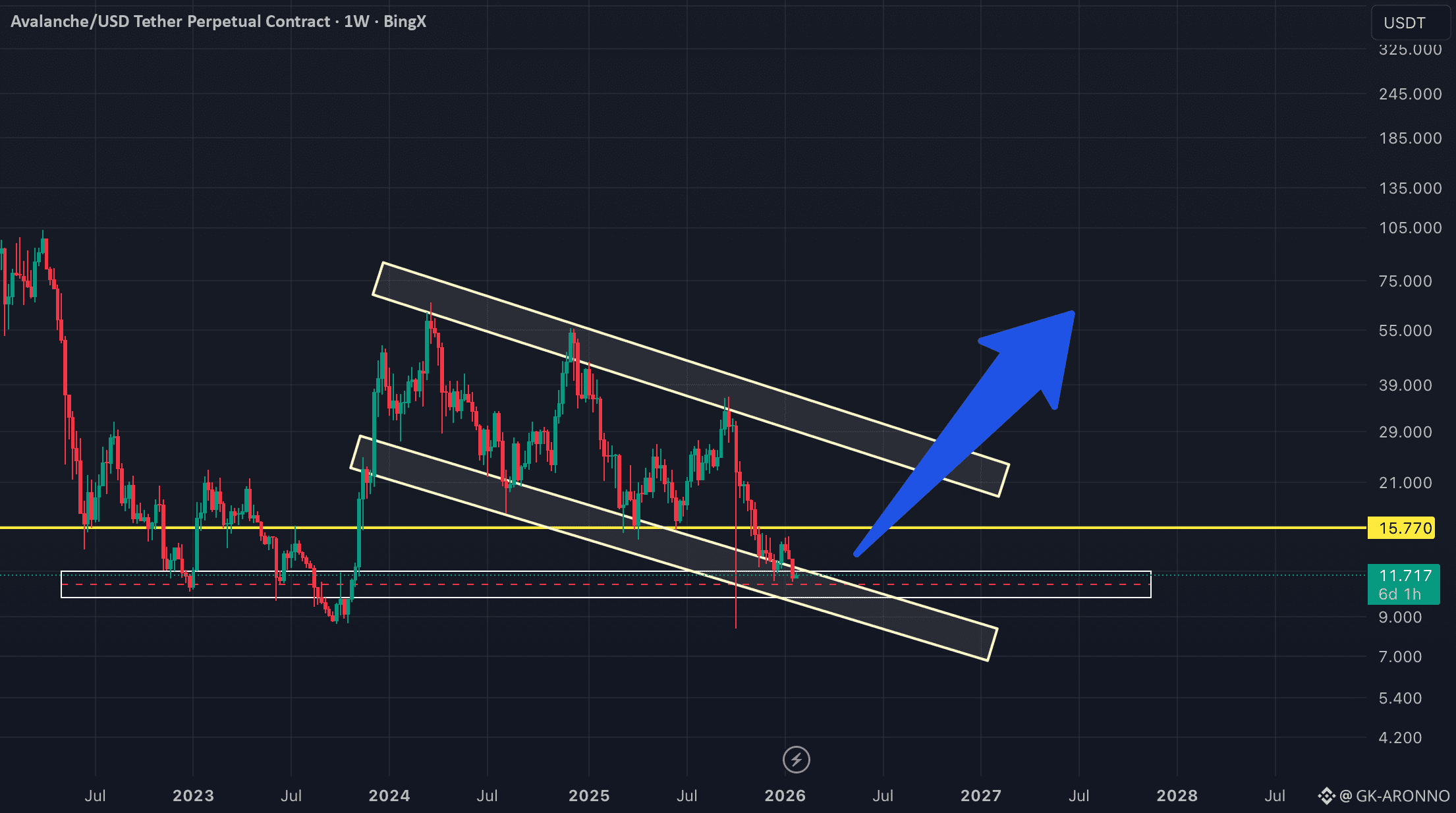

Context (1W):

AVAX has been respecting a descending channel (lower highs and lower lows). Price is currently showing a clear reaction at a support/demand zone (roughly 11–12), an area that has acted as interest before and is now holding again.

Core idea:

As long as price holds above the marked zone, the setup favors a bounce within the channel and, if momentum shows up, a potential breakout from the bearish structure.

Key levels:

• Support/Demand zone: 10–12 (area I expect buyers to defend).

• Mid resistance: ~15.77 (marked level; first area where supply can appear).

• Channel top: the upper band of the bearish channel (decision zone for bullish continuation).

Scenarios:

1. Conservative bounce: from demand toward 15.77 as a first target / partial take-profit.

2. More bullish case: if price reclaims 15.77 and breaks out strongly from the channel, look for continuation toward higher resistances (previous supply zones on the chart).

Invalidation / risk:

If price cleanly loses the 11–12 zone on a close (ideally a weekly close), the bounce thesis weakens and the probability of further downside increases.

Note: This is a technical idea (not financial advice). Useful confirmations: strong weekly close, volume on the breakout, and holding reclaimed levels as support on a retest.

✅ Trade here on $AVAX