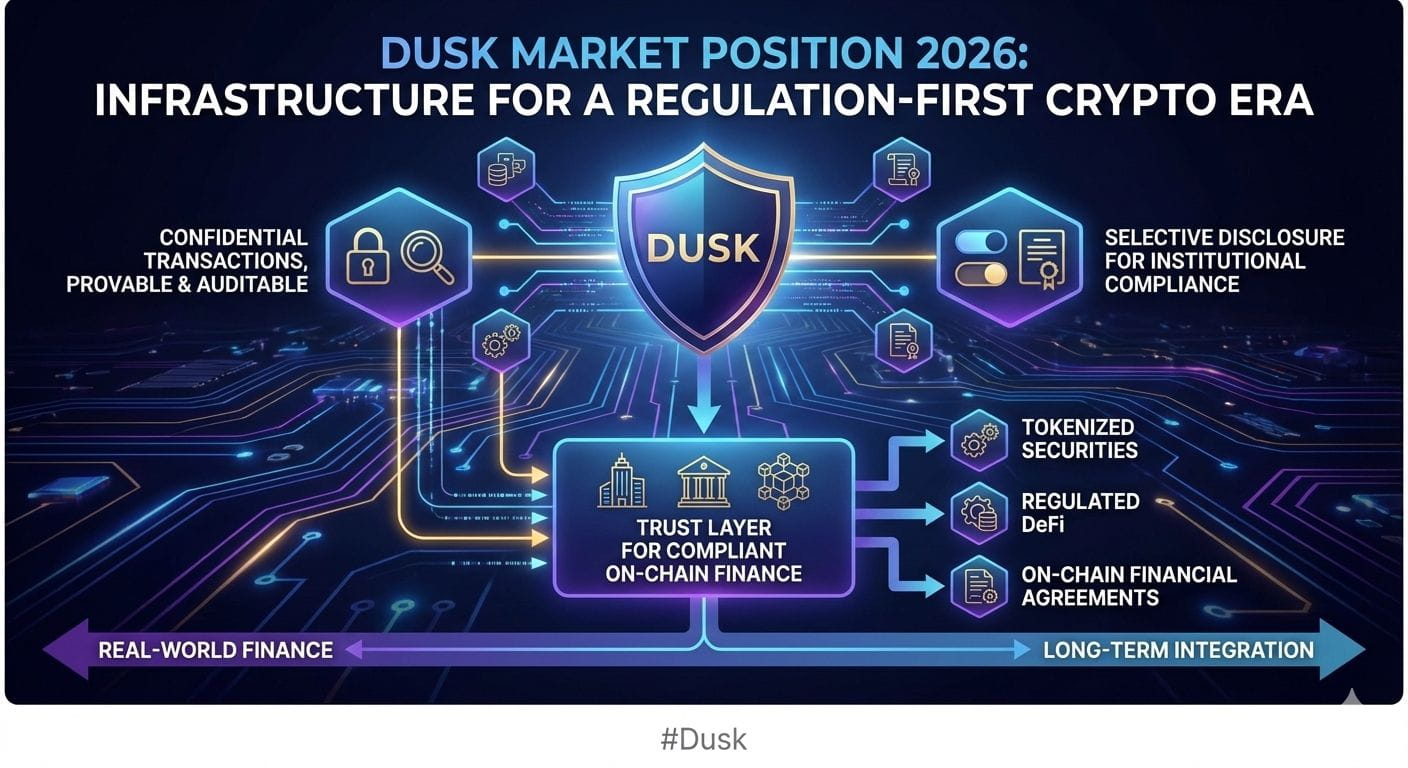

By 2026, the crypto market is no longer driven only by narratives and rapid experimentation. Clearer regulations, institutional participation, and real capital deployment have reshaped what matters. In this new landscape, Dusk holds a market position that feels increasingly intentional rather than accidental. From the start, @Dusk focused on building blockchain infrastructure that could survive regulatory scrutiny while preserving financial privacy, and this approach is defining the relevance of $DUSK in 2026.

Dusk operates where many blockchains struggle: enabling confidential transactions that remain provable and auditable when required. For institutions and enterprises, transparency without control is a liability, not a feature. Dusk’s selective disclosure model allows sensitive data to stay private while still meeting compliance obligations. This makes it well suited for tokenized securities, regulated DeFi, and on-chain financial agreements that must align with real-world laws.

In terms of market position, Dusk is no longer just a niche privacy chain. It is emerging as a trust layer for compliant on-chain finance, supporting use cases that demand both discretion and accountability. As the industry matures, networks designed for regulation-first adoption gain an edge. Dusk’s steady, infrastructure-driven strategy places it firmly among the blockchains built not for hype cycles, but for long-term financial integration.