I’ve been in this market long enough to learn one thing, a token only holds lasting value when it is tightly tied to real usage flow, not slogans. Plasma is no different. If you ask how the Plasma token is used across the ecosystem, I don’t start with where the price might go, I start with a simpler question, what job does this token do that nothing else can replace.

Plasma is positioned as an EVM compatible layer one, designed around stablecoin payments at scale, with a strong focus on fast USDT transfers and extremely low cost. That sounds simple, but anyone who has lived through multiple cycles knows payments are one of the hardest sectors, because they demand stability, anti spam protection, resistance to congestion, and above all operational trust. So what sits underneath to make the system run, and keep running.

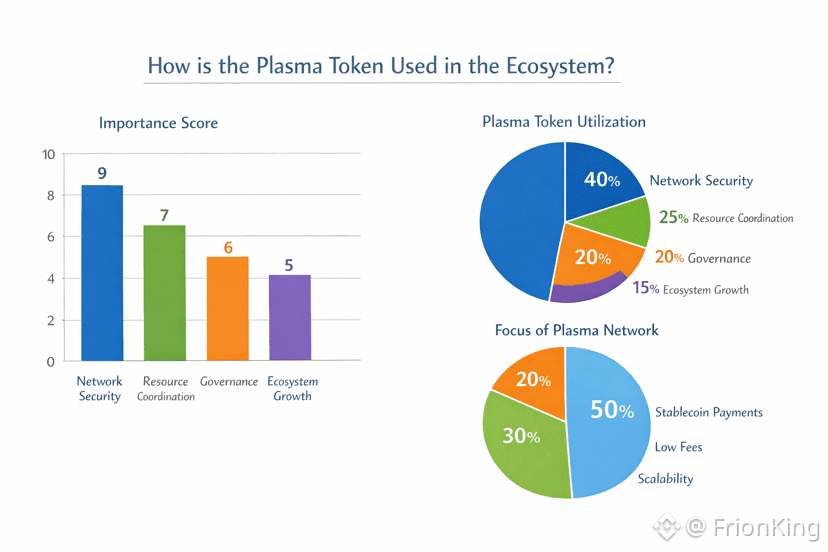

Plasma’s native token, XPL, is first and foremost the economic layer that secures the network. If you want a network to be secure, you need validators, you need people willing to bear the real cost of running infrastructure, you need a clear reward and penalty system, and you need validators to have strong incentives to behave correctly. That is where XPL comes in. It aligns validator incentives with network health, turning “security” into an enforceable economic contract rather than a promise. I’ve always believed this, in crypto, security doesn’t come from trust, it comes from incentives.

The next role of XPL is coordinating network resources, even if the end user experience feels close to fee free. A lot of chains talk about cheap fees, but once user volume rises, spam increases, or one application explodes in activity, weaknesses show up immediately. Plasma’s direction is to make stablecoin transfers smooth, potentially even aiming for a flow where users don’t need to hold a separate gas token before interacting. But behind that UX layer, the network still has to account for computation, still needs mechanisms to deter spam, and still must prioritize transactions when load spikes. At this level, XPL typically becomes the core economic unit the network uses to price and control operational discipline. Have you ever asked yourself, if everyone can send almost for free, what stops the network from being spammed to death.

Then there is a layer many people overlook, governance and long term ecosystem direction. A payments ecosystem only scales by pulling in wallets, payment gateways, dApps, liquidity, and most importantly, maintaining reliable standards. To do that, Plasma needs decision making around upgrades, network parameters, integration priorities, and how incentive budgets are deployed. Here, XPL becomes the tool that ties participation in shaping the network to actual economic commitment. I’ve seen too many projects fail because the community was just noise, while decisions were fragmented with no shared incentive axis. For a network that wants to serve payments, alignment on direction matters far more than a few months of hype.

Finally, XPL is also tied to ecosystem growth programs, where token allocation supports expansion, partner integrations, and early liquidity and user traction. But I’ll repeat what I always say, incentives are a catalyst, not the core. The core question is whether real usage remains after incentives fade.

If I had to summarize it in the language of someone who has survived multiple cycles, XPL is not there to “tell a story”. It is the economic engine running behind the payment experience Plasma is trying to simplify until users barely have to think about it. And the question I’ll leave you with is this, are you looking at Plasma as a cheap fee narrative, or are you looking at how the token is used to make cheap fees operationally sustainable.