Walrus is not simply a privacy-focused DeFi protocol built on Sui. It is a direct response to one of crypto’s most unresolved contradictions: the industry claims decentralization, yet most critical data, transaction metadata, and application logic still depend on fragile, centralized storage and opaque infrastructure layers. Walrus enters this landscape with a design philosophy that treats privacy, data persistence, and economic incentives as a single unified system rather than separate engineering problems. This is where its significance begins—not at the token level, not at the user interface, but deep in how economic behavior is reshaped when data itself becomes a decentralized asset.

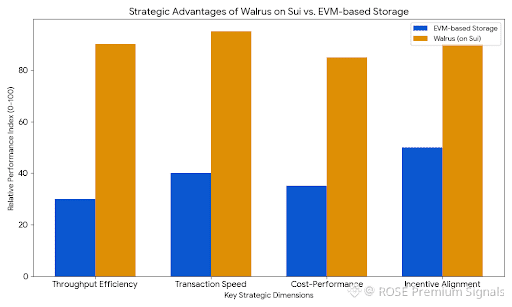

The strategic decision to build on Sui immediately positions Walrus differently from storage and privacy projects on EVM chains. Sui’s object-based architecture and parallel transaction execution allow Walrus to bypass many throughput bottlenecks that plague blob-heavy protocols on Ethereum and its rollups. This is crucial, because decentralized storage systems fail when latency and transaction finality degrade the user experience. Walrus exploits Sui’s execution model to treat data shards as live economic objects, enabling storage operations to move at speeds approaching centralized alternatives. This fundamentally shifts the cost-performance equation of decentralized storage and allows Walrus to compete not only ideologically but economically with traditional cloud providers.

What most observers overlook is how erasure coding and blob storage alter incentive alignment. By fragmenting data into redundant encoded shards distributed across independent nodes, Walrus removes single-point storage risk while simultaneously creating a new market structure. Storage providers no longer compete on capacity alone but on uptime, retrieval reliability, and reputation scoring embedded directly into staking and reward logic. This turns infrastructure operators into financially disciplined entities whose revenue depends on long-term reliability, not short-term exploitation. Over time, this pushes the network toward a professionalized, capital-intensive operator base, similar to how proof-of-stake validators evolved from hobbyists into institutional-grade actors.

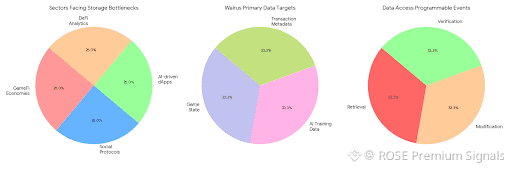

This structural shift matters because decentralized storage economics determine which applications can realistically operate without centralized fallbacks. Today, GameFi economies, social protocols, AI-driven dApps, and data-heavy DeFi analytics platforms all face storage bottlenecks that quietly reintroduce Web2 dependencies. Walrus directly targets this weakness. When game state, AI training data, and transaction metadata can live entirely on decentralized infrastructure at predictable cost and performance, entire business models become viable that previously collapsed under storage inefficiencies. This is where Walrus intersects with real capital flows, as venture funding increasingly targets protocols that eliminate hidden centralization risks rather than simply scaling transaction throughput.

Privacy within Walrus is not implemented as a cosmetic layer. It is deeply embedded into how data is encoded, stored, and retrieved. Instead of relying on surface-level encryption wrappers, Walrus treats data access as a programmable economic event. Every retrieval, modification, or verification carries both cryptographic guarantees and incentive consequences. This architecture allows developers to design financial products where selective disclosure becomes native, not bolted on. The implications for institutional DeFi are massive. Regulated entities require auditability without full data exposure, and Walrus provides a pathway where compliance and confidentiality coexist rather than collide.

This design approach quietly resolves one of DeFi’s longest-standing paradoxes: transparency versus confidentiality. On-chain finance cannot mature into real capital markets without granular privacy controls, yet it cannot abandon verifiability. Walrus threads this needle by making data visibility a permissioned economic state rather than a fixed attribute. That allows lending protocols, derivatives platforms, and on-chain treasuries to operate with institution-grade confidentiality while retaining cryptographic audit trails. As real-world assets and tokenized securities continue migrating on-chain, storage and privacy layers like Walrus become infrastructural keystones rather than auxiliary tools.

