Infrastructure projects are often misunderstood in early stages because their value is indirect. Plasma Coin fits this profile.

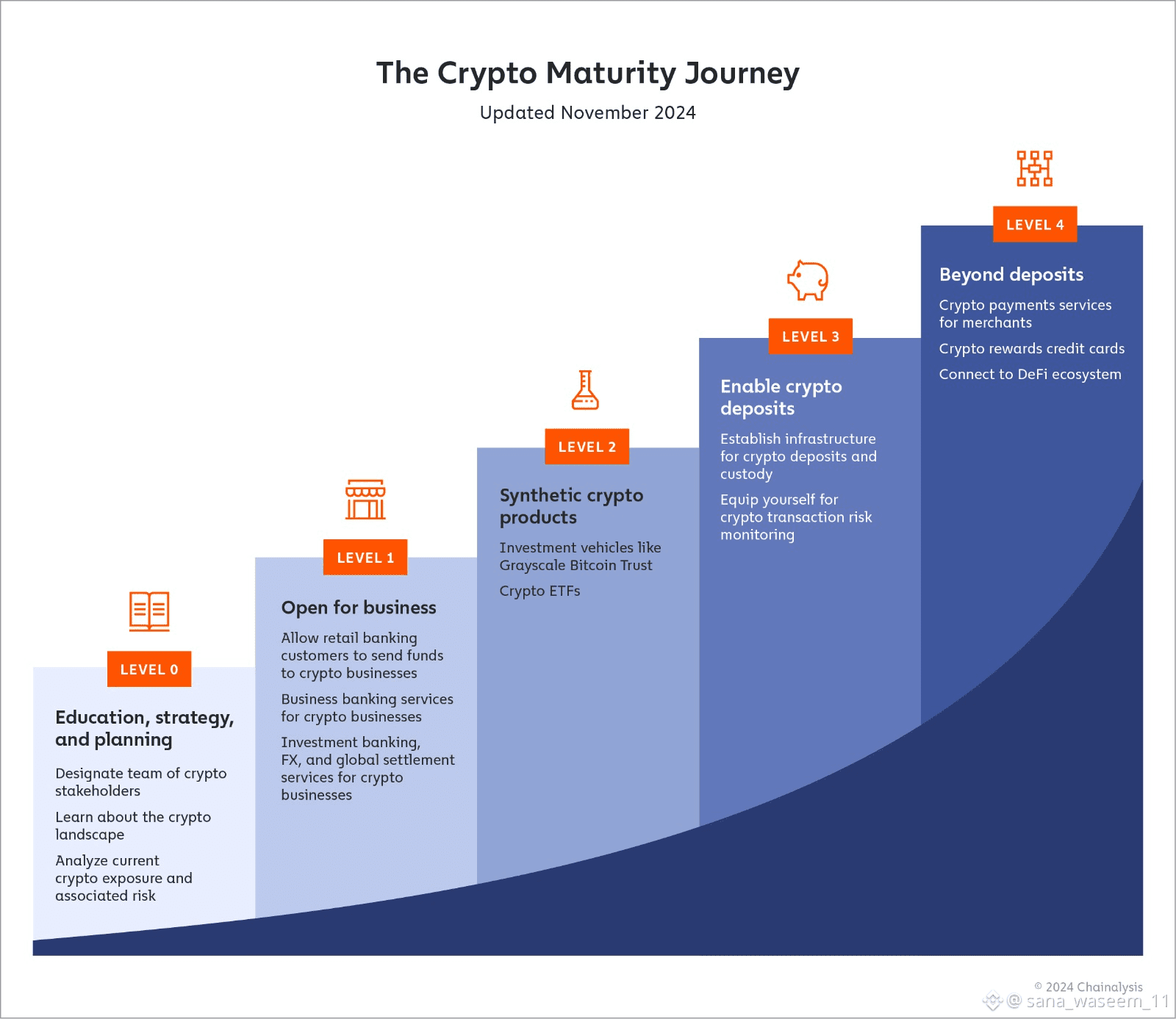

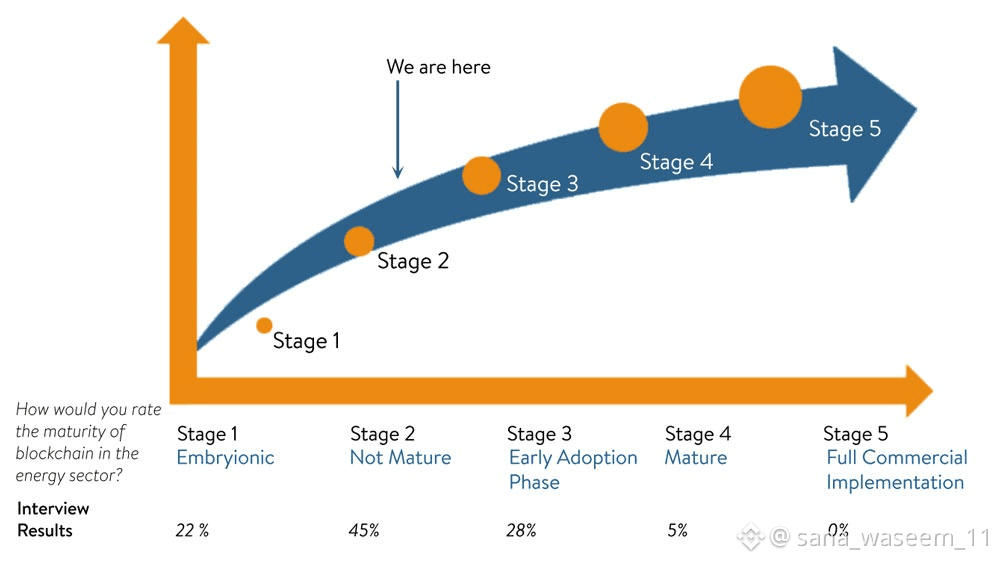

Rather than offering immediate consumer appeal, it addresses a systemic requirement: scalable execution. As blockchain ecosystems mature, such requirements move from optional to essential.

