Axie Infinity is flashing signals that most people are choosing to ignore. While timelines are busy debating long-term revival narratives, the short-term structure is telling a very different story.

What nobody discusses is this: whales don’t distribute loudly. They do it when sentiment is quietly improving, liquidity is back, and retail feels “safe” again.

That’s exactly the zone Axie Infinity is drifting into.

I’ve been watching AXS closely over the last few weeks, and what keeps nagging me isn’t price alone — it’s who is moving the tokens and when.

The Setup Most Traders Are Celebrating

On paper, AXS looks constructive.

Price has recovered from its local lows. Volume picked up modestly. On-chain chatter turned optimistic again. For many, this feels like the early stage of a trend reversal.

In theory, that makes sense.

AXS has already corrected over 90% from its all-time highs. Long-term holders argue most of the damage is done. From a pure risk-reward angle, downside feels limited compared to prior cycles.

That’s the theory.

But theory often breaks when it meets real liquidity behavior.

What the On-Chain Data Is Whispering

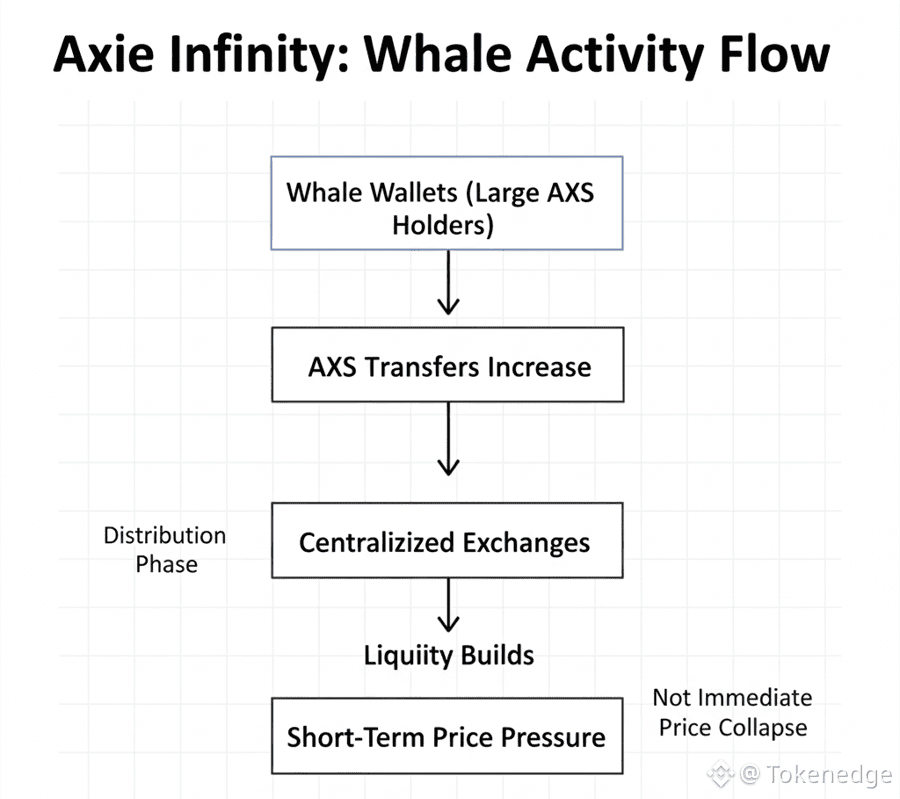

Recent on-chain data shows large AXS transfers moving toward centralized exchanges, not away from them.

We’re not talking about retail-sized flows. These are whale-level movements — wallets that historically act during distribution or hedging phases, not accumulation hype.

Historically, when AXS whales increase exchange inflows, price doesn’t collapse immediately. It stalls first. Then it bleeds.

That delay is what traps people.

The market gives you just enough green candles to feel confident before momentum quietly disappears.

The Gap Nobody Wants to Talk About

Here’s the real tension.

There’s a gap between narrative strength and market positioning.

The Axie Infinity ecosystem is still building. Development hasn’t stopped. Community efforts are real. That narrative is strong.

But markets don’t price narratives — they price flows.

And right now, flows suggest caution.

