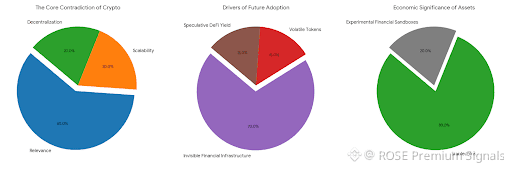

Plasma enters the market at a moment when crypto’s largest contradiction is no longer scalability or decentralization, but relevance. Most blockchains still behave like experimental financial sandboxes, while stablecoins have quietly become the most used, most trusted, and most economically meaningful crypto asset class. Plasma’s architecture reflects a brutal truth: the future of blockchain adoption will not be led by volatile tokens or speculative DeFi yield, but by invisible financial infrastructure moving stable value at planetary scale.

The design choice to build Plasma as a Layer 1 specifically optimized for stablecoin settlement rather than general-purpose computation flips conventional blockchain thinking on its head. Instead of asking how many transactions per second a network can theoretically support, Plasma asks how reliably and cheaply it can settle economic activity that people already care about. That reframing matters. When you optimize for stablecoins, every layer of system design changes — consensus incentives, fee markets, transaction ordering, validator economics, and even social trust assumptions. Plasma is not trying to compete with Ethereum, Solana, or any existing chain. It is carving out a new category: monetary infrastructure, not programmable speculation.

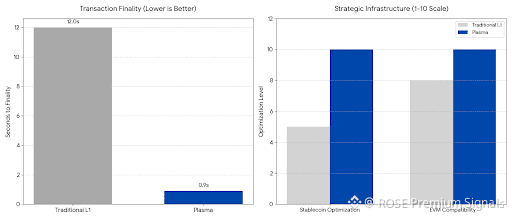

The decision to use a full EVM stack via Reth while pairing it with PlasmaBFT reveals a deep understanding of where real capital wants to flow. EVM compatibility is not a technical convenience; it is a liquidity magnet. It allows Plasma to import entire financial ecosystems without friction, pulling in payment protocols, wallets, exchanges, merchant systems, and compliance tooling already built around Ethereum standards. Meanwhile, sub-second finality is not about speed as a vanity metric. It is about human perception. Payments that finalize in under a second cross a psychological threshold where blockchain no longer feels like blockchain. It starts behaving like cash, card, or bank rails — but without intermediaries. This is where stablecoin usage shifts from speculative storage into transactional dominance.

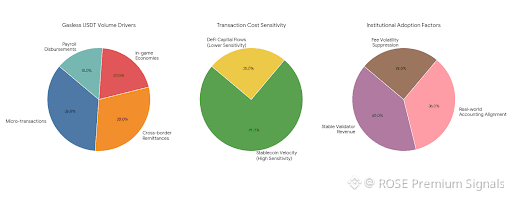

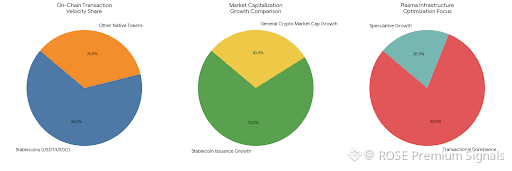

Gasless USDT transfers introduce a subtle but powerful economic shift. In most networks, transaction fees represent friction that disproportionately affects small-value payments. Gasless settlement removes that friction, allowing micro-transactions, payroll disbursements, cross-border remittances, and in-game economies to operate without cost anxiety. This is not simply user convenience; it restructures demand curves. When cost goes to zero, volume explodes. On-chain analytics already show that stablecoin velocity is far more sensitive to transaction cost than DeFi capital flows. Plasma is positioning itself to capture this velocity explosion before most chains even recognize it as a market.

Stablecoin-first gas pricing further distorts traditional fee economics. Rather than denominating gas in volatile native tokens, Plasma makes stablecoins the default economic unit. This seemingly minor choice stabilizes validator revenue, removes speculative distortion from fee markets, and allows transaction pricing models that institutions can actually plan around. Banks, payment processors, and enterprises do not budget in volatile assets. By anchoring gas to stable value, Plasma aligns blockchain infrastructure with real-world accounting systems, which is a prerequisite for institutional-scale adoption. This design also suppresses fee volatility spikes during market stress, smoothing network behavior exactly when financial stability matters most.

