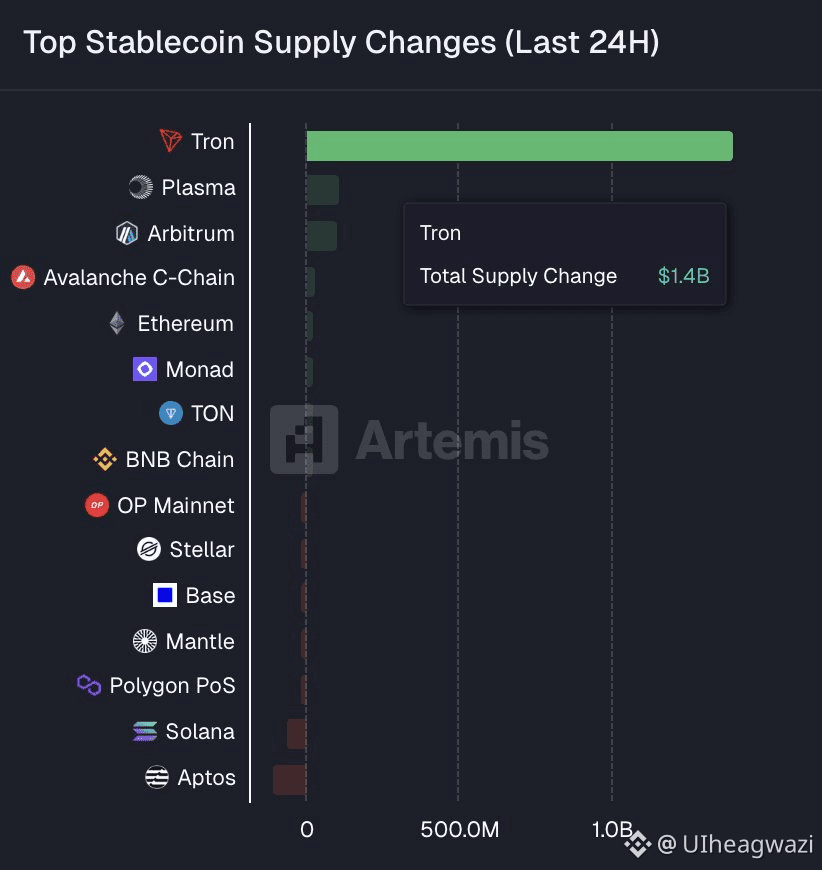

TRON Absorbs $1.4B in Stablecoin Inflows in 24 Hours – A Signal of Structural Demand

In the last 24 hours, TRON recorded the largest stablecoin supply inflow of any blockchain, adding $1.4 billion in new stablecoin supply, according to Artemis data.

This is not a one-off event driven by market excitement or short-term incentives. It is the latest data point in a long-running trend that highlights TRON’s role as a primary settlement layer for stablecoins at global scale.

Stablecoin Inflows Reflect Real Demand, Not Speculation

Unlike volatile assets, stablecoins move with intent. They flow into networks where users need to transact, not where they expect price appreciation.

A $1.4B net increase in supply within a single day suggests:

Rising transactional demand

Growing dependence on TRON for value transfer

Capital positioning for immediate on-chain use

This kind of inflow is fundamentally different from speculative liquidity. It represents money entering circulation funds preparing to move through exchanges, DeFi protocols, merchant payments, remittances, and payroll systems.

Consistency Over Cycles Is the Strongest Signal

What truly sets TRON apart is not the magnitude of the inflow, but its reliability.

TRON consistently ranks among the top networks for:

Stablecoin supply growth

Daily stablecoin transfer volume

Total transactions per day

Active addresses interacting with stablecoins

While many chains experience sharp inflows during bullish phases and equally sharp contractions when conditions tighten, TRON’s stablecoin metrics remain remarkably stable across market cycles.

This consistency indicates that TRON is being used as financial infrastructure, not as a speculative playground.

Why Capital Continues to Choose TRON

Stablecoins follow efficiency. TRON offers:

Near-instant finality

Predictable, low transaction costs

High throughput without congestion

A mature ecosystem optimized for stablecoin movement

For large holders and institutions, these characteristics reduce operational risk. For individuals and businesses, they reduce friction. When billions can move daily without interruption, trust compounds.

That trust is visible on-chain.

A Network Built for Circulation, Not Storage

On many blockchains, stablecoins accumulate without moving. On TRON, they circulate.

USDT and other stablecoins on TRON are actively used for:

Cross-border remittances in emerging markets

Exchange liquidity and arbitrage

Business settlements and treasury operations

On-chain savings and payments

This circulation explains why supply continues to expand. As usage grows, additional liquidity is required to support the velocity of transactions.

$1.4B in a single day is the network responding to that need.

Resilience in Quiet Markets

Perhaps the most telling aspect of TRON’s stablecoin inflows is when they occur.

These inflows are not limited to moments of market euphoria. They continue during neutral and low-volatility periods when speculation fades and only utility remains.

That resilience signals a user base that is:

Transaction-driven, not sentiment-driven

Global, not localized

Practical, not narrative-dependent

What This Means Long Term

Sustained stablecoin inflows point to a blockchain evolving into a global settlement layer.

Each day of consistent growth strengthens:

Liquidity depth

Network effects

Institutional confidence

Long-term relevance

$1.4B in 24 hours is impressive on its own. Repeated inflows of this nature define infrastructure.

TRON is not competing for attention, it is absorbing capital, quietly and consistently, as global stablecoin usage continues to scale.