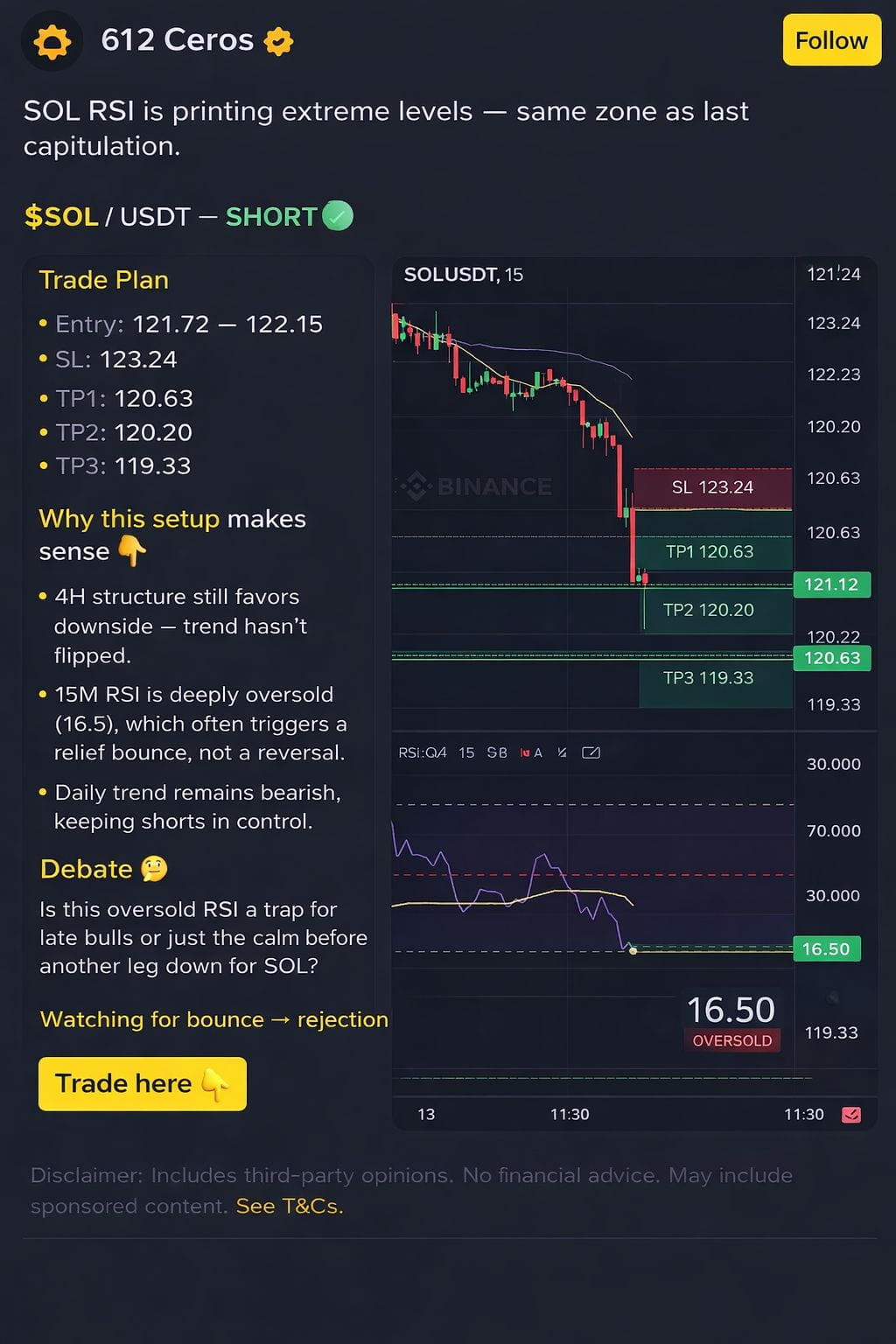

$SOL RSI is printing extreme levels — same zone as last capitulation.

$SOL / USDT — SHORT 🟢

Trade Plan Entry: 121.72 – 122.15

SL: 123.24

TP1: 120.63

TP2: 120.20

TP3: 119.33

Why this setup makes sense 👇

4H structure still favors downside — trend hasn’t flipped.

15M RSI is deeply oversold (16.5), which often triggers a relief bounce, not a reversal.

Daily trend remains bearish, keeping shorts in control.

In strong downtrends, oversold RSI usually becomes liquidity for sellers.

Debate 🤔 Is this oversold RSI a trap for late bulls

or just the calm before another leg down for SOL?

Watching for bounce → rejection.

Trade here 👇

SOL

127.44

+2.53%