In this market, I’ve learned one thing the hard way, tokenomics is never a side topic, it is the discipline framework that keeps VanarChain’s story from drifting with headlines, most people only look at price, but if you want to survive long term, you look at how tokens flow into the market, how they leave the market, and whether they end up in the right places to create real value.

VANRY is the token tied to VanarChain, and the first thing I look at is the supply cap, because the cap is a promise about how much dilution can happen over time, VanarChain sets a max supply at 2.4 billion, that sounds big, but big or small is not the point, what matters is how it is allocated, and how it unlocks, have you ever seen a project with a clean cap on paper, but an aggressive unlock schedule that the market simply could not absorb.

The second thing is block rewards, and this is where a lot of people misunderstand the game, they hear inflation and panic, but I treat inflation as the operating cost of security and network durability, if rewards are not attractive enough, validators leave, the network weakens, and the long term narrative turns into pure marketing, VanarChain chooses to mint additional supply through block rewards to sustain security and staking, and the emission is spread across many years, that structure turns network protection into an economic model that can live through multiple cycles.

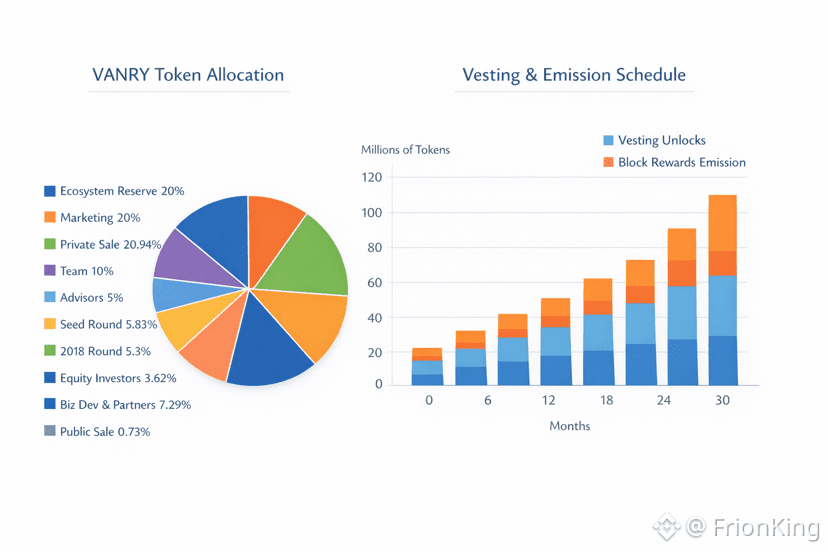

On allocation, I don’t read it emotionally, I read it like a map of power and a map of incentives, VANRY places a meaningful share into ecosystem growth, marketing, business development, and partnerships, while still allocating to the team, advisors, and fundraising rounds such as seed and private sale, the specific numbers matter, but the message matters more, VanarChain is clearly betting on scaling products and users, and it is willing to pay that cost through supply deployed over time, are you asking yourself what concrete outputs should prove that ecosystem budget is being spent well.

The lock and vesting schedule is what I always study closely, because this is where markets usually lose patience, the team typically has a cliff then unlocks gradually across many months, advisors are similar, ecosystem and marketing budgets are often released on a longer runway, and investor rounds commonly unlock a portion at the start and then vest over time, this structure creates a steady supply pressure, but it also avoids a single concentrated dump, the real question is whether the project can create real growth faster than the token supply flows out, have you ever watched a project with “perfect vesting” but no product traction, and the chart still broke anyway.

So what does VANRY tokenomics mean for long term holders, I reduce it to three questions I always use to keep myself honest, first, does new supply entering the market come with real on chain growth and real usage demand, second, are staking rewards high enough to keep security strong but not so high that they slowly drain holders through dilution, third, do ecosystem and partnership allocations turn into applications, users, and real fee flows, if these questions have strong answers, tokenomics becomes support, if not, tokenomics becomes drag.

In the end, I think going long term on VanarChain is not about blind belief, it is about tracking discipline, tracking unlocks, tracking real network usage, and tracking whether the project turns its ecosystem allocation into a value flywheel, are you holding VANRY for a quick wave, or because you believe VanarChain can turn tokenomics into a real economy.