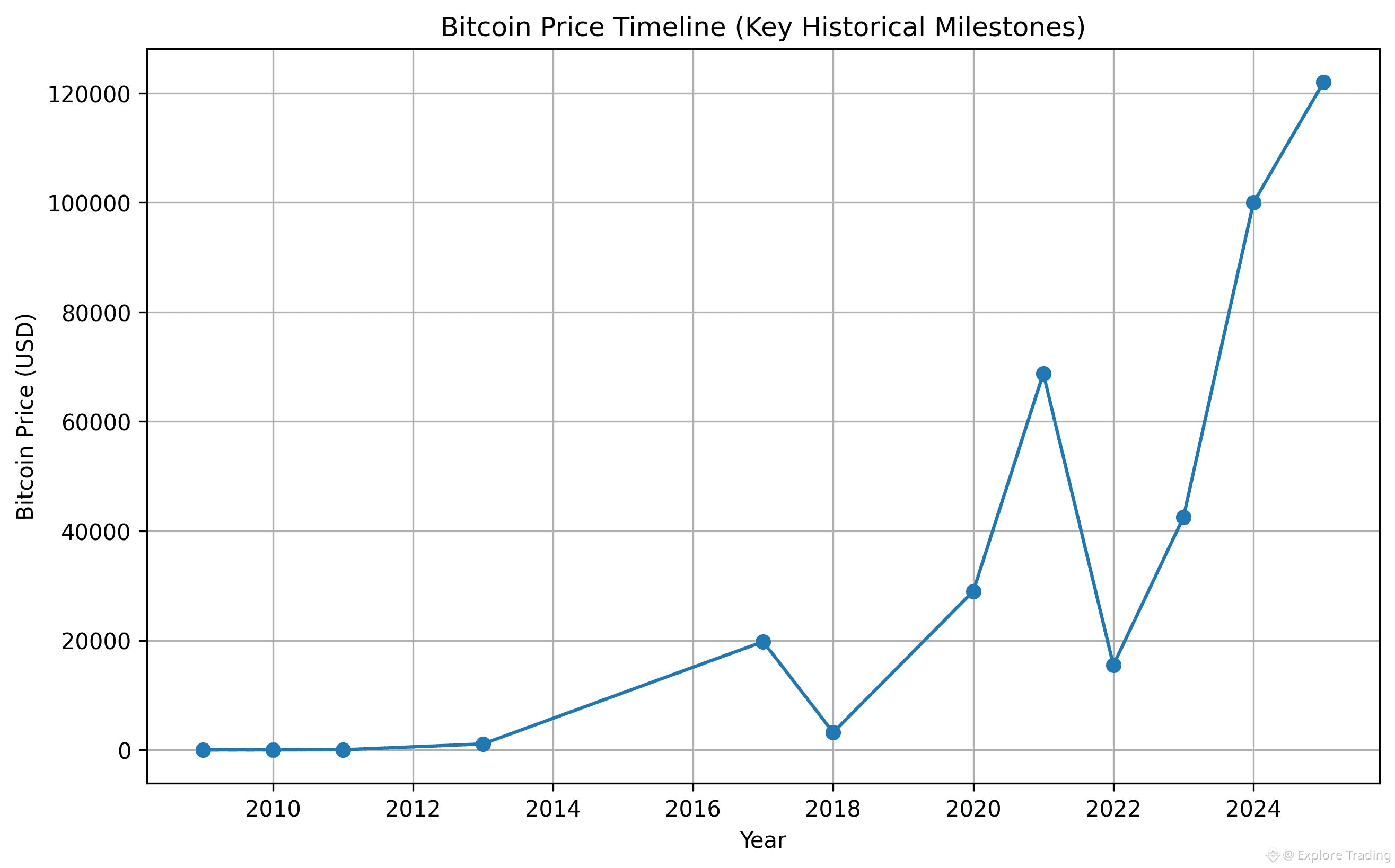

3) $BTC Price History (Year-by-Year)

2009: Bitcoin’s price was effectively $0 since there was no exchange trading.

2010: Bitcoin first traded on exchanges at less than $1; around $0.08 to $0.30 in early trades.

2011: Bitcoin rose from ~$1 to a peak near $31 then corrected lower.

2013: Bitcoin reached over $1,000 for the first time.

2017: Bitcoin experienced a major bull run to around $19,783.

2018: The market corrected sharply, falling to roughly $3,200.

2020: Bitcoin recovered through the year, ending near $29,000.

2021: Bitcoin reached a new high of about $68,789 amid institutional interest.

2022: The market faced volatility and ranged roughly $18,490–$47,835.

2023: Bitcoin traded between $16,000 and $42,500 as markets stabilized.

2024: Bitcoin saw renewed strength, with highs above $100,000 by year’s end.

2025: Bitcoin’s price reached a new record high of about $122,201 and traded between $75,000 and $122,201 through October 2025.

January 2026: Bitcoin continues to trade around $112,000+ to $125,000+, with volatility across the market.

4) Major Price Drivers

Bitcoin’s supply issuance halves approximately every four years (halving), reducing miner rewards and historically preceding price increases.

Adoption by institutions, ETFs, and financial products increased demand since 2021.

Global economic events, regulation news, and macro sentiment have been major drivers of volatility.

Media attention and market psychology (fear & greed) amplify price swings.

5) Historic Real-World BTC Purchases & Buyers

Laszlo Hanyecz (May 22, 2010): Spent 10,000 BTC (~$41 at the time) to buy two pizzas — now worth over $1.1 billion+ at recent Bitcoin prices. This event is celebrated annually as Bitcoin Pizza Day.

Hal Finney (2009): Received 10 BTC in the first documented Bitcoin transfer; early contributor and developer supporter.

Winklevoss Twins (2013): Purchased large amounts of Bitcoin (estimated ~70,000+ BTC) around ~$120–$140 each; holdings grew significantly in value.

Tim Draper (2014 Silk Road Auction): Bought ~29,500 BTC at auction prices far below later highs, becoming one of the prominent early institutional holders.

6) Bitcoin Halving (Supply Impact)

Bitcoin halving events occur about every 210,000 blocks, roughly every four years, cutting miner block rewards in half (2012, 2016, 2020, 2024).

Reduced supply issuance historically coincided with bullish market cycles as demand outpaced new issuance.

7) Risks of Bitcoin Investing

Bitcoin is highly volatile with large price swings over short periods.

Regulatory uncertainty in various countries can affect market sentiment and institutional participation.

Security risks exist if private keys or wallets are not properly managed.

Past crashes (e.g., 2018, early 2022) demonstrate sharp downturns that investors must understand.

8) Why Bitcoin Still Matters

Bitcoin remains the original and most widely recognized cryptocurrency with the largest market capitalization.

Its decentralized nature and limited supply make it attractive as a potential store of value.

Growing institutional adoption — including ETFs and treasury holdings — bridges traditional finance to digital assets.

Ongoing innovation and infrastructure development support broader usage and trust.

9) Conclusion

Bitcoin’s journey from $0 to over $100,000+ highlights technological innovation, global adoption, and market evolution.

While volatility and risks remain, Bitcoin’s history shows long-term growth potential amid structural changes in finance and investment.

Content presented here is factual, professional, and suitable for publication on platforms like Binance ID.

BTC86,745.03-2.89%

BTC86,745.03-2.89%#BTCCommunity #CryptoAnalysis" #exploretrading #bitcoin #ADPJobsSurge