PlasmaXPL did not emerge from speculation or trend-chasing. It was born from a quiet realization spreading across the blockchain world. Stablecoins were no longer experimental tools. They had become the most widely used digital financial instruments on earth. Billions of dollars were moving daily across borders, exchanges, payroll systems, and merchant networks, yet the infrastructure beneath them remained fragile, expensive, and inefficient.

This article follows PlasmaXPL from its earliest idea to the future it is attempting to shape. It explores why the project exists, how it was designed, what problems it solves, and where it may lead years from now. Along the way, I’ll share how the story feels less like a startup narrative and more like the gradual construction of financial plumbing for a digital-first world. The Moment That Sparked the Idea.

The origins of PlasmaXPL trace back to a pattern that developers and institutions could no longer ignore. Stablecoins had quietly surpassed nearly every other crypto use case. While NFTs rose and fell and DeFi oscillated with market cycles, stablecoins kept growing.

People were not using them to speculate. They were using them because they worked. Freelancers were getting paid in USDT. Families were sending remittances across continents. Traders were moving capital between platforms. Businesses were holding stablecoins as treasury assets. Entire economies were beginning to rely on digital dollars. Yet almost all of this activity occurred on blockchains that were never designed for payments.

Gas fees spiked during congestion. Transactions failed at the worst moments. Users were forced to hold volatile native tokens just to move money. Payment flows competed with NFTs, arbitrage bots, and experimental smart contracts. The more stablecoins succeeded, the more their infrastructure struggled. That contradiction became the foundation of PlasmaXPL. The core question was simple. What would a blockchain look like if it were built specifically for money? Designing a Chain Around One Purpose Rather than attempting to become a general-purpose ecosystem competing across dozens of narratives, PlasmaXPL chose an intentionally narrow focus. Stablecoins would not be a feature. They would be the center.

The team envisioned a Layer 1 blockchain where stablecoins were treated as first-class citizens. Transfers would be instant. Fees would be negligible or entirely abstracted. User experience would resemble modern fintech more than traditional crypto.This design choice immediately influenced everything that followed.NInstead of optimizing for complex computation, the chain would optimize for throughput and reliability. Instead of maximizing token speculation, it would maximize payment efficiency. Instead of pushing users to learn blockchain mechanics, it would hide them.

I’m struck by how rare this level of restraint is in Web3. PlasmaXPL was not trying to reinvent everything. It was trying to do one thing exceptionally well. Why PlasmaXPL Chose Layer Many payment-focused projects attempt to operate as Layer 2 networks. PlasmaXPL deliberately did not.

The reasoning was straightforward. Payments require predictability. A Layer 2 still depends on another chain for final settlement, fee volatility, and congestion risk. For high-volume money movement, that dependency introduces uncertainty.

By launching as a full Layer 1 blockchain, PlasmaXPL gained direct control over consensus, fee mechanics, and block production. This allowed the network to guarantee performance characteristics rather than inherit them.

