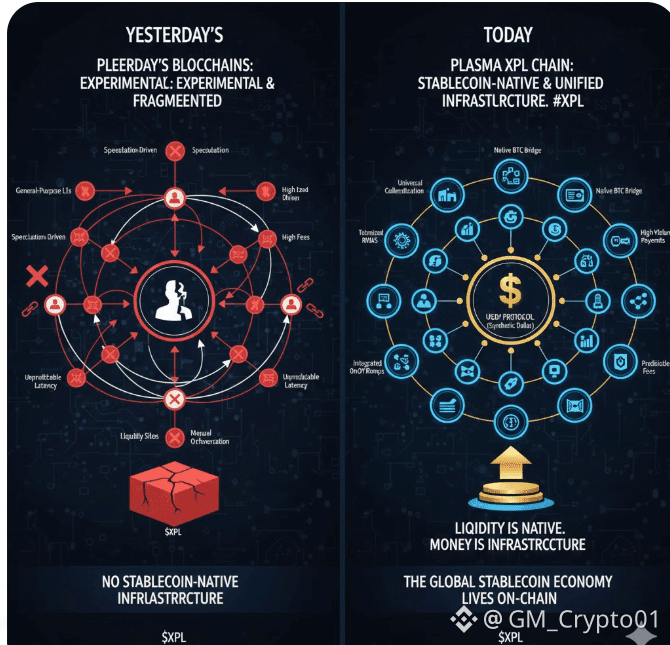

Stablecoins have quietly become the most successful product in crypto. Not because of narratives, speculation, or design elegance, but because they work. They move value across borders, settle trades, power remittances, and increasingly underpin real businesses. Yet for all their success, stablecoins have been forced to live on infrastructure never designed for their needs. General-purpose blockchains, optimized for experimentation and composability, were never meant to handle continuous, high-volume monetary flows at global scale. Plasma XPL begins from that uncomfortable mismatch.

The story of Plasma is not about adding another chain to an already crowded ecosystem. It is about acknowledging that money behaves differently from applications. Payments are repetitive, latency-sensitive, cost-intolerant, and unforgiving at scale. A user sending ten dollars does not care about expressive smart contracts; they care that the transfer is instant, final, cheap, and reliable every single time. Plasma is built around this reality. It treats stablecoins not as just another token standard, but as the core economic primitive the network exists to serve.

This purpose built approach becomes most visible when volume enters the picture. At low throughput, almost any chain looks functional. At millions of transactions per day, the cracks appear. Fees fluctuate, UX degrades, and infrastructure that was “good enough” suddenly becomes the bottleneck. Plasma is designed with the assumption that stablecoins are not edge cases but the default transaction type. Its execution environment, fee model, and settlement logic are optimized for sustained, high-frequency movement of value rather than episodic bursts of activity.

But infrastructure alone is not enough. Money requires liquidity, and liquidity requires trust that it will be there when needed. Plasma’s launch with over a billion dollars in USD₮ ready from day one is less about marketing scale and more about economic credibility. Developers building on Plasma are not deploying into a vacuum; they are entering an environment where capital is already present, mobile, and usable. This changes what can be built. Payments, treasury systems, market makers, and consumer applications behave differently when liquidity is native rather than aspirational.

What truly distinguishes Plasma XPL, however, is how it reframes collateral itself. In most on-chain systems, liquidity creation is destructive. Assets must be sold, locked inefficiently, or removed from productive use to access dollars. Plasma’s universal collateralization model challenges that assumption. By allowing liquid digital assets and tokenized real-world assets to be deposited as collateral for issuing USDf, the protocol turns idle value into active liquidity without forcing liquidation. This is a subtle shift with outsized consequences. Capital no longer has to choose between exposure and utility; it can maintain both.

USDf, as an overcollateralized synthetic dollar, is designed to behave as infrastructure money rather than speculative leverage. It exists to be spent, settled, and reused, not farmed and forgotten. In a payments-first environment like Plasma, this matters. Stable liquidity becomes a continuous resource flowing through applications rather than a static pool waiting to be tapped. Yield, in this context, is not extracted from users but generated from real economic movement.

Compatibility plays an equally important role in adoption. Plasma does not ask developers to relearn their craft. Full EVM compatibility ensures that existing tooling, contracts, and workflows transfer seamlessly. This is not ideological convenience; it is practical necessity. The fastest way to scale stablecoin applications is to remove friction for builders who already know how to ship. Plasma meets developers where they are, while offering an environment that behaves better once their applications grow.

Beyond execution and liquidity, Plasma recognizes that stablecoins now live in a regulated, interconnected financial world. Integrated access to card issuance, on- and offramps, compliance tooling, and risk infrastructure signals a shift from experimental crypto rails to production-grade financial systems. These integrations are not decorative. They acknowledge that stablecoins increasingly serve users who expect the same reliability and safeguards as traditional finance, without sacrificing the speed and openness that make crypto valuable.

The inclusion of a native, trust-minimized Bitcoin bridge completes the picture. Bitcoin remains the largest pool of monetary value in the digital asset ecosystem, yet it is largely disconnected from modern stablecoin infrastructure. By enabling BTC to move directly into Plasma’s EVM environment without centralized custodians, new forms of liquidity emerge. Bitcoin can become productive collateral, participate in dollar-denominated economies, and interact with stablecoin-native applications without abandoning its security assumptions.

Taken together, Plasma XPL does not feel like another experiment competing for attention. It feels like an acknowledgement of maturity. The stablecoin era is no longer hypothetical. It is here, messy, high-volume, and economically meaningful. Infrastructure must evolve accordingly. Plasma’s bet is that the future of on-chain finance is not defined by how expressive a chain can be, but by how reliably it can move money at scale.

In that sense, Plasma is less about innovation for its own sake and more about alignment. Alignment with how stablecoins are actually used. Alignment with how capital wants to remain productive. Alignment with how developers build when liquidity, tooling, and settlement are no longer uncertain. If blockchains were once about making computation scarce and valuable, Plasma suggests the next chapter is about making money boring again, fast, cheap, predictable, and everywhere.