Most people skim tokenomics sections looking for one number: total supply. They see 10 billion $XPL, calculate some hypothetical market cap, and move on. Maybe they glance at the allocation pie chart. Team gets 25%, investors get 25%, ecosystem gets 40%, public sale gets 10%. Standard stuff. Nothing alarming.

What keeps me up is the part that comes after the percentages. The part where Plasma's carefully structured vesting schedule collides with actual market reality. Because right now, with XPL trading at $0.1266 and down roughly 92% from its September highs, we're sitting in the calm before a very specific kind of storm. And the thing is, Plasma isn't hiding any of this. The unlock schedule is public. The dates are set. But I don't think most people have actually worked through what happens when those dates arrive.

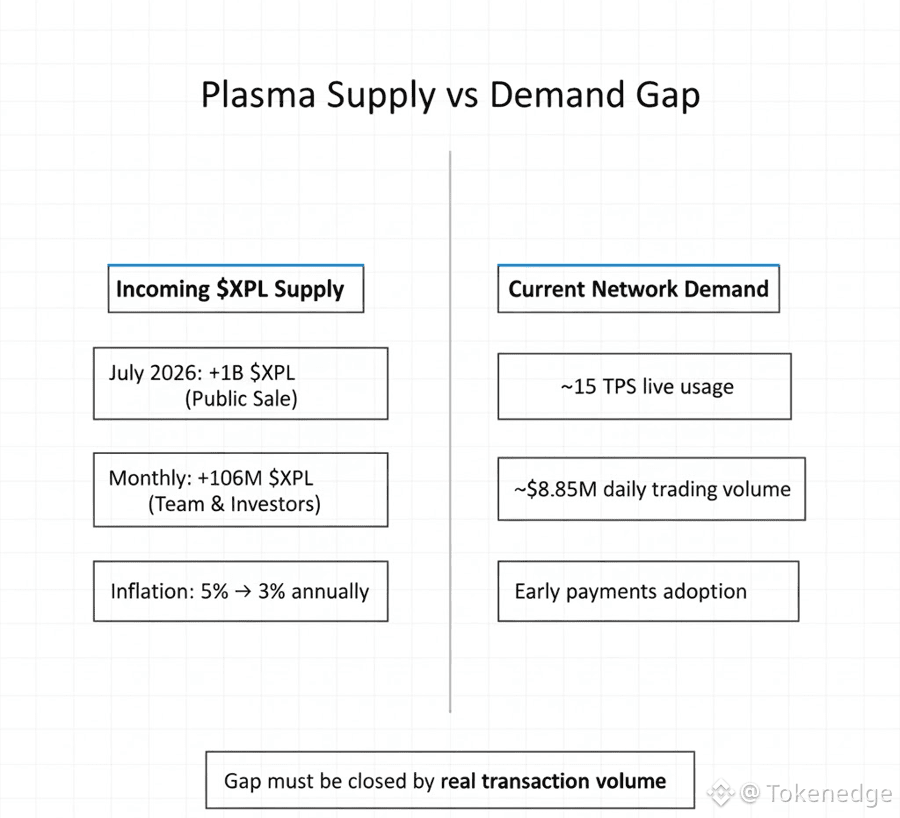

Today's trading volume sits at around 69.66 million XPL changing hands over 24 hours. That's roughly $8.85 million in dollar terms at current prices. Plasma is processing about 15 transactions per second despite a theoretical capacity of 1,000+ TPS. The network has room. Liquidity exists. Everything feels manageable.

But that manageability is temporary, and the clock is very visible if you look.

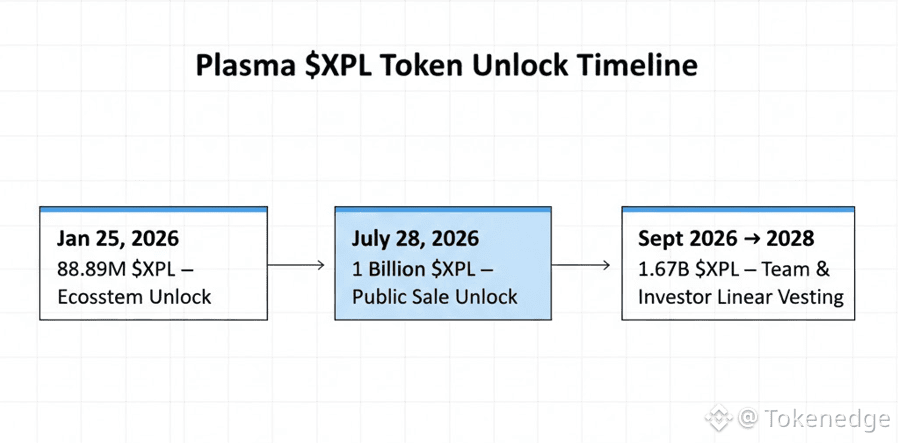

According to the unlock tracker, we're six days away from an 88.89 million XPL ecosystem unlock on January 25th. That's about $11-12 million worth of tokens at current prices, representing roughly 0.89% of total supply. Not catastrophic. Barely a blip compared to what's coming later in the year. But it's a reminder that Plasma's vesting schedule isn't theoretical anymore. It's operational.