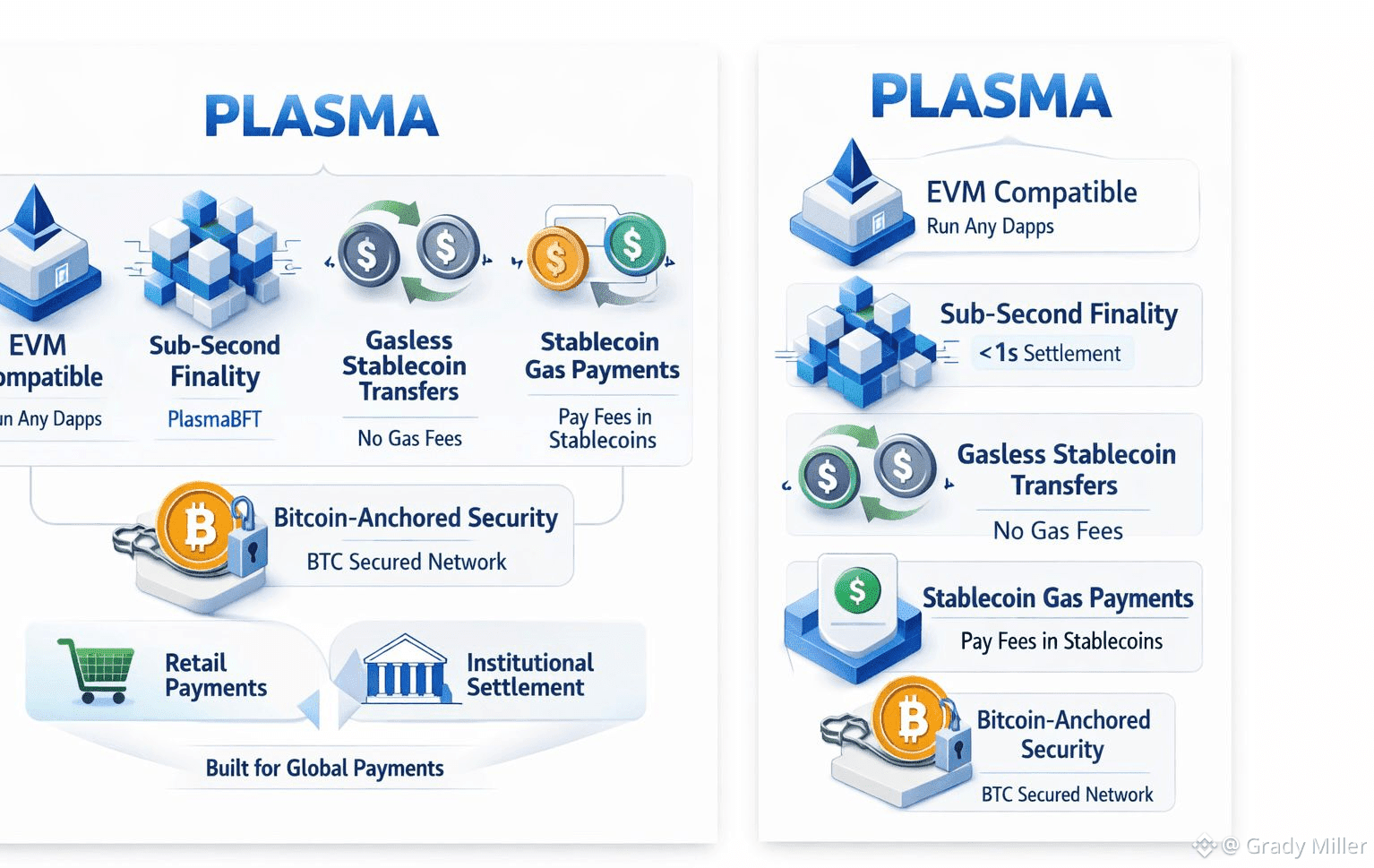

EVM compatibility ensured developers could migrate easily. Solidity contracts worked out of the box. Existing tooling required no reinvention. But beneath that familiarity, the network was optimized very differently. PlasmaBFT and Deterministic Finality At the heart of PlasmaXPL lies its consensus engine, PlasmaBFT.

Built as a modern Byzantine Fault Tolerant system inspired by Fast HotStuff, PlasmaBFT delivers deterministic finality in under a second. Once a transaction is confirmed, it is final. There is no waiting. No probabilistic assurance. No rollback risk. For payments, this matters enormously. When money moves, certainty matters more than throughput headlines. Merchants, payroll systems, and remittance providers cannot operate on “probably final.” They require guarantees.

PlasmaBFT achieves this through parallel consensus phases that allow blocks to be proposed, voted, and committed simultaneously. The system remains secure even if up to one-third of validators behave incorrectly.

Instead of harsh slashing, PlasmaXPL emphasizes reward denial for misbehavior. This lowers operational risk while maintaining honest incentives, making validator participation accessible to professional infrastructure providers.

What emerges is a network optimized not for experimentation, but for reliability. Execution Powered by Reth The execution layer of PlasmaXPL is built using Reth, a high-performance Ethereum client written in Rust. This choice was deliberate. Reth provides full EVM equivalence, meaning every Ethereum opcode behaves identically. Developers can deploy existing smart contracts without modification. Wallets integrate smoothly. Indexers and RPC providers function as expected.

At the same time, Rust brings performance advantages that allow PlasmaXPL to scale horizontally. Transaction processing remains efficient even under sustained load.

