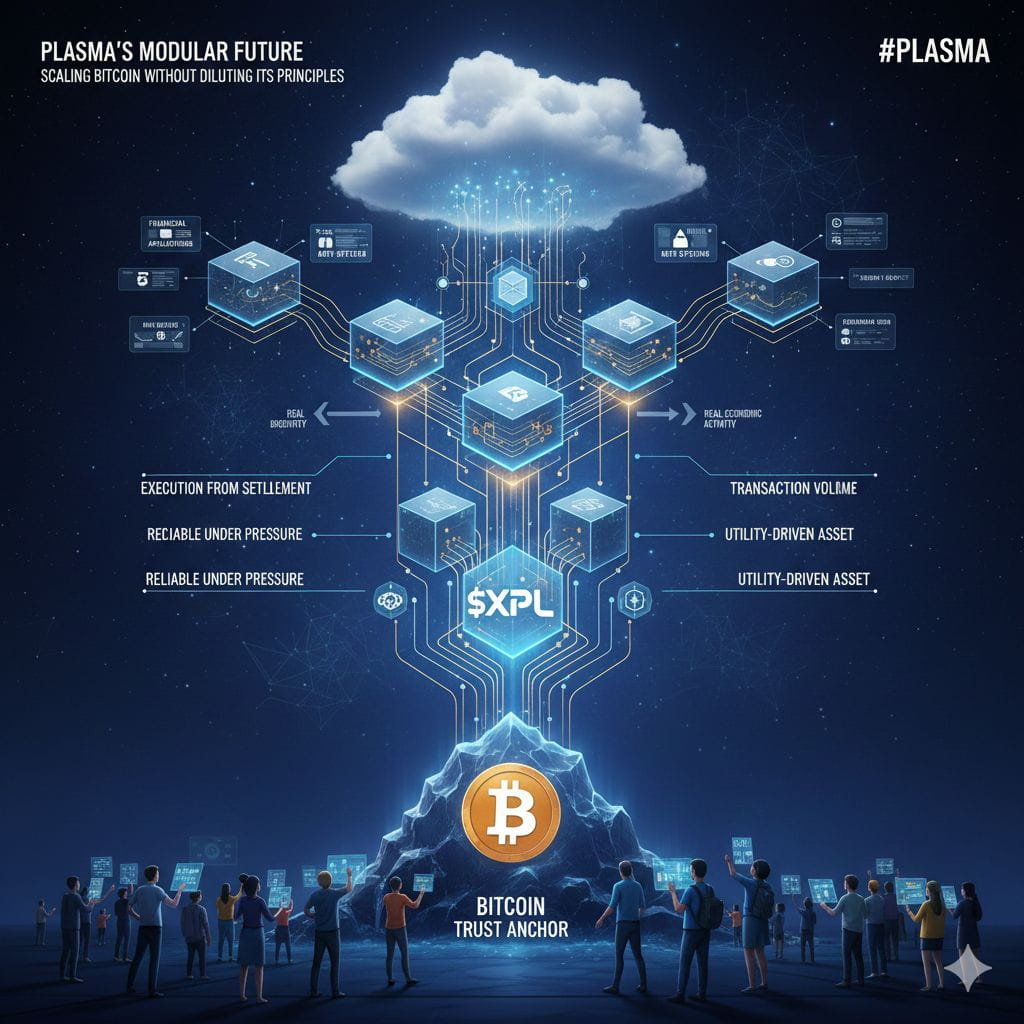

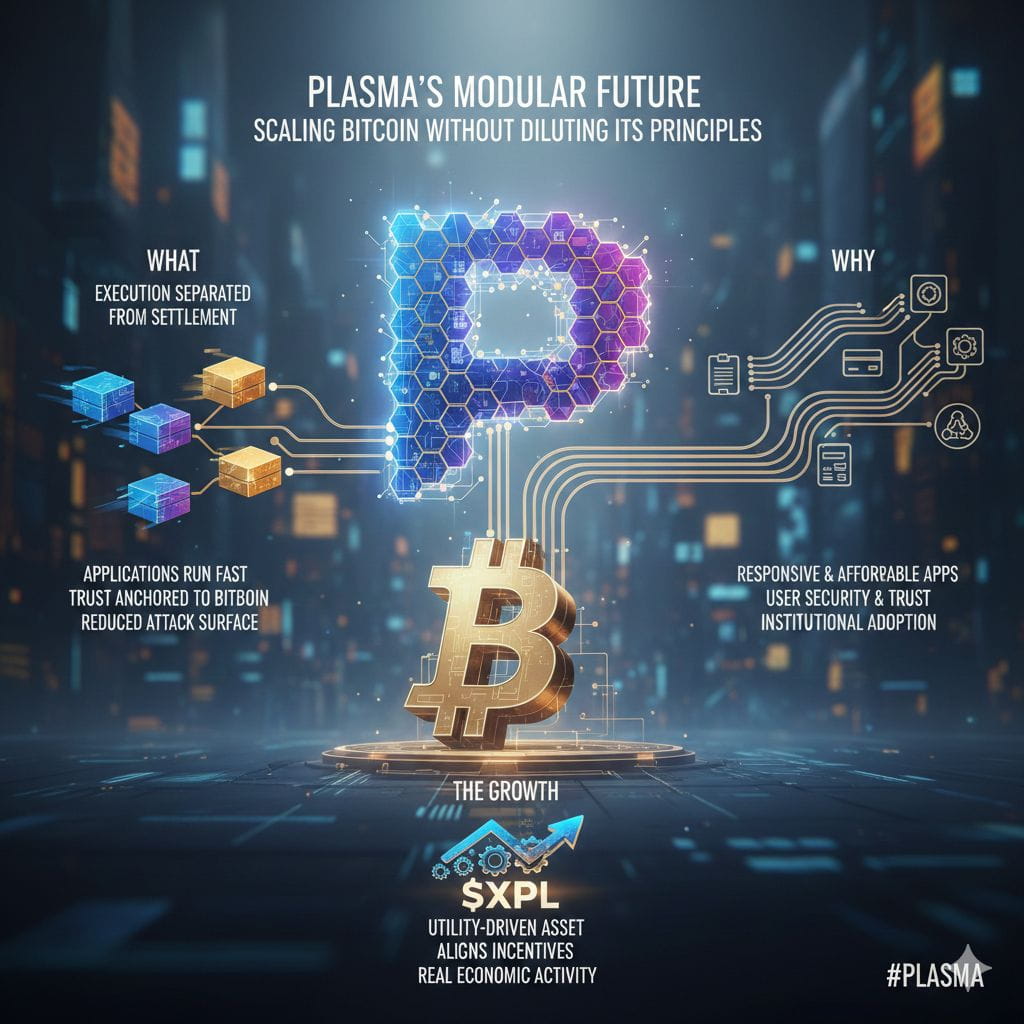

The long-term relevance of blockchain infrastructure depends on one thing: whether it can scale without compromising trust. @undefined is built around this exact challenge. Instead of redesigning security from scratch, Plasma modularizes execution while anchoring final trust to Bitcoin — a design choice that prioritizes longevity over short-term performance metrics.

From an educational and technical (“What”) angle, Plasma separates execution from settlement. Applications can run in a high-performance environment, but their ultimate security assumptions trace back to Bitcoin. This dramatically reduces attack surfaces compared to standalone chains and avoids the governance-heavy trade-offs seen elsewhere. Plasma’s architecture is not about being the fastest — it’s about being the most reliable under pressure.

The user experience and use cases (“Why”) emerge naturally from this design. Plasma enables developers to build financial applications, payment rails, and DeFi systems that feel responsive and affordable, while users benefit from security they already trust. For institutions and long-term users, this reliability is not optional — it’s a prerequisite for adoption.

Looking at $XPL and ecosystem growth (“The Growth”), the token is positioned as a utility-driven asset rather than a narrative-driven one. $XPL aligns incentives for network participants, supports protocol operations, and ties value capture to real economic activity. As more applications deploy on Plasma and transaction volume increases, $XPL’s role becomes increasingly connected to genuine usage.

What makes Plasma compelling is its community ethos. It attracts builders and users who believe crypto’s future lies in durable infrastructure, not temporary hype. In a market rediscovering fundamentals, @undefined stands as a thoughtful attempt to scale Bitcoin’s principles into a usable, modern financial stack.