The real pressure point arrives on July 28, 2026. That's when the US public sale participants get their tokens after a full 12-month lockup. One billion XPL unlocks in a single event. At today's price, that's about $126 million entering circulation. For context, Plasma's entire 24-hour trading volume right now is $8.85 million. You're looking at roughly 14 days of current volume materializing in one unlock.

Then September hits. Team and investor tokens finish their one-year cliff. Another 1.67 billion XPL becomes eligible for monthly vesting. From that point forward, roughly 106 million XPL will drip into the market every month for the next two years as team and investor allocations vest linearly.

Plasma's design relies on something very specific to absorb this supply: real usage demand, not speculative demand. The whole point of zero-fee USDT transfers is to drive actual payment volume. Stablecoin settlements. Cross-border remittances. Merchant transactions. The kind of activity that requires operational XPL holdings, not just trading positions.

That's the theory. In practice, we're still early. Plasma launched in September 2025 with spectacular TVL numbers—over $5.5 billion in the first week—but much of that was DeFi farming across integrations like Aave, Ethena, Fluid, and Euler. Farming is not the same as sustained payment flow. It's capital looking for yield, and capital moves when yield moves.

The actual payments infrastructure is still being built out. Plasma One, the neobank app offering 10%+ APY on stablecoin deposits and up to 4% cashback, is live. MassPay integrated native USDT payments. NEAR Intents connected XPL to liquidity pools spanning 125+ assets across 25+ blockchains. These are real products. But adoption curves take time, and time is exactly what the unlock schedule isn't giving the network.

What Plasma very deliberately chose to do is make staking and validator delegation a core part of the economic model. When validators go live in Q1 2026—which should be any week now—XPL holders can stake tokens to secure the network and earn rewards. Inflation starts at 5% annually, decreasing by 0.5% per year until it stabilizes at 3%. Importantly, locked XPL held by team and investors isn't eligible for unlocked staking rewards during the vesting period. That's a design feature meant to prevent insiders from farming their own tokens before they're even liquid.

Staking creates natural demand. If you're earning 5% on staked XPL while contributing to network security, there's incentive to hold rather than dump. But here's where the math gets uncomfortable: even if 30-40% of circulating supply gets staked—which would be strong participation—you're still dealing with hundreds of millions of newly unlocked tokens every month starting mid-2026. Staking helps. It doesn't solve.

The other absorption mechanism is fee burning. Plasma burns a portion of transaction fees, creating deflationary pressure on circulating supply. But this only works if transaction volume is high enough to offset inflation and unlocks. Right now, at 15 TPS, we're nowhere near that threshold. Plasma would need to be processing thousands of meaningful transactions per second—actual stablecoin payments with real fees attached—to burn enough XPL to counterbalance the supply expansion.

That's the gap nobody seems to be talking about. The gap between where Plasma is today and where it needs to be by the time July and September roll around.

In theory, the market prices this in efficiently. Everyone can see the unlock schedule. Smart money anticipates the dilution and adjusts positions accordingly. Prices should already reflect future supply expansion.

In practice, markets are messy. Especially in crypto, where attention is seasonal and capital rotates based on narratives more than fundamentals. What often happens is nothing dramatic until the unlock actually hits, and then liquidity evaporates because nobody wants to catch the falling knife. Prices compress not because the project failed, but because the float just tripled and demand didn't keep pace.

Plasma's current price of $0.1266 reflects a lot of pessimism. An 89% decline from all-time highs says the market is either deeply skeptical of the unlock schedule, unconvinced by real-world adoption metrics, or both. The 24-hour change shows a modest 2.09% gain, but in the context of an asset that's been bleeding for months, that's noise. Trading volume of $8.85 million suggests there's still participation, but it's thin compared to the capital flows this network will need to manage in six months.

What Plasma very deliberately avoids is pretending this isn't a problem. The vesting schedule is transparent. The unlock dates are published. There's no mystery, no hidden cliff, no surprise dilution event. If you're building on Plasma or holding XPL, you know exactly what's coming and when.

That transparency is valuable, but it doesn't change the fundamental challenge: Plasma has roughly six months to convert from a DeFi farming destination into a genuine payments infrastructure with enough real transaction volume to justify absorbing billions of tokens into circulation. That's not impossible. The technology is there. PlasmaBFT consensus delivers sub-second finality. The protocol-level paymaster system works. EVM compatibility makes migration easy for developers. Bitcoin security anchoring is live. The infrastructure is credible.

But infrastructure isn't adoption. And adoption is what determines whether those July and September unlocks get absorbed into productive network activity or dumped into spot markets by participants who just want out.

The roadmap shows USD-anchored pricing coming in Q1 2026, which helps with predictability for long-term storage commitments. Validator staking launching soon creates holding incentives. The NEAR Intents integration expands liquidity access. Plasma One is onboarding real users to neobank features. These are all the right moves.

The question is whether they happen fast enough.

Not fast enough to pump the price. Fast enough to generate the kind of organic, sticky transaction volume that makes billions of newly unlocked XPL feel like liquidity instead of supply overhang. Fast enough that when those dates arrive, the network isn't negotiating with speculators anymore—it's serving actual users who need XPL to interact with the cheapest stablecoin settlement layer available.

That's not a guarantee. It's a race. And Plasma's unlock schedule just made the finish line very, very visible.