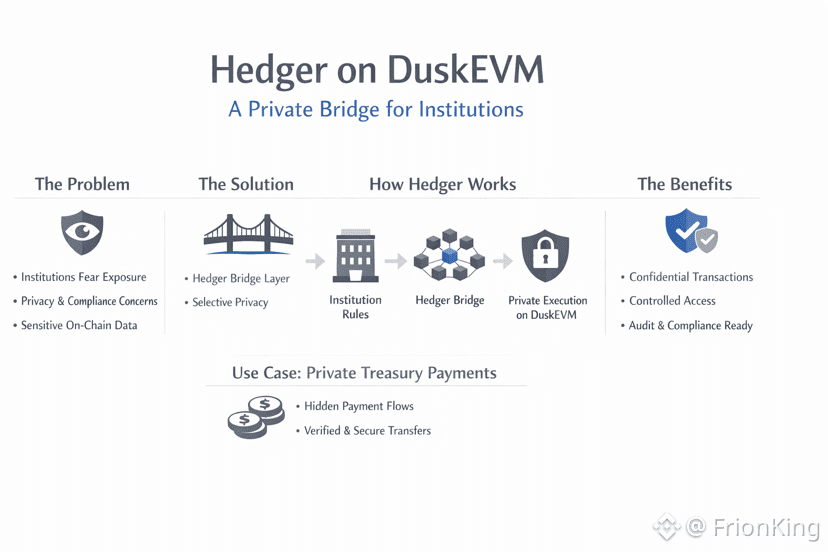

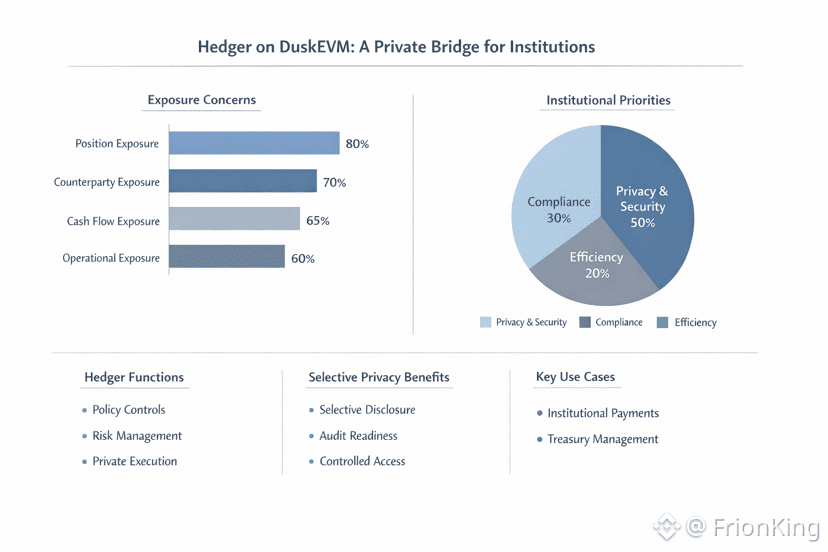

Ihave been in this market long enough to learn one thing, institutions are not afraid of technology, they are afraid of exposure, exposure of positions, counterparties, cash flows, and even operating patterns, and in crypto the first thing that gets exposed is on chain data. Dusk goes straight for that bottleneck, DuskEVM is not trying to be loud, it is trying to do something hard, put smart contracts into an environment with privacy strong enough for institutions to actually use, and Hedger is the bridge layer that makes that deployable in a serious way.

i do not see Hedger as a bridge that just moves tokens around for fun, I see it as a bridge for process, where an institution brings internal rules, limits, permissions, and compliance requirements, and only then steps into the execution space of DuskEVM. Have you ever watched a fund want to enter DeFi but stop because they could not accept everyone seeing their wallet. Have you ever seen an OTC desk avoid public flows because the moment it leaks, it gets hunted. If you have lived through that, you understand why a “private bridge” is what institutions actually look for.

What I respect about Dusk is the idea of “selective privacy”. This market loves a false binary, either everything is fully transparent, or everything is fully hidden, but in reality institutions need a third option, hidden from the crowd, but provable to the right parties. They need to prove they belong to an allowed set, they need to prove transactions meet conditions, they need to present evidence during audits, but they do not want to publish business sensitive data to the entire network. Would you want a system where you can stay compliant without exposing yourself.

When Hedger sits between an institution and DuskEVM, it feels like a translator between two languages, enterprise operations and on chain execution. Institutions do not run on vibes, they run on process, approvals, risk thresholds, whitelists, departmental limits, and emergency controls. Hedger helps those requirements enter the flow, so that once it moves into DuskEVM, execution can keep sensitive data private while correctness is still enforced. Do you see the difference between a product that “has privacy” and a product that is “ready for institutions”.

I often use payments and treasury as an example because it is the closest thing to real life. A company wants to pay suppliers in stablecoins, they do not want competitors to see payment schedules, they do not want profit structure inferred from cash flow timing, they do not want their counterparty network exposed, but they still need the supplier to trust the transfer is valid, and they need internal audit to verify when required. DuskEVM creates the ground for private execution, Hedger helps connect the enterprise process into that ground, so “private” does not become “blind”, and “compliance” does not become “public disclosure”. Which option do you think an institution chooses, a place that is private and still provable, or a place where everything is public and they carry the full risk of data leakage.

In this market I learned a hard lesson, infrastructure is only real when it can survive operational discipline. Hedger on DuskEVM, if done right, will not be just a marketing narrative, it is a path for institutions to enter on chain finance in a way they can accept. Not because they like privacy, but because they need privacy to stay alive, and they need the ability to prove things to exist in a regulated world. Do you want to stand on which side of the next cycle, the loud side, or the side that builds bridges big money can actually cross.

If you have lived through a few cycles, you will understand why I look at Dusk this way, the question is not “does it have privacy”, the question is “who can use it, and can they use it at institutional scale”, and Hedger is aiming directly at that question.