If you’ve spent time in crypto, you already know that stablecoins are doing the real work. People use them to move value, avoid volatility, pay others, and shift liquidity fast. Plasma is built around this reality. Instead of treating stablecoins as “just another token,” Plasma is designed as a Layer 1 blockchain where stablecoin payments are the main focus. The idea is simple: make sending stablecoins feel as easy and fast as sending a message, without confusing steps or surprise fees. That is why Plasma positions itself as stablecoin-first infrastructure for global payments, not just another general-purpose chain.

If you’ve spent time in crypto, you already know that stablecoins are doing the real work. People use them to move value, avoid volatility, pay others, and shift liquidity fast. Plasma is built around this reality. Instead of treating stablecoins as “just another token,” Plasma is designed as a Layer 1 blockchain where stablecoin payments are the main focus. The idea is simple: make sending stablecoins feel as easy and fast as sending a message, without confusing steps or surprise fees. That is why Plasma positions itself as stablecoin-first infrastructure for global payments, not just another general-purpose chain.

Plasma matters because today’s stablecoin experience still has friction. On many networks, users must first buy a gas token, wait for confirmations, and deal with changing fees. This blocks real adoption outside crypto-native users. Plasma aims to remove this pain by enabling near-instant transfers and supporting gas-free stablecoin sends for basic payments. This makes it easier for normal users, businesses, and apps to onboard without needing deep crypto knowledge. When payments are smooth and predictable, real-world usage can grow.

From a technical point of view, Plasma stays EVM compatible. This means developers can use familiar Ethereum tools, wallets, and smart contracts. Builders do not need to learn a new programming model. Under the hood, the network is optimized for high throughput and fast finality, especially for stablecoin movement. Simple transfers can be sponsored by the protocol, while more advanced smart contract actions still use normal gas mechanics to keep the network secure and sustainable.

A unique part of Plasma’s vision is its focus on Bitcoin liquidity. Plasma plans a native, trust-minimized Bitcoin bridge that allows BTC to move into its EVM environment without relying on centralized custodians. If done safely, this opens access to the largest pool of crypto capital and allows Bitcoin to be used in payments, DeFi, and settlement use cases on Plasma. This could become a strong differentiator if security and reliability are proven over time.

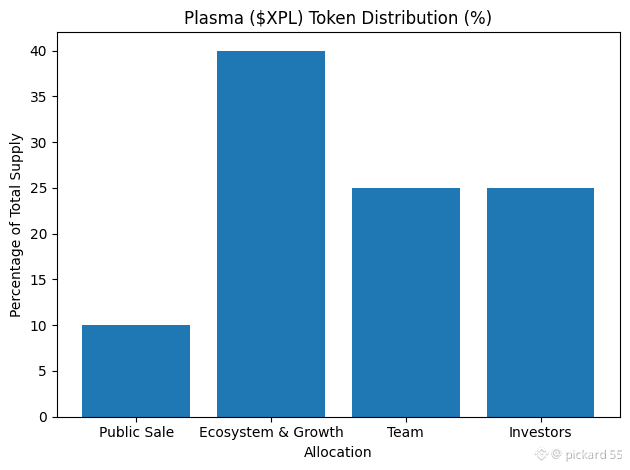

The $XPL token is the core of Plasma’s security and incentive system. It is used for staking, validator rewards, and gas for advanced transactions. The initial supply at mainnet beta is 10 billion XPL. The distribution is designed to focus heavily on long-term ecosystem growth. Ten percent is allocated to the public sale, forty percent to ecosystem and growth, and the remaining fifty percent is split between team and investors with long-term vesting schedules. Plasma also plans to use an EIP-1559-style fee burn model, which helps balance emissions as network usage grows.

The ecosystem vision goes beyond just DeFi. Plasma talks about stablecoin payments, on- and off-ramps, fintech-style apps, merchant tools, and settlement infrastructure. The goal is to make it easier for real payment and finance products to launch on-chain without rebuilding everything from scratch. This positions Plasma as a bridge between crypto and real-world financial use cases.

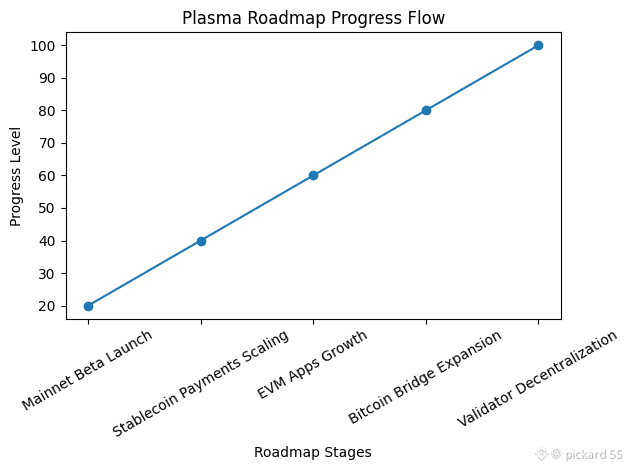

Looking ahead, Plasma’s progress will depend on execution. Key things to watch are real transaction volume, how smooth fee-free transfers feel during high activity, growth of apps and liquidity, security of the Bitcoin bridge, and decentralization of validators. The challenges are real too. Competition among fast chains is intense, stablecoin regulation keeps evolving, and fee-free systems must still maintain strong economic incentives for validators.

Overall, Plasma is making a clear bet: stablecoins are not a side feature, they are the core of crypto’s future payments layer. If Plasma can deliver a smooth user experience, strong security, and real adoption, it can carve out a meaningful role in the next phase of blockchain infrastructure.