Whales positioning for liquidity events doesn’t mean Axie is “dead.” It means timeframes are being confused.

Long-term believers are acting like short-term traders.

Short-term traders are acting like long-term investors.

That mismatch is where pullbacks are born.

Theory vs Practice: Where Traders Slip

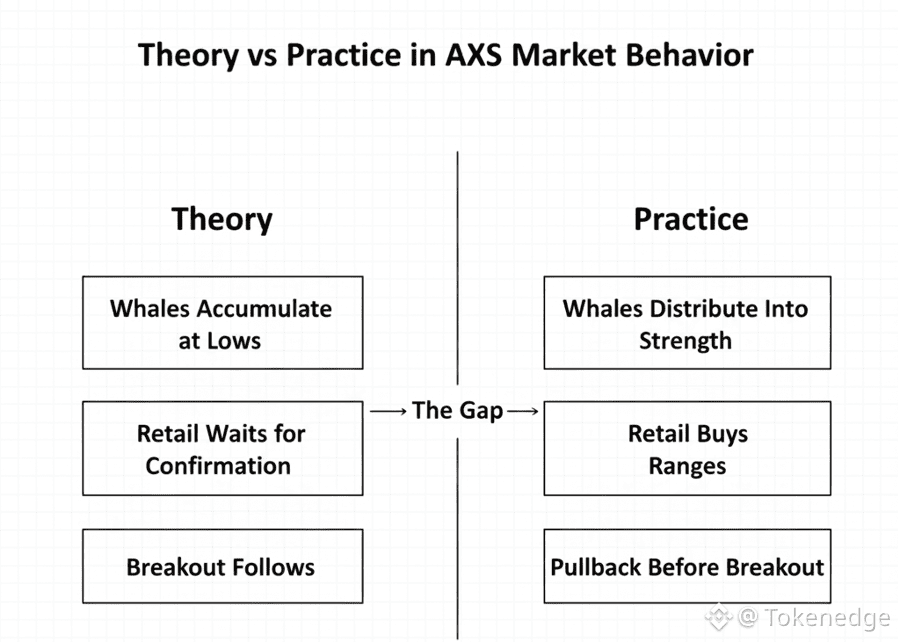

In theory:

Whales accumulate low.

Whales sell high.

Retail follows trends.

In practice:

Whales distribute into strength.

Price ranges before breakdown.

Retail buys “confirmation.”

AXS is currently in that uncomfortable middle zone.

Price isn’t breaking down hard enough to scare people.

But it’s also not breaking out with conviction.

That’s usually where leverage builds — and where it gets punished.

Price Structure Tells a Quiet Story

From a technical perspective, AXS is struggling to reclaim key resistance levels that previously acted as strong support.

Each bounce is getting sold faster.

Each push higher has weaker follow-through.

That’s not what strong reversals look like.

If momentum were real, we’d see expanding volume on upside moves. Instead, volume spikes are happening during sell-offs.

That asymmetry matters.

Imagine the Next Scenario

Imagine this plays out the way similar setups have before.

Price chops sideways. Sentiment stays hopeful. Influencers talk about “base building.”

Then one broader market dip hits — maybe BTC pulls back 5–7%.

Suddenly, AXS doesn’t hold its range.

Whale supply that was already positioned gets absorbed by the market. Liquidity thins. Stops cascade.

That’s how short-term pullbacks happen without a single piece of “bad news.”

This Isn’t Bearish — It’s Temporal

I want to be clear: this isn’t a death sentence for Axie Infinity.

Short-term pullback risk doesn’t cancel long-term potential. It just means timing matters more than conviction.

What worries me isn’t fear — it’s complacency.

Markets punish comfort far more than doubt.

Right now, too many participants are comfortable assuming upside without questioning who’s selling into it.

The Opening Matters Again

Axie Infinity faces short-term pullback risks not because the project failed — but because positioning is ahead of price confirmation.

That’s the part nobody likes to hear.

The market doesn’t move on belief alone. It moves when belief aligns with flows, structure, and timing.

Until that alignment returns, caution isn’t bearish.

It’s professional.

#Binance #BinanceNews #AxieInfinity