Bitcoin-anchored security adds another layer of strategic depth. Rather than competing with Bitcoin or borrowing its narrative, Plasma leverages Bitcoin as a cryptographic and economic anchor. This design reduces governance capture risk and increases censorship resistance in a way most modern chains cannot replicate. By tying final settlement security to the most battle-tested consensus network on earth, Plasma inherits a credibility premium that no VC-backed chain can manufacture. This anchoring also changes validator incentives. It shifts security competition away from token inflation wars and toward operational excellence, aligning long-term network stability with conservative capital rather than speculative mercenaries.

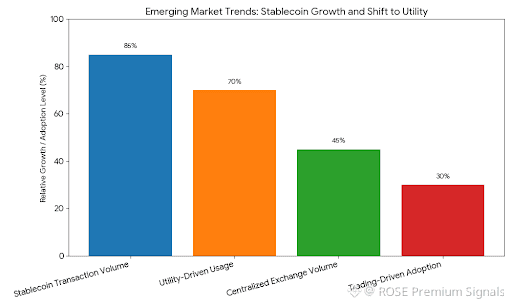

Where Plasma becomes particularly dangerous to incumbents is in emerging markets. Retail users in high-adoption regions do not care about decentralization philosophy. They care about inflation resistance, transfer speed, reliability, and accessibility. Stablecoins already serve as de facto savings accounts and payment rails across Latin America, Africa, Southeast Asia, and parts of the Middle East. Plasma’s architecture compresses the full banking stack — settlement, custody, compliance, and payments — into a permissionless protocol layer. On-chain data already shows stablecoin transaction volume in emerging markets growing faster than centralized exchange volume, signaling a structural shift from trading-driven adoption to utility-driven usage.

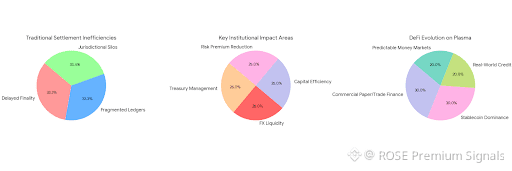

Institutional payments represent the second vector of disruption. Traditional settlement systems operate on delayed finality, fragmented ledgers, and jurisdictional silos. Plasma collapses these inefficiencies into a single global ledger where settlement becomes atomic, transparent, and instant. This is not incremental improvement; it is a paradigm shift in how money moves between financial institutions. The impact on treasury management, foreign exchange liquidity, and capital efficiency is enormous. On-chain analytics would likely show reduced settlement latency correlating directly with lower counterparty risk premiums, reshaping global credit pricing models.

DeFi mechanics on Plasma will evolve differently than on general-purpose chains. When stablecoins dominate transaction flow, yield curves flatten, liquidation cascades dampen, and reflexive volatility loops weaken. Lending markets become closer to traditional money markets, with predictable utilization rates and lower risk premiums. This allows the construction of financial instruments that resemble commercial paper, trade finance, and real-world credit facilities rather than speculative leverage machines. Plasma’s design encourages economic utility rather than casino dynamics, potentially drawing conservative institutional capital into on-chain finance for the first time.

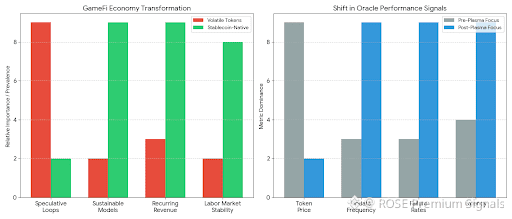

GameFi economies also transform under stablecoin-native settlement. Instead of volatile in-game tokens that distort gameplay incentives, developers can price assets, rewards, and services in stable value. This removes speculative extraction loops that hollow out player engagement. When in-game economies operate on stable units, developers can build sustainable pricing models, recurring revenue streams, and long-term digital labor markets. Plasma’s sub-second finality allows these economies to operate at real-time speeds, blurring the boundary between gaming, labor, and digital commerce.

