More than half of the largest banks in the United States are now actively preparing to offer Bitcoin-related services, signaling a major shift in institutional attitudes toward digital assets.

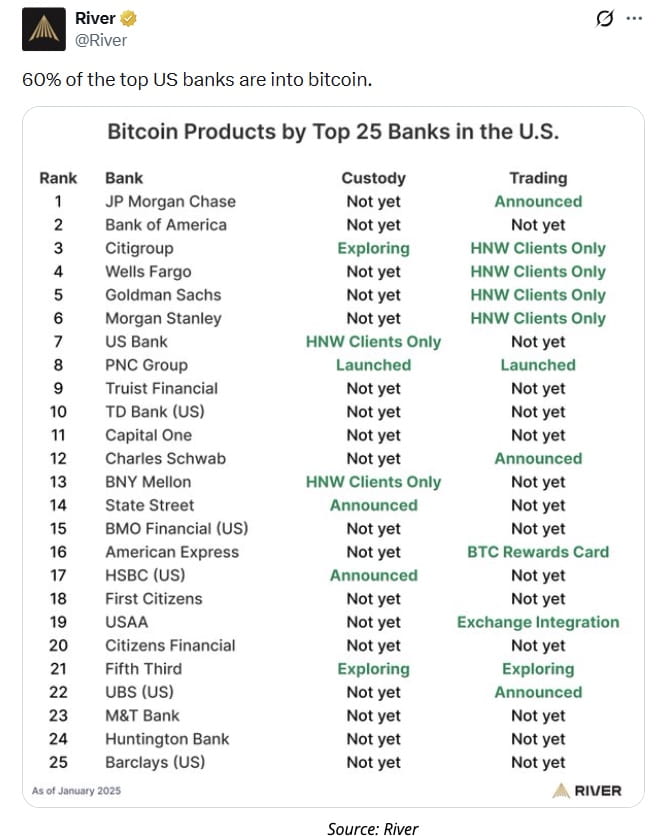

According to data shared by Bitcoin financial services firm River, 60% of the top 25 U.S. banks have either already launched or publicly announced plans to support Bitcoin products, including trading, custody, and crypto-backed lending.

The update underscores how rapidly traditional finance is moving toward Bitcoin integration following years of regulatory uncertainty and industry pushback.

Bank executives turn increasingly pro-Bitcoin

The trend was echoed by Coinbase CEO Brian Armstrong, who said discussions with bank executives at the World Economic Forum in Davos (Jan. 19–23) revealed a sharp change in sentiment.

Armstrong said that most of the banking CEOs he met were no longer hostile toward crypto.

“Most of them are actually very pro crypto and are leaning into it as an opportunity,” Armstrong said. “One CEO of a top 10 global bank told me crypto is their number one priority — they view it as existential.”

The comments mark a notable reversal from previous years, when U.S. banks were widely accused by the crypto industry of limiting access to financial services under what became known as Operation Chokepoint 2.0 — an alleged effort to debank crypto firms.

Three of the Big Four U.S. banks move toward crypto

Among the Big Four U.S. banks, three have now taken concrete steps toward Bitcoin exposure:

JPMorgan Chase has indicated it is considering crypto trading services

Wells Fargo already offers Bitcoin-backed lending products to institutional clients

Citigroup is exploring crypto custody solutions for institutional investors

Together, these three banks manage more than $7.3 trillion in assets, according to Forbes.

The latest addition to River’s list is UBS, which operates extensively in the U.S. market. Bloomberg reported last week that UBS is evaluating Bitcoin and Ether trading access for high-net-worth clients, further strengthening institutional momentum.

Banks remain cautious on stablecoins

Despite the growing openness toward Bitcoin, banks continue to express concerns about certain areas of digital finance.

In particular, large financial institutions have been among the strongest critics of yield-bearing stablecoins, arguing that they could pose systemic risks by competing with bank deposits and money market funds.

This suggests that while banks are increasingly comfortable with Bitcoin as an asset class, full crypto integration remains selective rather than universal.

Major institutions still on the sidelines

Not all major U.S. banks have committed to Bitcoin services.

Bank of America, the second-largest U.S. bank with over $2.67 trillion in assets, has yet to announce formal plans related to Bitcoin, according to River.

Other large institutions still on the sidelines include:

Capital One, with approximately $694 billion in assets

Truist Financial, holding roughly $536 billion

While these banks have not publicly disclosed crypto strategies, industry analysts note that competitive pressure may eventually push them to follow peers already moving into the space.

Bitcoin increasingly viewed as institutional infrastructure

River’s data reinforces a broader industry narrative: Bitcoin is transitioning from a speculative asset into core financial infrastructure.

With spot Bitcoin ETFs now firmly embedded in U.S. markets and custody standards improving, banks are increasingly positioning themselves to avoid being left behind as institutional adoption accelerates.

As Armstrong noted from Davos, for many banking leaders, crypto is no longer optional — it is becoming strategic.