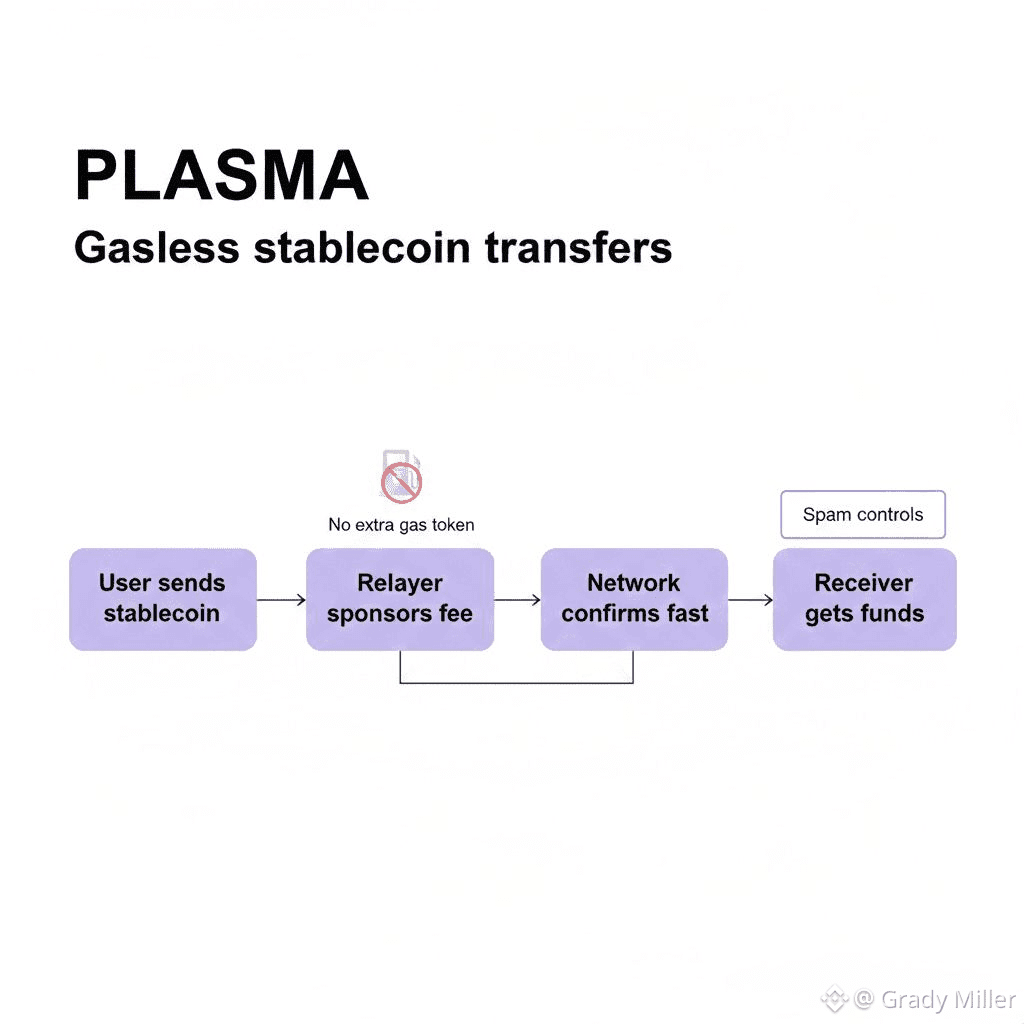

We’re seeing an architecture that respects Ethereum’s developer ecosystem while freeing itself from Ethereum’s congestion constraints. Gas Abstraction and Zero-Fee Stablecoin Transfers Perhaps the most transformative feature of PlasmaXPL is its native gas abstraction system.

Users are not required to hold XPL to move stablecoins. Transactions can be paid directly in USDT or other supported ERC-20 tokens. In many cases, transfers are effectively zero-fee at the protocol level.

This is achieved through a built-in paymaster system controlled by audited smart contracts. Rather than relying on third-party relayers, the network itself sponsors transactions under defined rules. From a user’s perspective, this changes everything.

Sending stablecoins feels like sending money, not executing blockchain operations. There is no confusion about gas. No need to manage extra balances. No onboarding friction. If crypto is ever to reach billions of users, this kind of abstraction is essential. Anchoring Security to Bitcoin One of the most distinctive elements of PlasmaXPL is its Bitcoin anchoring model. Rather than positioning itself as a competitor to Bitcoin, PlasmaXPL treats Bitcoin as the ultimate settlement layer. Periodically, the state of the Plasma chain is committed to the Bitcoin blockchain.

This approach allows PlasmaXPL to inherit Bitcoin’s proof-of-work security while operating independently for performance.

It is a hybrid model that combines the finality and immutability of Bitcoin with the programmability of the EVM.

