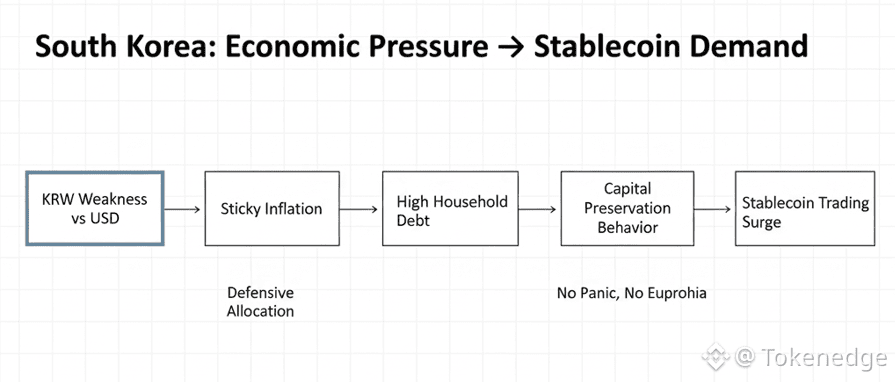

South Korea’s stablecoin trading surge isn’t being driven by hype, innovation, or some sudden love for DeFi. It’s being driven by pressure. Quiet, persistent, economic pressure that most global traders aren’t paying attention to.

What nobody discusses is this: stablecoin volume doesn’t explode when people feel optimistic. It explodes when they’re trying to hold still in a moving economy.

And that’s exactly what’s happening in South Korea right now.

I’ve been tracking regional volume data for a while, and what keeps nagging me is how disconnected the narratives are. On the surface, Korea looks technologically advanced, regulated, and resilient. Underneath, traders are behaving defensively — not aggressively.

That difference matters.

The Surface-Level Explanation (And Why It’s Incomplete)

The easy explanation is currency convenience.

Stablecoins offer faster settlement. Easier on/off-ramps. Better access to global markets. All true.

In theory, rising stablecoin trading just reflects crypto market maturity.

But theory skips a critical detail: why now?

Stablecoin volume doesn’t surge randomly. It spikes when local participants feel friction — either in purchasing power, capital movement, or monetary confidence.

South Korea is showing all three.

The Economic Pressure Most Charts Don’t Show

The Korean won has been under stress relative to the dollar. Not collapsing — but weakening enough to be felt.

Inflation remains sticky. Household debt is already high. Interest rates have stayed restrictive longer than many expected.

None of this screams crisis.

But markets don’t wait for crises. They react to direction.

Stablecoins, especially dollar-pegged ones, become a quiet hedge long before panic sets in.

That’s the part people miss.

The Gap Between Intent and Interpretation

Here’s the central tension.

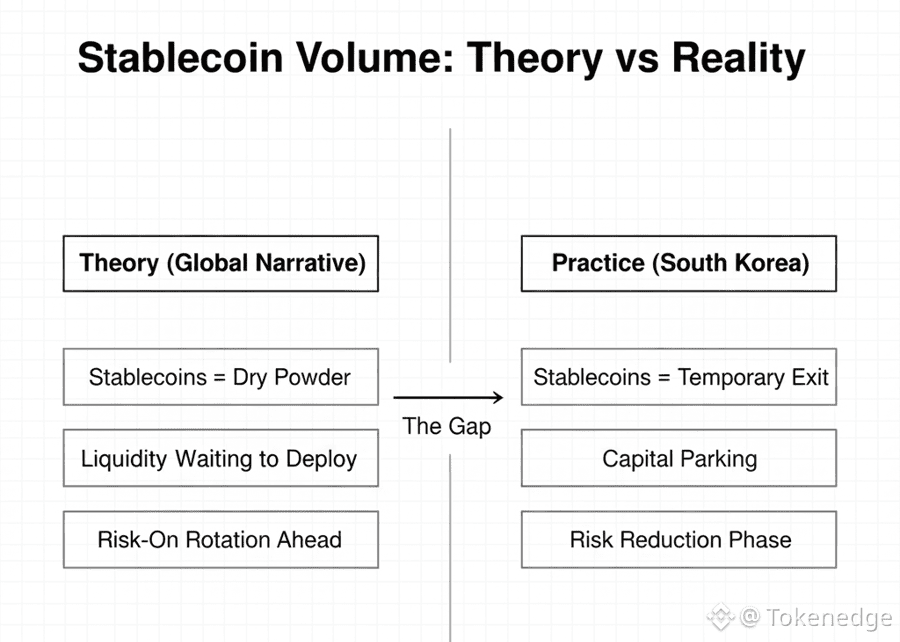

Global analysts see rising stablecoin volume and assume speculation.

Local traders are using stablecoins for preservation.

That gap creates misreads.

When stablecoin activity rises alongside spot crypto trading, it’s often framed as bullish fuel. Liquidity waiting to deploy.

But in South Korea’s case, much of this volume is parking, not positioning.

Funds are moving into stablecoins — and staying there.

That changes the signal entirely.

Theory vs Practice in Stablecoin Flows

In theory:

Stablecoins are dry powder.

Rising stablecoin volume means future risk-on behavior.

Capital rotates into volatile assets.

In practice:

Stablecoins act as temporary exits.

Volume rises when traders hesitate.

Capital waits for clarity, not opportunity.

South Korea’s data aligns far more with the second model.

You don’t see aggressive leverage building.

You see balance consolidation.

That’s defensive behavior.

Why This Isn’t Just a Korea Story

This is where it gets interesting.

South Korea has historically been early to behavioral shifts. Retail participation is deep. Market reflexes are fast.

When Korean traders move toward stablecoins en masse, it often precedes broader regional caution, not local exuberance.

We’ve seen this before.

Capital doesn’t flee overnight. It neutralizes first.

Stablecoins are neutrality.

Imagine the Next Phase

Imagine economic conditions remain tight.

No dramatic collapse. No sudden recovery.

Just slow erosion of purchasing confidence.

In that scenario, stablecoin usage doesn’t drop — it becomes normalized. More trades settle in stables. More portfolios anchor around them.

That subtly reduces speculative velocity across the market.

Price can still rise. But rallies become thinner. More fragile.

That’s the downstream effect nobody prices in early.

Why This Matters for Crypto Traders

If you’re trading from outside Korea, this isn’t a reason to panic.

But it is a signal to adjust expectations.

Rising stablecoin trading under economic pressure doesn’t scream “incoming bull run.” It whispers capital caution.

That means:

Faster profit-taking

Lower tolerance for drawdowns

Reduced patience for weak narratives

Markets still move up in those conditions — but they punish mistakes faster.

This Isn’t Anti-Crypto — It’s Pro-Context

I don’t see this as bearish for crypto long-term.

Stablecoins doing their job during economic stress is proof of utility, not failure.

But mistaking defensive flows for bullish conviction is how traders get blindsided.

South Korea’s surge in stablecoin trading is less about optimism and more about adaptation.

Bringing It Back to the Beginning

South Korea sees a surge in stablecoin trading amid economic pressures because traders are responding rationally, not emotionally.

They’re not betting big.

They’re bracing.

And in crypto, how people brace often tells you more than how they speculate.

Ignore that, and you’re trading narratives.

Read it correctly, and you’re trading reality.