The crypto space has seen countless token launches over the years. Most of them follow familiar patterns. Early access for a small group, complicated allocation rules, and limited opportunities for everyday users to participate meaningfully. Plasma is taking a different path.

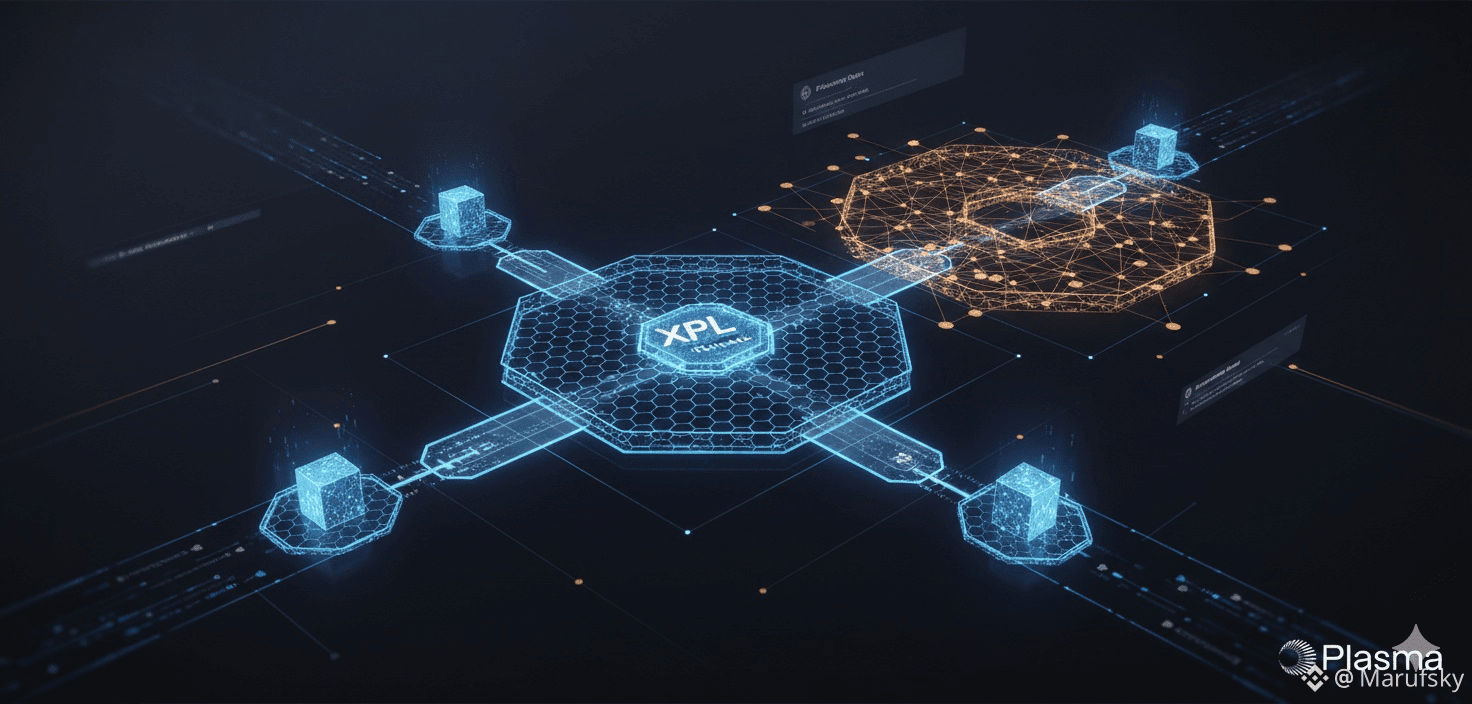

With the announcement of the XPL Public Sale, Plasma is making it clear that this is not just another blockchain launch. It is the foundation of a new global financial system, built around participation, alignment, and transparency from the very beginning.

The public sale will be conducted using Sonar by Echo. Echo is already known as the market leader in private investment infrastructure for early stage projects. Sonar is their new public sale infrastructure, and Plasma is the first project ever to launch using it. That choice alone reflects the level of intention behind this sale.

Plasma is a blockchain purpose built for stablecoins. The goal is not only faster transactions, but reliable, scalable movement of dollars at a global level. In this system, the XPL token plays a central role. It secures the PlasmaBFT consensus mechanism, powers EVM execution, and supports critical infrastructure such as the trust minimized Bitcoin bridge.

In the public sale, 10 percent of the total XPL supply will be sold at a fully diluted network valuation of 500 million dollars. This valuation matches Plasma’s most recent equity raise, signaling consistency and long term thinking rather than short term hype. There are no special prices and no hidden advantages. The same rules apply to everyone.

One of the most distinctive aspects of this sale is how allocations are earned. There is no race to be first and no gas war. Instead, participants deposit stablecoins into the Plasma Vault on Ethereum and begin earning units over time. These units represent a time weighted share of the total vault deposits, and they determine each participant’s guaranteed allocation in the XPL sale.

Supported stablecoins include USDT, USDC, USDS, and DAI. Participants can withdraw during the deposit period if they choose, but withdrawing reduces their units proportionally. This design strongly favors long term commitment over short term speculation, which closely reflects the kind of network Plasma aims to build.

Once the deposit period ends, the vault enters a lock up phase. During this time, deposits are locked and prepared for bridging to Plasma Mainnet Beta. The public sale then takes place directly on the Plasma site using the same wallet that was used for deposits. Sonar by Echo handles identity verification, jurisdictional screening, and compliance checks, while Plasma manages the sale execution and token distribution.

When Plasma Mainnet Beta launches, several important things happen at once. XPL tokens are distributed to participants, vault positions are bridged to Plasma, and deposited USDT becomes withdrawable directly on the Plasma network. For US participants, any purchased XPL tokens will be subject to a 12 month lock up, reflecting regulatory requirements.

Security and transparency are core priorities throughout this process. The pre launch vault infrastructure is built with Veda, using audited contracts that already secure billions of dollars in total value. Full audits by Spearbit and Zellic are planned for Mainnet Beta, with final reports published ahead of launch.

Ultimately, the XPL Public Sale is not just about raising funds. It is an invitation to help shape a network from the ground up. Plasma is betting on its community, on developers, users, and institutions who want to be involved early and meaningfully.

Plasma believes the future of money should be built in the open, with aligned incentives and real participation. This public sale is the first major step toward that vision.