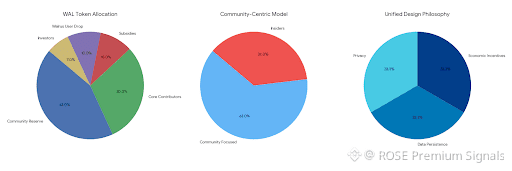

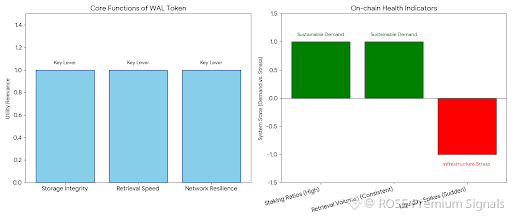

The WAL token itself functions less as a transactional currency and more as a programmable economic lever. Staking mechanisms directly control storage integrity, retrieval speed, and network resilience. Unlike speculative governance tokens that derive value primarily from narrative cycles, WAL accrues utility through real resource coordination. Its velocity and lock-up patterns will reveal more about network health than price alone. High staking ratios paired with consistent retrieval volumes indicate sustainable demand, while sudden liquidity spikes often precede infrastructure stress or exploit attempts. This makes WAL a rare example of a token whose on-chain analytics genuinely reflect system stability.

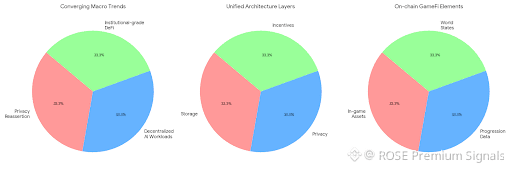

From a macro perspective, Walrus sits at the intersection of three converging trends: privacy reassertion, decentralized AI workloads, and institutional-grade DeFi infrastructure. Each trend independently strains current blockchain architectures. Combined, they create systemic pressure that only vertically integrated protocols can absorb. Walrus’s architecture directly answers this convergence by treating storage, privacy, and incentives as a unified layer. This approach mirrors how modern data centers integrate compute, storage, and networking rather than outsourcing each component. In crypto terms, this represents a shift away from modular fragmentation toward economically cohesive systems.

GameFi economies illustrate this transformation vividly. On-chain games require persistent, verifiable state data at high frequency. Traditional decentralized storage cannot handle this load without latency spikes or cost explosions. Walrus changes this calculus. By enabling efficient, censorship-resistant storage, it allows in-game assets, progression data, and world states to exist fully on-chain. This creates truly sovereign digital economies where player-owned assets maintain permanence beyond the lifespan of any single game studio. Over time, this may lead to interoperable virtual economies that behave more like nation-states than entertainment platforms.

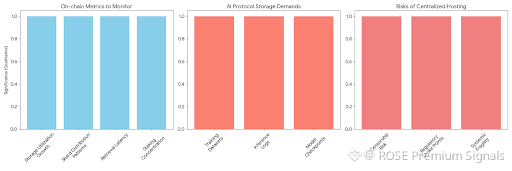

The same dynamics apply to AI-driven protocols. Training datasets, inference logs, and model checkpoints represent massive storage demands. Centralized hosting introduces censorship risk, regulatory choke points, and systemic fragility. Walrus enables AI protocols to anchor their data infrastructure on decentralized rails without sacrificing performance. This will become increasingly important as regulatory scrutiny intensifies around data provenance, model bias, and auditability. On-chain storage of training and inference data offers transparent accountability, while cryptographic privacy preserves intellectual property.

From an investment standpoint, Walrus represents an infrastructure bet rather than an application narrative. These bets tend to mature slowly but compound violently once adoption inflects. Historical parallels include early Ethereum layer-2 projects and foundational oracle networks, which remained undervalued until application ecosystems forced their relevance. On-chain metrics to monitor include storage utilization growth, shard distribution patterns, retrieval latency, and staking concentration. A steady rise in enterprise-sized storage allocations would signal early institutional penetration, likely preceding major valuation repricing.

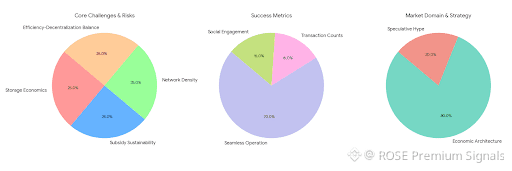

Risk remains, as with any deep infrastructure protocol. Storage economics are notoriously difficult to balance, and aggressive underpricing can lead to unsustainable subsidy cycles. Additionally, erasure-coded systems depend heavily on network participation density. Sparse operator distributions introduce retrieval fragility. Walrus must maintain a delicate equilibrium between capital efficiency and decentralization, a challenge that historically separates enduring protocols from those that collapse under scaling stress.

Looking forward, Walrus is positioned to become a silent backbone of decentralized finance rather than its public face. The protocols that matter most are often invisible to users but indispensable to system integrity. If Walrus succeeds, its impact will not be measured in transaction counts or social engagement, but in how seamlessly applications operate without centralized dependencies. This is the kind of infrastructural dominance that defines crypto’s true economic maturation.

In a market obsessed with narratives, Walrus operates in the less glamorous but far more consequential domain of economic architecture. Its design choices reflect a sober understanding that decentralization only matters when it functions under real-world constraints. As capital rotates away from speculative cycles toward durable infrastructure, protocols like Walrus are likely to define the next generational shift—not through hype, but through structural necessity.