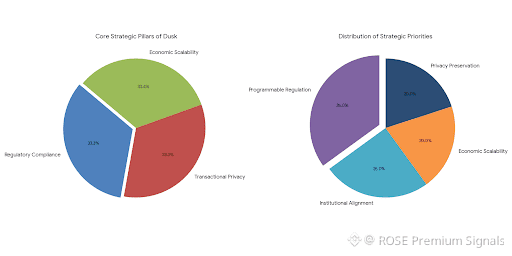

Dusk enters the blockchain arena not as another ideological experiment in decentralization, but as a direct response to the structural contradictions that have kept institutional finance and crypto permanently misaligned. Since its founding in 2018, Dusk has quietly built toward a future where regulatory compliance, transactional privacy, and economic scalability do not undermine one another. In doing so, it challenges one of the industry’s deepest assumptions: that privacy and compliance must exist in permanent opposition. Instead, Dusk treats regulation not as an external constraint, but as a programmable variable, embedded into protocol logic itself. This philosophical shift fundamentally alters how financial infrastructure is architected, governed, and monetized.

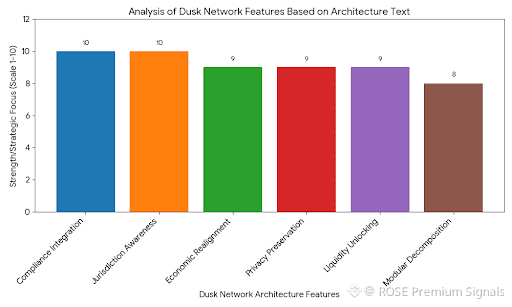

Most blockchain networks attempt to retrofit compliance after launching permissionless systems. The result is often clumsy, layered surveillance tooling that fractures user experience and introduces centralized chokepoints. Dusk inverts this approach. By designing compliance mechanisms directly into the base layer, it eliminates the adversarial dynamic between regulators and network participants. This is not merely a technical improvement; it realigns economic incentives. Institutions can finally deploy capital without regulatory friction, while users retain cryptographic privacy. The protocol becomes not just a ledger, but a regulatory co-processor, capable of selectively revealing transactional data without breaking confidentiality. This subtle architectural choice positions Dusk as a foundational layer for capital markets rather than a niche privacy chain.

The modularity of Dusk’s architecture reveals a sophisticated understanding of financial system design. Traditional Layer-1 chains collapse execution, settlement, data availability, and compliance into monolithic pipelines, forcing tradeoffs at every layer. Dusk decomposes these functions, allowing each to evolve independently. This modularity does more than improve scalability; it enables jurisdiction-aware logic. Financial rules vary dramatically across borders, yet most blockchains enforce a single global policy layer. Dusk’s architecture allows financial primitives to adapt dynamically to regulatory contexts, which is critical for real-world asset tokenization. In markets where securities laws differ widely, this adaptability becomes a decisive competitive advantage, unlocking liquidity pools that other chains structurally cannot access.

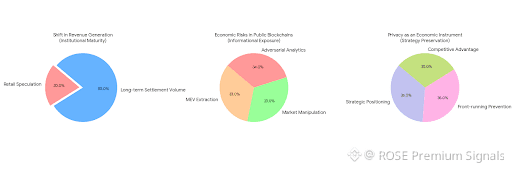

The economic implications of this architecture are profound. Capital in regulated markets behaves differently from speculative crypto liquidity. It is slow-moving, compliance-bound, and risk-averse, but once deployed, it remains sticky. On-chain metrics increasingly show institutional wallets clustering around infrastructure capable of regulatory integration. Early Dusk deployments indicate similar capital behavior: longer holding periods, lower velocity, and deeper liquidity pools. These patterns mirror early institutional adoption of settlement rails like SWIFT and TARGET2 rather than retail-driven DeFi platforms. Over time, this could reshape fee dynamics, shifting revenue generation from retail speculation toward long-term settlement volume.

Privacy within Dusk is not a superficial feature; it is economically instrumental. In conventional finance, transactional opacity protects strategic positioning, prevents front-running, and preserves competitive advantage. Public blockchains, by contrast, expose every trade, enabling MEV extraction, market manipulation, and adversarial analytics. Dusk’s cryptographic privacy restores informational asymmetry, which paradoxically increases market efficiency. When traders can operate without revealing strategy, liquidity becomes more organic and price discovery improves. On-chain analytics from privacy-preserving networks often show tighter spreads and lower slippage, contradicting the assumption that transparency inherently enhances efficiency.