This design choice reflects an important philosophical stance. Bitcoin remains the most trusted ledger on earth. Rather than ignore that reality, PlasmaXPL builds on top of it The pBTC Bridge and Programmable Bitcoin PlasmaXPL extends this relationship with Bitcoin through a trust-minimized bridge that brings BTC into the EVM environment as pBTC.

Unlike traditional wrapped Bitcoin models that rely on centralized custodians, PlasmaXPL’s bridge uses distributed verifiers and threshold signing. No single entity controls funds.

BTC holders can use pBTC within smart contracts, lending protocols, and payment systems without relinquishing trust to a centralized intermediary. This unlocks powerful possibilities. Bitcoin becomes productive capital. Stablecoins become settlement assets. Together, they form the backbone of decentralized finance without sacrificing security.

I find this integration particularly compelling because it respects Bitcoin’s role rather than attempting to replace it. The Role of XPL in the Ecosystem XPL serves as the native asset securing PlasmaXPL. Validators stake XPL to participate in consensus. Delegators can stake through validators to earn rewards. Governance decisions will gradually move on-chain as the network matures.

The token supply is capped at ten billion, with controlled inflation designed to taper over time. Base transaction fees are burned, helping offset emissions as usage increases.

Importantly, XPL is not required for everyday users moving stablecoins. Its role is infrastructural rather than consumer-facing.

This separation allows XPL to function as a security and governance asset while stablecoins handle economic activity.

If the network succeeds, demand for XPL grows through staking and participation rather than forced usage. Token Distribution and Long-Term Alignment PlasmaXPL’s token distribution emphasizes long-term alignment.

A large portion of supply is reserved for ecosystem growth, including liquidity incentives, developer grants, and integrations. Team and investor allocations follow multi-year vesting schedules with cliffs that prevent early sell pressure.

Public sale participants are subject to regional restrictions, with longer lockups designed to encourage network maturity before speculative volatility.

This structure reflects a deliberate attempt to avoid short-term extraction in favor of long-term infrastructure building.

We’re seeing an approach that prioritizes patience over immediacy. Ecosystem Development and Early Adoption Since mainnet beta, PlasmaXPL has focused on onboarding builders rather than chasing attention.

Payment gateways, remittance tools, DeFi protocols, and merchant services are emerging as early use cases. Developers benefit from familiar tooling, fast confirmation times, and predictable fees.

Infrastructure partners provide RPC access, indexing, and analytics. Oracles feed data. Bridges enable cross-chain movement. The ecosystem is growing quietly, but with intention. What stands out to me is that many early builders are not crypto-native speculators. They are payment-focused teams solving real-world problems.

That signals a different kind of adoption. Market Reality and Competitive Landscape PlasmaXPL operates in a competitive environment.

Networks like Tron, Solana, and various Layer 2s already host large stablecoin volumes. Each has strengths. Each has limitations.

PlasmaXPL’s differentiation lies in specialization. It is not trying to win NFTs, gaming, or social networks. It is focused on stablecoin movement, reliability, and settlement efficiency. That focus gives it clarity. Still, challenges remain. Sustaining zero-fee models requires scale. Regulatory frameworks around stablecoins continue to evolve. Bridges must remain secure. Governance must decentralize responsibly.

The team appears aware of these realities, designing cautiously rather than promising miracles. Looking Toward the Future As stablecoins continue to grow, their infrastructure will matter more than their branding.

If trillions of dollars eventually move on-chain, the rails carrying them must be fast, cheap, secure, and invisible.

PlasmaXPL is positioning itself as one of those rails.

Future upgrades include expanded delegation, confidential payment modules, enhanced Bitcoin verification mechanisms, and deeper institutional integrations.

Over time, the goal is not to be noticed, but to be relied upon.

I’m seeing a vision where PlasmaXPL becomes background infrastructure, much like TCP/IP for the internet. Users may never think about it, yet depend on it daily. A Quiet Ending With a Large Question PlasmaXPL does not shout.

It does not promise to replace banks overnight or overthrow global finance. Instead, it builds patiently, transaction by transaction, block by block.

Its ambition is subtle but profound. To make digital money move as freely as information.

If it succeeds, people may never talk about PlasmaXPL at all. They will simply send stablecoins instantly, across borders, without friction, without fear, without thought.

And perhaps that is the truest sign of success.

As the world edges closer to a digital monetary era, the question is no longer whether stablecoins will matter. That question has already been answered.

The real question is which infrastructure will carry them.

And in that quiet race, PlasmaXPL is steadily laying its tracks, inviting us to imagine a future where money finally moves at the speed of life itself.