Oracle design becomes more straightforward yet more critical. When transactions settle in stable value, oracle manipulation risk shifts from price volatility to settlement reliability. Plasma incentivizes oracle networks to prioritize uptime, latency, and redundancy over price discovery. This reorients the oracle market toward infrastructure-grade reliability rather than speculative feed accuracy. On-chain metrics tracking oracle update frequency, failure rates, and latency will become leading indicators of network health, replacing token price metrics as the dominant performance signals.

From an architectural perspective, Plasma’s EVM implementation via Reth signals a deeper commitment to performance determinism. Reth’s modular execution allows precise tuning of state access, transaction ordering, and memory handling. This is critical for high-throughput settlement environments where microsecond inefficiencies compound into macro-scale congestion. By controlling execution determinism, Plasma can deliver predictable transaction behavior, enabling algorithmic payment routing, automated treasury management, and real-time liquidity balancing systems that would break under conventional blockchain variability.

Capital flows are already hinting at where this design trajectory leads. Stablecoin issuance is accelerating faster than crypto market capitalization. On-chain data shows USDT and USDC velocity surpassing that of most native tokens combined. Payment processors, fintech platforms, and neobanks are increasingly integrating blockchain rails directly, bypassing traditional correspondent banking systems. Plasma is positioned precisely at this convergence point, offering infrastructure optimized not for speculative growth, but for transactional dominance.

The long-term implication is profound. As stablecoin settlement becomes a default financial primitive, monetary power migrates from nation-state-controlled payment systems toward programmable, neutral infrastructure. Plasma does not merely facilitate transactions; it reshapes how value sovereignty is exercised. The network becomes a monetary substrate where individuals, businesses, and institutions interact without permission, jurisdictional friction, or settlement uncertainty. This erodes traditional financial gatekeeping while exposing new systemic risks related to governance capture, infrastructure centralization, and geopolitical pressure.

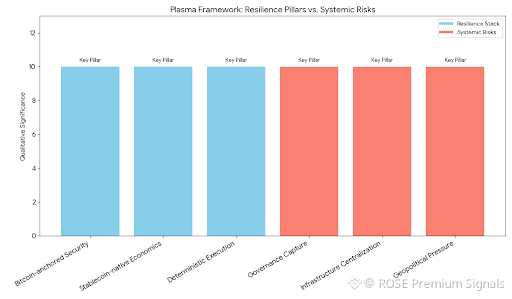

Yet Plasma’s design acknowledges these risks rather than ignoring them. Bitcoin-anchored security, stablecoin-native economics, and deterministic execution together form a resilience stack aimed at surviving regulatory turbulence, capital flight cycles, and macroeconomic stress. In a world where financial systems are increasingly weaponized, neutrality becomes a competitive advantage. Plasma is not neutral by ideology; it is neutral by engineering.

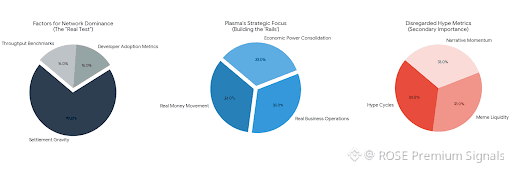

The real test will not be throughput benchmarks or developer adoption metrics. It will be settlement gravity. Whichever network processes the highest volume of stablecoin value over time will quietly become the financial backbone of the digital economy. Plasma’s architecture suggests it understands this better than most. It is not chasing hype cycles, meme liquidity, or narrative momentum. It is building the rails beneath the surface, where real money moves, real businesses operate, and real economic power consolidates.

If current adoption curves hold, the next decade of crypto will not be remembered for speculative bubbles, but for the silent migration of global settlement infrastructure. Plasma is positioning itself not as a participant in that shift, but as one of its primary architects.