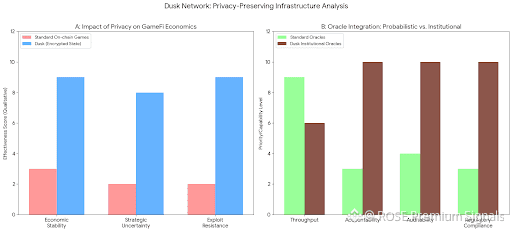

One overlooked dynamic is how privacy reshapes GameFi and on-chain economic behavior. Game economies collapse when players can fully audit resource distribution and predict reward flows. Dusk enables encrypted state transitions, allowing game developers to design economies where scarcity, randomness, and strategic uncertainty function properly. This introduces new economic primitives where player behavior mirrors real-world market psychology rather than exploit-driven optimization. As capital increasingly flows into on-chain gaming ecosystems, privacy-preserving infrastructure becomes essential for sustaining long-term player engagement and economic stability.

Dusk’s approach to oracle integration further underscores its institutional focus. Most oracle systems operate as probabilistic truth layers, optimizing for speed and decentralization at the expense of accountability. In regulated environments, data provenance, auditability, and liability matter more than raw throughput. Dusk treats oracle data as legally consequential input rather than mere informational feed, embedding verification logic that can stand up to regulatory scrutiny. This creates a structural moat for real-world asset markets, where inaccurate data feeds can trigger cascading legal and financial failures. Market participants increasingly price this risk, favoring infrastructures that internalize oracle accountability.

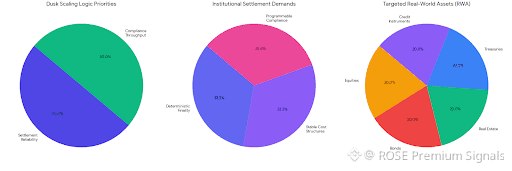

Layer-2 scaling strategies across the industry largely prioritize transaction throughput for speculative trading. Dusk’s scaling logic instead optimizes for settlement reliability and compliance throughput. This distinction is subtle but critical. High-frequency retail transactions generate volatile fee markets and unpredictable congestion, whereas institutional settlement demands deterministic finality and stable cost structures. On-chain activity metrics reveal that networks attracting institutional flows exhibit smoother fee curves and lower volatility. Dusk’s architecture directly aligns with this demand profile, suggesting long-term fee stability rather than short-lived speculative spikes.

The tokenization of real-world assets remains one of crypto’s most overpromised narratives, largely because existing infrastructure cannot reconcile legal compliance with on-chain settlement. Dusk directly addresses this gap. By enabling programmable compliance at the protocol level, assets such as equities, bonds, and real estate can exist natively on-chain without violating securities law. This eliminates costly intermediaries, reduces settlement cycles from days to seconds, and unlocks global liquidity pools. Market signals already suggest accelerating institutional interest in tokenized treasuries and credit instruments, and Dusk’s design aligns precisely with these capital flows.

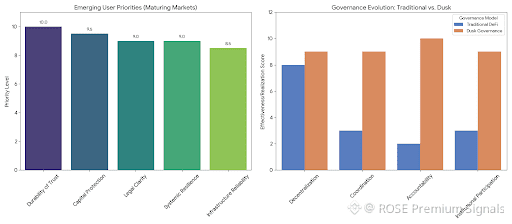

Perhaps the most underappreciated aspect of Dusk is how it redefines on-chain governance. In traditional DeFi, governance is dominated by speculative token holders whose incentives rarely align with long-term protocol health. Dusk introduces governance models that reflect regulatory accountability and institutional participation. Voting rights, upgrade mechanisms, and protocol parameters become economically meaningful rather than symbolic. This shifts governance from performative decentralization to functional coordination, where protocol evolution mirrors corporate governance structures while preserving cryptographic transparency.

On-chain data increasingly reveals that user behavior is migrating away from yield-chasing toward infrastructure reliability. Wallet clustering patterns, transaction frequency metrics, and capital retention curves all point toward a maturation of crypto markets. Users now prioritize legal clarity, capital protection, and systemic resilience. Dusk’s architecture is not designed for the speculative cycles of yesterday, but for the capital stability of tomorrow. Its slow, deliberate build reflects an understanding that financial infrastructure is not about speed of innovation, but about durability of trust.

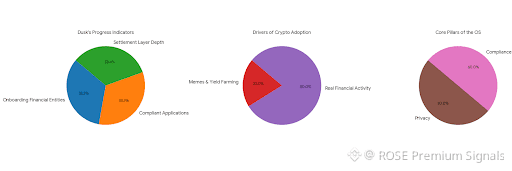

In a market saturated with narratives, Dusk stands apart by refusing to chase attention. Its progress is visible not in social engagement metrics, but in the quiet onboarding of financial entities, the steady expansion of compliant applications, and the growing depth of its settlement layer. The next phase of crypto adoption will not be driven by memes or yield farming, but by the migration of real financial activity onto programmable rails. Dusk is not building a blockchain. It is constructing the operating system for regulated digital finance, where privacy and compliance coexist not as compromises, but as mutually reinforcing forces.

This is not a speculative bet on technological novelty. It is a structural play on the inevitable convergence of traditional finance and decentralized infrastructure. And in that convergence, Dusk is positioned not as a participant, but as a foundational layer upon which the next generation of financial markets will be built.