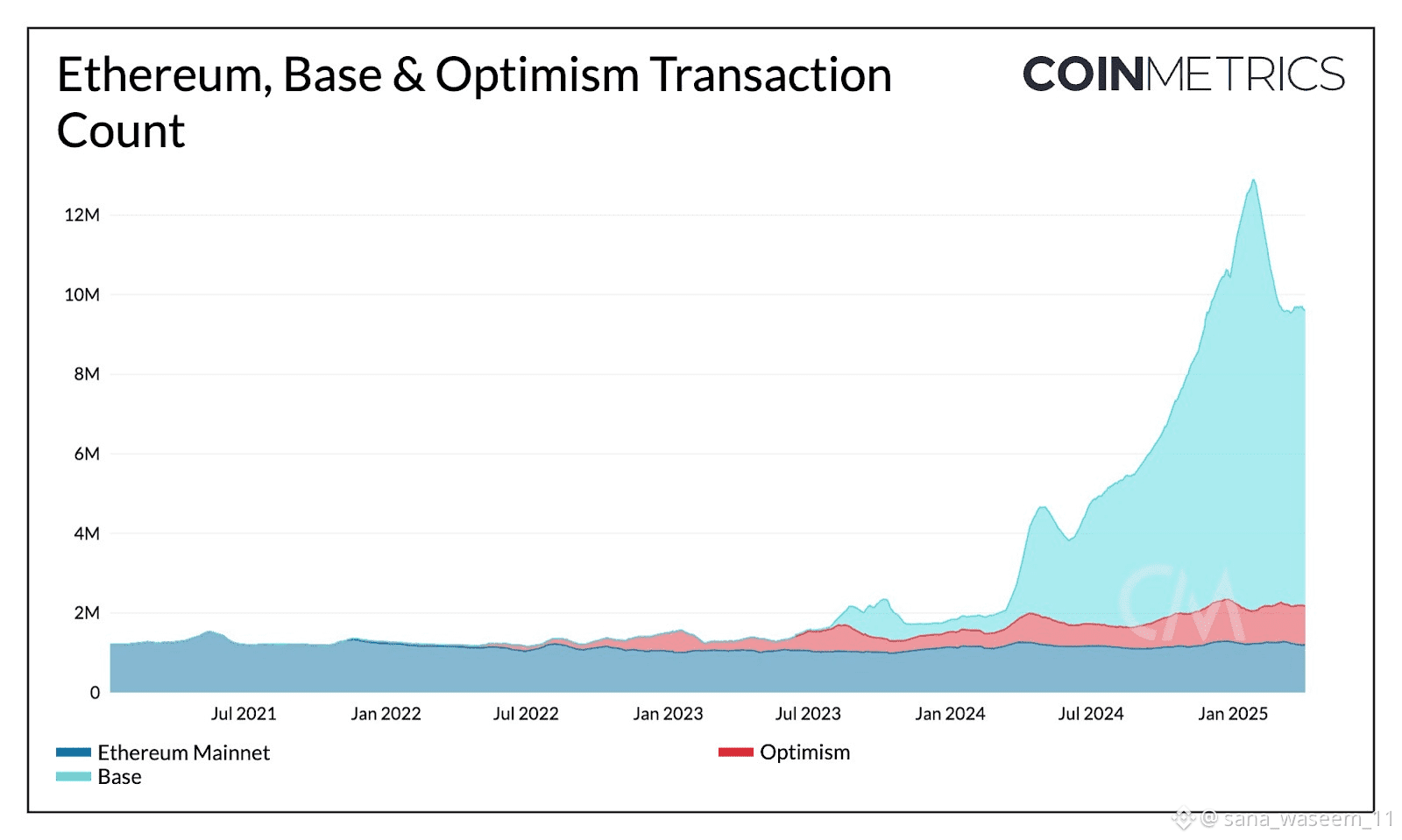

From an adoption perspective, scalability determines whether applications can support real users under real conditions. Networks that fail to scale efficiently often experience rising fees and degraded performance — outcomes that discourage long-term participation.

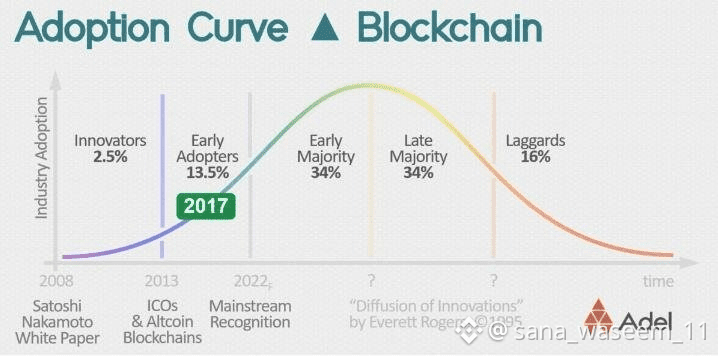

Plasma Coin aligns with the phase of crypto where usability becomes more important than experimentation. This transition typically marks the shift from early adoption to sustained growth.

History shows that infrastructure solutions tend to gain value as ecosystems reach capacity. The market often reprices these projects later, once their necessity becomes visible.

Plasma Coin’s positioning reflects readiness for that stage.

Rather than focusing on visibility, it focuses on function. And in maturing markets, function tends to outlast narrative.

Key takeaway: Viewing Plasma Coin as infrastructure highlights its relevance beyond short-term price movements.

#PLASMA #PlasmaCoin #LongTermCrypto #Web3Future #plasma $XPL @Plasma